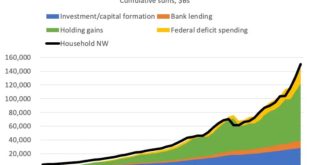

Short answer: Lending, government deficits, capital formation, and holding gains by Steve Roth Originally Published at Wealth Economics I ended my last post with an apparent conundrum: “One person’s spending is another person’s income.” It seems to imply that spending and income must be equal. And since saving equals income minus spending, saving must be…zero? That’s obviously not the case. As I pointed out, other people’s spending is not...

Read More »The “Wealth Effect” on Spending from Stock-Market Price Changes

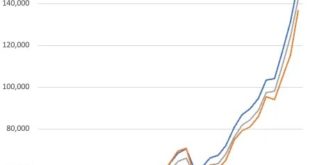

by Steve Roth Wealth Economics This post is prompted by Matthew Klein’s (very wonky) post about recent changes in QE/QT, and the Fed’s balance sheet. It prompted me to do a quick calculation that I’ve been meaning to get to: when household wealth increases (due to stock-market price runups or really anything else), what effect does that have on household spending in the next year? I’m going to start with a bald two-part claim. A. The...

Read More »Where Does Wealth Come From?

Wrong answers only: “saving” Originally Published at Wealth Economics In my last post, I tried to say precisely what the words “wealth” and “assets” mean as they’re used in this blog. This post tackles the question of wealth accumulation. Where does wealth come from? What are the mechanisms that create assets? Households and the accounting-ownership pyramid I realize first, though, that I left out an important issue in the last post: what...

Read More »What is Wealth?

The wealth of people and the wealth of nations Originally Published at Wealth Economics If you read this blog much, you’ll find many careful definitions of terms — something that the economics profession is terrible at. A blog called Wealth Economics really has to start at the top, with wealth. So here it is. “The only real, true wealth is…” You hear that sentence a lot — from economists, pundits, and all sorts of everyday people. It has...

Read More »Earned Labor Income Is a Small and Weak Lever. Unearned Property Income, and Wealth, Rule

Reversing extreme wealth concentration means going after property income. Originally Published at Wealth Economics Economists and pundits have been cheered of late by the labor-share increase during the first couple of years of the Covid era. And even, for a moment, lower-income workers were making progress vs higher-income folks. This is good news. In the long view, though, these happy developments are just a minor blip in the half-century...

Read More »Ten things to know about poverty measurement in Canada

I’ve written a blog post providing an overview of poverty measurement in Canada. Points raised in the post include the following: -One’s choice of poverty measure has a major impact on whether poverty is seen to be increasing or decreasing over time. -Canada’s federal government recently chose the make the Market Basket Measure (MBM) its official poverty measure. -According to the MBM, Canada has seen a major decrease in poverty over the past decade. -Also...

Read More »Ten things to know about poverty measurement in Canada

I’ve written a blog post providing an overview of poverty measurement in Canada. Points raised in the post include the following: -One’s choice of poverty measure has a major impact on whether poverty is seen to be increasing or decreasing over time. -Canada’s federal government recently chose the make the Market Basket Measure (MBM) its official poverty measure. -According to the MBM, Canada has seen a major decrease in poverty over the past decade. -Also...

Read More »Trudeau’s proposed speculation tax

I’ve written a blog post about the Trudeau Liberals’ recently-proposed speculation tax on residential real estate owned by non-resident, non-Canadians. The full blog post can be accessed here. Nick Falvo is a Calgary-based research consultant with a PhD in Public Policy. He has academic affiliation at both Carleton University and Case Western Reserve University, and is Section Editor of the Canadian Review of Social Policy/Revue canadienne de politique sociale. You can...

Read More »Trudeau’s proposed speculation tax

Posted by Nick Falvo under BC, bubble, cities, economic thought, foreign investment/ownership, globalization, housing, inequality, interest rates, investment, Liberal Party policy, monetary policy, municipalities, Ontario, party politics, prices, private equity, regulation, Role of government, taxation, Toronto, wealth. September 25th, 2019Comments: none I’ve written a blog post about the Trudeau Liberals’ recently-proposed speculation tax on residential real estate owned...

Read More »Taxing Wealth to Create a More Equal Canada

This is a longer, wonkier version of a piece I wrote for National Newswatch. As part of a broader fair tax agenda, Jagmeet Singh and the federal New Democratic Party have proposed a wealth tax. This is intended to fight obscene and rising levels of economic inequality by limiting the concentration of wealth in the hands of the very rich, who can well afford to pay more, and by generating new fiscal resources to be invested in equality-promoting programs such as expanded public health...

Read More » Heterodox

Heterodox