by New Deal democrat Weekly Indicators for October 3 – 7 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. Although I have read a few pieces this past week about deep downgrades to Q3 GDP estimates, and other problems with sales, the fact remains that the high-frequency indicators are almost all positive, across all timeframes. As usual, clicking over and reading will bring you fully up to date on the economic trends,...

Read More »Employers Added 194M jobs, U3 Down, PR Declined

Blogger RJS, Marketwatch 666, September jobs report September Summary Major agency reports released this past week included the the Employment Situation Summary for September from the Bureau of Labor Statistics, the August report on our International Trade from the Commerce Dept, and the Full Report on Manufacturers’ Shipments, Inventories and Orders for August, and the August report on Wholesale Trade, Sales and Inventories, both from the...

Read More »The Passing Of Peter Flaschel And The Bielefeld School Of Macroeconomics

The Passing Of Peter Flaschel And The Bielefeld School Of Macroeconomics German economist Peter Flaschel died yesterday at age 78. I am not sure precisely of what, although it was not Covid-19. He had been in declining health for some years, with a heart problem at least. Roberto Veneziani, from whom I learned the news, said that Peter “sounded tired” when he spoke with him a few days ago. Ironically he spoke with him to tell him I had...

Read More »September jobs report: once again, two very different surveys net to a “relatively” disappointing gain

September jobs report: once again, two very different surveys net to a “relatively” disappointing gain As I previously indicated, two items I was particularly watching for in this morning’s report (Oct. 7) were (1) manufacturing hours and payrolls – to see if that white-hot sector was holding up in the face of supply bottlenecks, and (2) whether there were continued gains in leisure and hospitality jobs, or whether Delta had caused those to...

Read More »Updated US wealth distribution data shows how bad the Great Recession and its aftermath were, and how effective the pandemic assistance has been

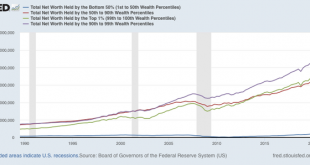

Updated US wealth distribution data shows how bad the Great Recession and its aftermath were, and how effective the pandemic assistance has been The desert of new economic data this week continues today. But last week the Fed released its quarterly data on wealth distribution in the US, and it shows an important point about the efficacy of the emergency pandemic assistance. Let’s take a look. Let’s start with the raw absolute levels of...

Read More »Housing and car sales, oh my!

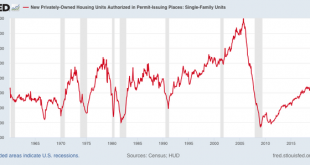

Housing and car sales, oh my! [If last week was a slow week for economic data, this week is a virtual wasteland until Thursday, so I took yesterday off.] Last month I wrote that typically it has taken at least a 20% decline in housing construction to be consistent with an oncoming recession and that we weren’t there yet. As of the most recent housing permits report, single-family permits were down 17% from their recent peak: One...

Read More »Will Krysten Sinema Change Parties?

EconoSpeak: Will Krysten Sinema Change Parties?, Barkley Rosser, October 5, 2021 I have resisted posting something like this, but while I have yet to see anybody else suggest it, this possibility has been on my mind now for several days. We have never seen to my knowledge a senator refuse to offer their views on possible resolution of a major disagreement involving money. The contrast to Sen. Sinema is her associate in the Senate in blocking...

Read More »The Case of The Creeping Crud

In her 2020 book ‘Waste’, Catherine Flowers speaks to the practice in Alabama – throughout the South – of keeping the poor and ignorant poor and ignorant so that there would always be a cheap source of labor on hand. In a September 2021 House Budget Committee hearing, a member from neighboring Georgia patiently explained the economic necessity of cheap labor; how increased wages were a threat to small businesses; and how any increase in wages would...

Read More »USPS Small Banking Services Initiated

Briefly, with more info being found at The American Prospect by David Dayen (link below). The USPS has initiated check cashing service for a minimal fee. And Louis Destroy the USPS DeJoy has bought into this service. The pilot was launched on September 13 (?) in four locations: Washington, D.C.; Falls Church, Virginia; Baltimore; and the Bronx, New York. The initial banking test allows customers to cash business or payroll checks at the post...

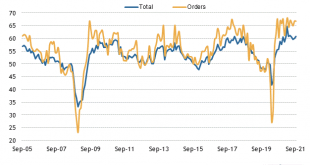

Read More »Manufactuing remains white hot, while construction spending is mixed

Manufactuing remains white hot, while construction spending is mixed As usual, we started out the month with the forward-looking ISM manufacturing report for September, as well as construction spending for August. Let’s take the ISM report first since it is an important short-leading indicator for the production sector. And here, the news was good, as the overall index improved to 61.1, among its highest numbers in several decades (but not...

Read More » Heterodox

Heterodox