Wrong answers only: “saving” Originally Published at Wealth Economics In my last post, I tried to say precisely what the words “wealth” and “assets” mean as they’re used in this blog. This post tackles the question of wealth accumulation. Where does wealth come from? What are the mechanisms that create assets? Households and the accounting-ownership pyramid I realize first, though, that I left out an important issue in the last post: what I call the accounting-ownership pyramid. The household sector sits at the top; households ultimately “own” everything (that’s ownable and measurable), in accounting terms. The market-cap value of all firms, for instance, is an asset on the household-sector balance sheet. We can think of the firms’ sector

Topics:

Steve Roth considers the following as important: Hot Topics, US/Global Economics, wealth

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Joel Eissenberg writes How Tesla makes money

NewDealdemocrat writes January JOLTS report: monthly increases, but significant downward revisions to 2024

Wrong answers only: “saving”

Originally Published at Wealth Economics

In my last post, I tried to say precisely what the words “wealth” and “assets” mean as they’re used in this blog. This post tackles the question of wealth accumulation. Where does wealth come from? What are the mechanisms that create assets?

Households and the accounting-ownership pyramid

I realize first, though, that I left out an important issue in the last post: what I call the accounting-ownership pyramid. The household sector sits at the top; households ultimately “own” everything (that’s ownable and measurable), in accounting terms. The market-cap value of all firms, for instance, is an asset on the household-sector balance sheet. We can think of the firms’ sector as a wholly-owned subsidiary of the household sector.1 At least in this accounting sense, the measured wealth of the nation is the wealth of households. (See the first figure in the previous post.)

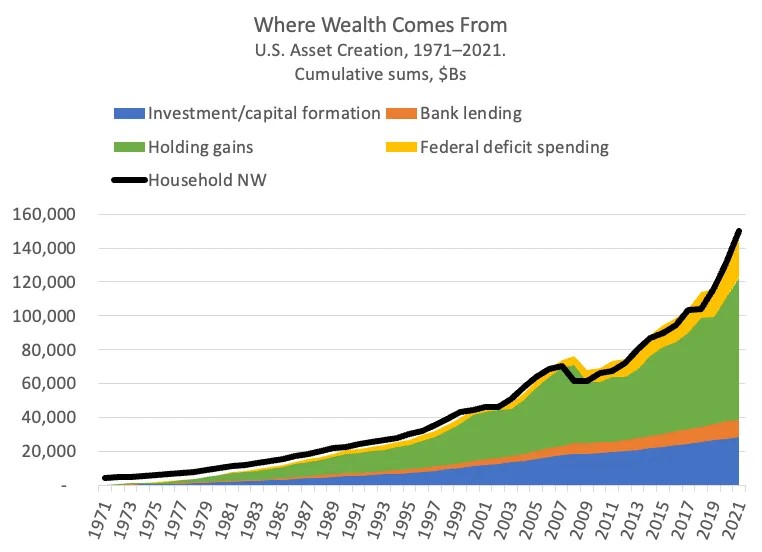

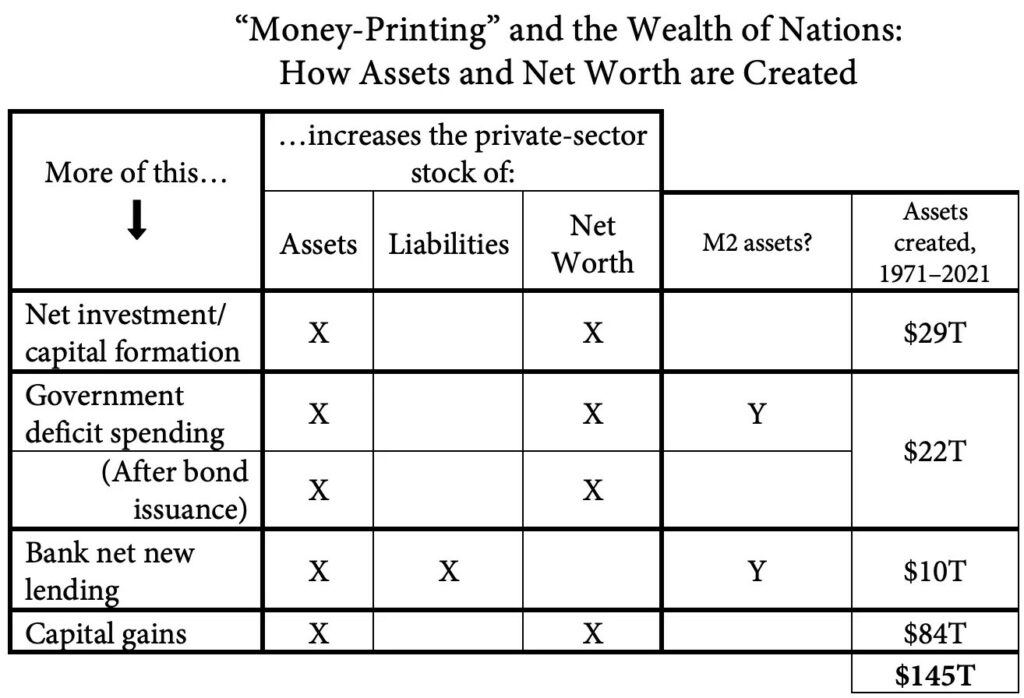

So how are assets created? There are four big mechanisms: Investment a.k.a. capital formation, government deficit spending, bank lending, and holding gains. (Data series.)

This is a rough cut to illustrate the idea. Not surprisingly, you can see some discrepancy. Accounting measures are imperfect estimates, and there are various ways to tally each of these measures. (Treatment of the U.S. net international investment position, for instance, is an accounting judgment call.) But the general picture is clear. The four mechanisms pretty closely explain U.S. national wealth accumulation. 2

Before we detail those mechanisms, though, we need to tackle the wrong answer, one that economists, economics textbooks, pundits, and everyday people constantly fall back on, somewhat unthinkingly: saving.

The (non-)paradox of thrift

Imagine firms and households each have $1T in assets. There’s $2T total. Then firms pay households $1T in wages and dividends, and households pay firms $900B for stuff that they consume (so, the produced stuff vanishes). Households save $100B. Now households have $1.1T, and firms have $900B. Total assets are still $2T. That $2T sum would be the same if households spent all their $1T income, didn’t save at all.

Of course an individual household’s saving increases their own asset holdings, their wealth. But it doesn’t increase our asset holdings. Saving doesn’t create assets. (Or, hence, any long-fabled “loanable funds”). 3 Likewise, of course: spending — even on goods for immediate consumption — does not “consume” assets. They just move from one account to another. The purchased goods are consumed, not the transferred assets.

It can help to instead think of saving as holding assets (versus transferring them to others). Saving is just a residual, or remainder, of two economic flows: income minus outlays. It’s not itself an economic flow. In fact by its very nature, it’s a non-flow: holding assets, sitting on them like Smaug the Dragon.4 (The saving remainder is a flow measure; it’s tallied over a time period, not at a single instant as with stock measures, e.g. wealth.)

There is no national-accounts stock measure of “savings,” by the way, even though you hear that usage all the time — including, constantly, from people who should know better like Ben Bernanke. There are just (different categories of) assets, and net worth.

So how are assets created? In the previous post, we defined assets as accounting objects (that have very real “real-world” import). So, what accounting events create those objects? How do new assets appear and get added to economic units’ account statements and balance sheets? How do we (collectively) accumulate new assets, wealth? Here are details on the four mechanisms.

Investment spending

In our example of household saving above, all the spending paid for the production of goods that were consumed immediately (within the accounting period). Assets were transferred, but total assets didn’t increase. But what if the spending pays for production of long-lived goods? (Call this “capital” if you must.) Think of firms paying households to build factories, or households paying firms to build houses. This is the definition of “investment spending”: paying people/firms to produce long-lived (productive) goods.5

With investment spending, there’s a key result: the payer/spender owns the newly produced goods. And there’s a key accounting event: the payer posts the value of those new goods to their balance-sheet assets (via their capital account). In national accounting, those goods are posted at the cost of production; that’s how their value is measured. So the payer is cash out of pocket, just like with consumption spending. But then they post that amount right back to their balance sheet, recording the new long-lived goods they own. Voilà, there are more assets, both individual and collective.

Interestingly, looking at the payer from a pure big-picture accounting perspective, this investment spending/capital formation just looks like an asset swap: cash in return for a house or a factory. It has no effect on their net worth. Any net-worth increase for the investor arrives in future periods, from 1. revenues/profits/benefits generated and attributed to the “capital good,” and 2. from markups for holding gains, posted to the balance sheet if the good’s market value increases over time. (We’ll get to that increase in a moment.)

Federal Deficit Spending

Modern monetary theory has hammered this point home over decades, to the point that pretty much everyone understands it: When the U.S. Treasury deficit-spends, it’s adding assets to private-sector checking and money market accounts, and balance sheets, ab nihilo. (The government posts new notional liabilities to its balance sheet, to “offset” those new private-sector assets and achieve accounting closure.) Government is emitting new private-sector M2 assets out of its magic hole in the ground.

A bit of necessary detail: Because of a self-imposed government requirement, Treasury constantly and simultaneously issues new treasury bonds equaling the deficit spend and sells them to the private sector. That’s an asset swap: bonds assets for M2 assets. The M2 is retired back into Treasury’s magic money hole. Combine those events, and Treasury is helicopter-dropping T-bond assets onto the private-sector balance sheet. Whatever: in the big-picture discussion here, assets are assets.

Government deficit spending doesn’t create any new private-sector liabilities (aside from some imagined long-future tax increase that exactly nobody posts to their balance sheet today). So, it increases private-sector assets and net worth.

What does not follow from this, is a common MMT-driven misconception: that the private sector can only “save” if government runs deficits (and/or there’s a balance-of-trade surplus). This whole post serves to confound that understanding.

Bank lending

When households and firms borrow money from banks, they add new (M2) assets and liabilities to their balance sheets, in equal measure. The banks do similarly; both sides “expand their balance sheets.” There’s no effect on net worth, but new private-sector assets are created, with the stroke of an accounting pen. Similarly for loan payoffs; that’s shrinking balance sheets. Banks, chartered and licensed for this very purpose, essentially act as franchisees of government; they have a magic money hole just like Treasury does. (But banks expect to be paid back.) 6 To paraphrase Milton Friedman, “banks and governments have both printing presses (helicopters) and furnaces.”

This is why households and firms borrow: to add M2 assets to their accounts/balance sheets, so they can spend those assets on consumption or investment, or swap them for other assets (bonds, equities, real-estate titles, etc.) in hopes of receiving total returns greater than their interest payments. The whole point of borrowing is to acquire assets, for whatever purposes. The banks create those assets.

A measurement reality is important here: national accounts of lending and borrowing don’t tally up “transaction” flows. They just monitor banks’ asset and liability levels — and so, changes in those levels. The measure tallied here of net new lending/borrowing, new assets created, is just the change in bank loans outstanding.7

Holding gains

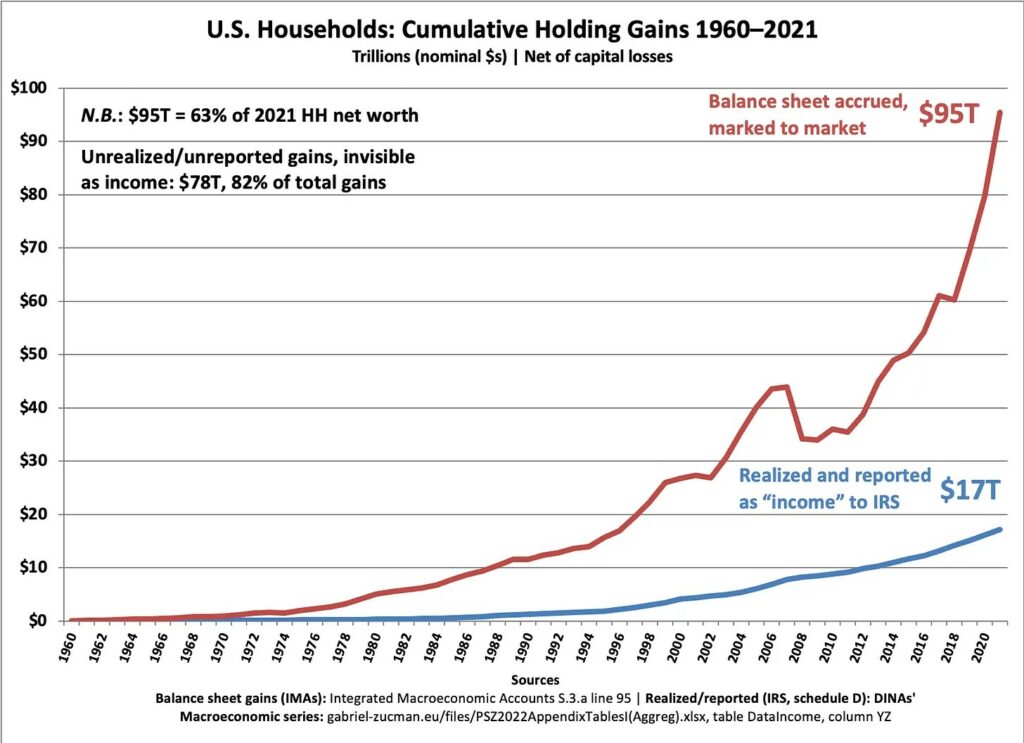

When it comes to asset creation, holding gains are the 8,000-pound elephant in the room.

Accumulated holding gains in this picture — which are absent from income hence saving measures — are equivalent to 63% of 2021 national wealth. Even in income measures that include realized gains, 82% of holding gains are ignored and invisible. Significantly, given holding gains’ volatility (and thus their frequent dismissal as “not real wealth”), over six decades there has been only one significant drawdown in the cumulative accrued series, in 2008 (down $9.7T, a 13.7% asset decline). Holding gains create assets, wealth. Ask any zillionaire, or millions of retirees over decades. In this case, what’s true for individuals is also true for the collective.

The mechanism here is simple: a block-trade of Apple shares goes through at a higher price. Every brokerage in the world sees that trade and marks up their account holders’ assets to market. (The estimation for real-estate and private-business valuations is similar, with market-value estimated based on “comparable” or actual sales, but the markups happen more slowly.) There are more collective assets, and net worth. Because: these assets are created doubly ab nihilo. Nobody posts any new liabilities to their balance sheets when market prices rise, to offset those new assets. These asset increases don’t “flow from” anywhere, they’re not “funded” by any new liability. That’s why they’re invisible in the Flow of Funds.8

What about quantitative easing?

People constantly describe Fed quantitative easing as “money printing.” Why isn’t that included here? The short answer: QE doesn’t add assets to the private-sector balance sheet. It’s just an asset swap. The Fed does issue new “reserves” (monetary base, or MB assets) ab nihilo, but it doesn’t (can’t) spend them.9 It swaps them with banks, for treasury bonds — effectively retiring those bonds from the private market (at least for now), just as Treasury retires M2 when it issues and swaps new treasury bonds. The result is just a change in the banks’ portfolio mix: more MB, less bonds. (This is what “monetization” means.)

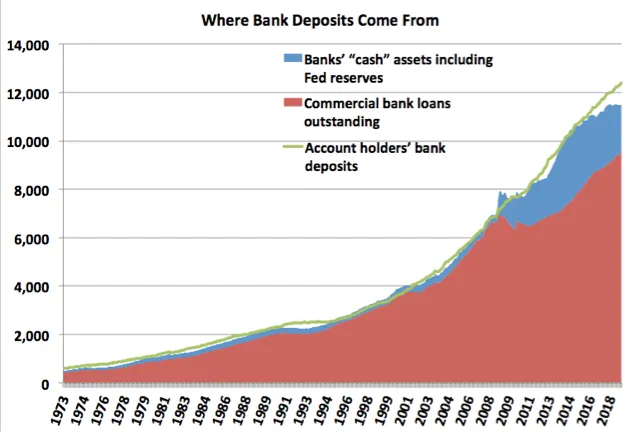

QE certainly has carry-on economic effects, which are beyond the scope of this post. But in terms of asset creation, it has also changed the mechanisms for creation of “deposits” (M2 assets).

Until 2008, bank lending was the only thing that created deposits/M2 assets. (As depicted in the table at the top of this post.) That all changed with the Great Financial Crisis. QE ends up incentivizing the creation of M2 assets when the Fed issues new MB, stepping in for the huge decline in bank lending, but the banking mechanisms are arcane, including transactions between domestic/foreign banks and their own foreign/domestic subsidiaries. For the excruciating details I’ll refer my gentle readers to Céline Choulet (the figure above derives from her Figure 4).

But this is all getting deep in the weeds. Total M2 only comprises 10%–15% of total assets, and we’re talking smallish changes to that stock here. The four mechanisms of asset creation described above provide a good fundamental understanding of wealth accumulation, and where that wealth comes from.

~~~~~~~~~~

1 Rest of World (ROW) owns roughly $10T in U.S. equities, but the U.S. owns a roughly equal quantity of foreign equities. It nets out to $1T or $2T, circa 1% of U.S. wealth.

2 For a more fastidious tally using a somewhat different approach, see Table 1 in this paper, and its accompanying spreadsheet.

3 This seeming paradox is explained by two common conceptual errors: naive methodological individualism, and errors of composition. Both can be the basis for a problematic belief — that individual actions and results can be summed simplistically to identical collective actions and results. That erroneous belief can in turn help explain pervasive socioeconomic coordination failures.

4 There’s also moral baggage at play here in these labels. Think of schuld, the German word for debt, which also means guilt. Saving is viewed as sober and responsible; spending is impecunious and rash. Similarly, “hoarding” has moral valences that don’t attach to holding.

5 The IMAs use a different label for this measure: “capital formation.” Investment refers to the spending that causes production of long-lived goods, while capital formation gestures at the goods production itself. They’re numerically equivalent, but conceptually distinct. Investment spending is what causes capital formation.

6 It’s set up this way under the assumption that banks’ (owners’) self-interests will result in better lending decisions than would arise if government just did all the lending directly.

7 More precisely: “Loans and leases in bank credit.”

8 This also explains why — contrary to a widespread belief — financial assets ≠ liabilities. Not even close.

9 MB literally only exists in central-bank accounts. That’s what MB is: CB account deposits. So, MB can only be held by, and transferred between, CB account-holders: banks, other central banks, and big international institutions like the IMF.