The US Treasury yield curve is on the verge of inverting My graphing issue hasn’t resolved yet. Fortunately there is no big new economic news today, and there is something I’ve been following with particular interest in the past week that doesn’t require any graphing: namely, the Treasury bond yield curve is on the verge of inverting. Normally, we should expect to see increasing yields the longer the maturity. This is pretty simple stuff: if I...

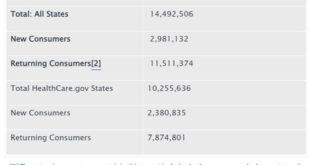

Read More »14.5 million in the ACA due to American Rescue Plan

January 2021 finds 14.5 million people having healthcare plans due to Joe Biden’s American Rescue Plan Act. As commenter “Arne” pointed out, this represents an increase of ~2.98 million more people insured under the ACA. Even the other Joe voted for it. Manchin that is. Kind of catching up with old news here. Earlier this year mid- January (some states end enrollment at the end of January), the Department of Health and Human Services (HHS)...

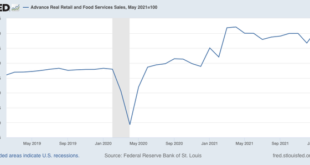

Read More »February Retail Sales Up, January Sales Revised Higher

RJS, MarketWatch 666 Retail Sales Rose 0.3 % in February After January’s Sales were Revised 1.0% Higher Seasonally adjusted retail sales increased 0.3% in February after retail sales for January were revised 1.0% higher . . . the Advance Retail Sales Report for February (above) from the Census Bureau estimated our seasonally adjusted retail and food services sales totaled $658.1 billion during the month, which was 0.3 percent (±0.5%)*...

Read More »1974 Redux?

1974 Redux? The stock of Thomas Robert Malthus rises and falls with the real price of food. He was not the inventor of his theory of population, a point that Karl Marx threw at him among other criticisms, with such people as James Anderson and Benjamin Franklin preceding him with pretty much the entiretly of his theory. But his timing was much better, publishing the flawed first edition of his Essay on the Principle of Population in 1798, a year...

Read More »Weekly Indicators for March 14 – 18 at Seeking Alpha

by New Deal democrat Weekly Indicators for March 14 – 18 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. The economic indicators are coming under pressure from both ends. The long leading indicators are being buffetted by inflation and the Fed, as interest rates generally rise, and the yield curve gets very tight. Meanwhile the coincident and short leading indicators have been hit by the exogenous event of the war in...

Read More »Housing permits and starts: still an economic positive – for the moment

Housing permits and starts: still an economic positive – for the moment As you know, I consider housing, and in particular single-family housing permits, one of the very best long leading indicators for the economy. In the past year, however, there has been a unique divergence between housing permits and housing starts, necessitating some adjustments. In the past year, permits soared then sank, while starts held much more steady. The explanation...

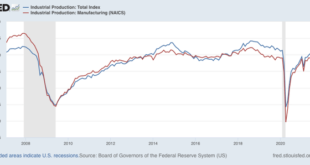

Read More »Industrial production nowcasts that the economy continues to perform well

Industrial production nowcasts that the economy continues to perform well Industrial production increased in February by 0.5%, its highest reading ever with the exception of two months in 2014, and the second half of 2018. Manufacturing production increased 1.2%, also its highest ever with the exception of 24 months from late 2006 through early 2008:Of course, considering population and GDP growth in the past 15 years, this is hardly...

Read More »On that “deep feeling that something is wrong…”

On that “deep feeling that something is wrong…” Georg Simmel called it “a faint sense of tension and vague longing” connected with the modern preponderance of means over ends. What Simmel calls estrangement [We] feel as if the whole meaning of our existence were so remote that we are unable to locate it and are constantly in danger of moving away from rather than closer to it. Furthermore, it is as if the meaning of life clearly confronted...

Read More »Yet another new 50+ year low in continuing jobless claims

Yet another new 50+ year low in continuing jobless claims After 3 days of a data desert, today there is a cornucopia of data: not just initial claims, but housing starts and permits, and industrial production as well. On top of that, a large stretch of the yield curve in the bond market is close to inverting after yesterday’s Fed rate hike. I’ll report on housing and production later; below is the read on new and continuing jobless claims....

Read More »Real retail sales for February: not recessionary, but not healthy either

Real retail sales for February: not recessionary, but not healthy either Let’s take a look at the February update for one of my favorite indicators, real retail sales. For the past few months, I have suspected that a sharp deceleration beginning with the consumer sector of the economy was more likely than not. At the moment, the verdict on that forecast is mixed. In February, nominal retail sales rose +0.3%. Since consumer inflation rose 0.8%,...

Read More » Heterodox

Heterodox