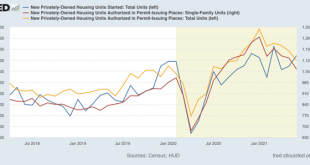

RJS, MarketWatch 666, New Housing Starts Reported Higher in June, Building Permits 5.3% Lower The June report on New Residential Construction (pdf) from the Census Bureau estimated that new housing units were being started at a seasonally adjusted annual rate of 1,643,000 in June, which was 6.3 percent (±11.5 percent)* above the revised May estimated annual rate of 1,546000 units started, and was 29.1 percent (±11.2 percent) above last June’s pace...

Read More »Natural Gas Prices at a 31 month High

Commenter and Blogger R.J.S. brings the latest on Natural Gas and the impact on it from the heat wave. Focus on Fracking blogspot Natural gas prices rose every day this week in surging to a new 31 month high, as yet another continental heat wave loomed…after ending last week unchanged at $3.674 per mmBTU as strong export demand offset cooler weather and a bearish storage report, the contract price of natural gas for August delivery opened the week...

Read More »Comments on existing home sale prices

Comments on existing home sale prices Existing home sales were reported yesterday. Since, although they are about 90% of the market, they have much less effect on the economy than new home sales, I normally don’t pay that much attention.But I did want to emerge from my vacation hideaway to make a few comments. 1. Inventory is up 11% YoY. Inventory follows prices, and as prices rise, more and more people decide now is a good time to sell...

Read More »Private Equity invests in “Primary Care” Medicine

I am adding a brief comment here (it fits and is on topic) rather than going back to the earlier post which I believe to be titled correctly; “Little Good can Come from Private Equity in the Healthcare Industry.” As my source of information I had identified two different articles taken from Modern Healthcare and also MedPage Today. Both I read religiously and from both I get email notifications. My three points to my titling are as follows:...

Read More »BREAKING AND ENTERING: How to get into farming . . .

Farmer – Economist Michael Smith is discussing how people get into farming and the issues. There are three ways to get into faming, each with their own issues, pitfalls, and nuances. There are three distinct ways to get into farming and those paths are all not worn at all. After a few rainy and hot weeks of watching the Top Gear guy farm his land he previously was subbing out, he now wants to argue with his wife about Cartel Avocados, and...

Read More »Distraction*

So … . What was the House Un-American Activities Committee (1945-1975, with a few interesting precursors) really all about? Looking back through the lens of history, it was much about distracting the Nation’s attention from the racist atrocities being committed in southern states. Still today, all a red state Republican politician needs do is yell, “Communist!”, “Socialist!”, “Nancy Pelosi!” or “Hillary Clinton!” and their constituents forget to even...

Read More »Housing permits continue decline in June; more challenging YoY comparisons ahead

Housing permits continue decline in June; more challenging YoY comparison First, a brief comment about the NBER’s declaration yesterday that the COVID recession ended in April 2020. I am not surprised at all that they chose that date. It has been clear for a year that the trough in economic activity across the board was that month (which we’ll see below as to housing, for example). Remember that a recovery starts when economic activity improves,...

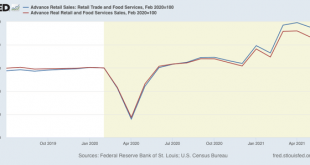

Read More »June retail sales decline after taking inflation into account, but overall pandemic gains “stick”

June retail sales decline after taking inflation into account, but overall pandemic gains “stick” As usual, retail sales is one of my favorite indicators, because it gives us so much information about the consumer economy. The news for June was mixed. Nominally retail sales were up +0.6% for the month. But after taking into account consumer inflation, real retail sales declined -0.3%. Still, nominal retail sales are up over 18% since just...

Read More »Focus on Fracking

DUC well report for June, Focus on Fracking, RJS Monday of this past week saw the release of the EIA’s Drilling Productivity Report for July, which includes the EIA’s June data for drilled but uncompleted (DUC) oil and gas wells in the 7 most productive shale regions….that data showed a decrease in uncompleted wells nationally for the 13th month in a row, as both completions of drilled wells and drilling of new wells increased, but remained below...

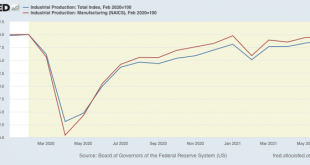

Read More »Industrial production slightly positive overall, but with negative revisions

Industrial production slightly positive overall, but with negative revisions Industrial production is the King of Coincident Indicators. It is the single datum that most frequently coincides with the NBER determination of the beginning and end of recessions. Production increased 0.4% in June, but May’s result was reduced by -0.2%. The manufacturing component declined less than -0.1%, and May’s result was also reduced, by -0.3%. As a result,...

Read More » Heterodox

Heterodox