Housing continues to roll over and is no negative year over year: Highlights Purchase applications for home mortgages fell a seasonally adjusted 1 percent in the July 20 week, while applications for refinancing increased by 1 percent from the previous week. Unadjusted, purchase applications were 2 percent higher than in the same week a year ago. The refinance share of mortgage activity rose 0.3 percentage points from the prior week to 36.8 percent. The average interest rate for 30-year fixed rate conforming mortgages (3,100 or less) remained unchanged at 4.77 percent. Purchase applications dipped into negative year-on-year territory in June and while managing to post modest gains compared to the year ago level in recent weeks, the jump in financing costs by more than a

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Housing continues to roll over and is no negative year over year:

Highlights

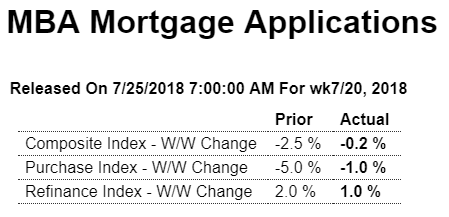

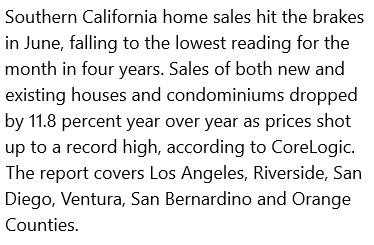

Purchase applications for home mortgages fell a seasonally adjusted 1 percent in the July 20 week, while applications for refinancing increased by 1 percent from the previous week. Unadjusted, purchase applications were 2 percent higher than in the same week a year ago. The refinance share of mortgage activity rose 0.3 percentage points from the prior week to 36.8 percent. The average interest rate for 30-year fixed rate conforming mortgages ($453,100 or less) remained unchanged at 4.77 percent. Purchase applications dipped into negative year-on-year territory in June and while managing to post modest gains compared to the year ago level in recent weeks, the jump in financing costs by more than a half of a percentage point since the start of the year (though roughly unchanged since April) is likely to continue to suppress homebuyer appetites. Later this morning, the release of the New Home Sales report for June will provide further insights into homebuyer activity.

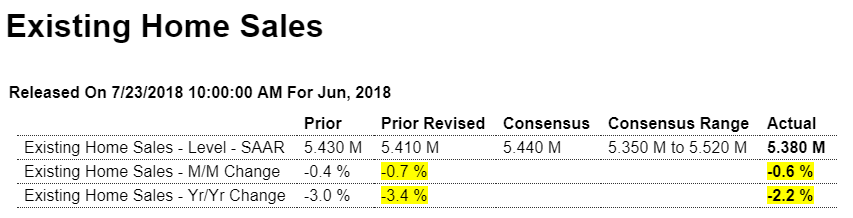

Highlights

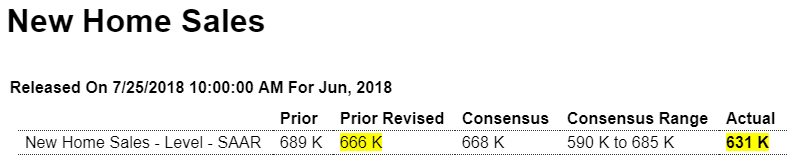

New home sales unfortunately join the host of housing data showing weakness. Sales fell 5.3 percent in June to a 631,000 annualized rate vs Econoday’s consensus for 668,000. The disappointment comes despite price concessions as the median fell a monthly 2.5 percent to $302,100. Year-on-year, the median is down 4.2 percent vs a 2.4 percent rise for sales.

But good news comes from supply which rose 1.7 percent to 301,000 new homes on the market. Relative to sales, supply is at 5.7 months vs 5.3 and 5.6 months in the prior two months.

New home sales in the West, which is a key region for home builders, fell 5.2 percent with this yearly rate at minus 15.0 percent. The Northeast is the smallest region for new home sales but sales here have been picking up, jumping 37 percent in the month for a 21 percent year-on-year increase. Sales in the Midwest and South were weak in June, down a monthly 13.4 and 7.7 percent respectively.

The Spring selling season was a poor one for the housing sector with both new sales and especially resales showing little life. Less-than-favorable mortgage rates are one reason for the slowing as are constraints on new building including scarcity of skilled construction labor as well as materials.

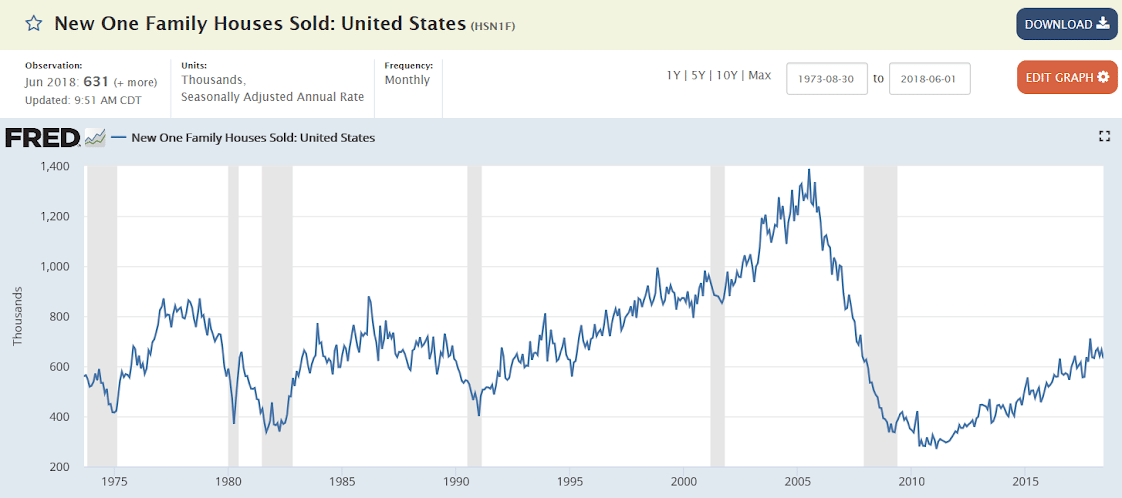

Rolling over after not even getting to half what they were in the last cycle, and population adjusted they are well below prior cycles:

Chinese investors have become net sellers of U.S. commercial real estate for the first time in a decade, reversing a yearslong trend when these buyers spent tens of billions of dollars and helped boost the market for hotels and other properties.

Chinese insurers, conglomerates, and other investors sold $1.29 billion worth of U.S. commercial real estate in the second quarter, while purchasing only $126.2 million of property, according to data firm Real Capital Analytics. This marked the first time that Chinese investors were net sellers for a quarter since 2008.

The more than $1 billion in net sales reflects how much the Chinese government’s attitude toward investing overseas has changed in recent months.

Puerto Rico still losing people. When the Fed’s take over they don’t work to grow the economy, but only to limit PR gov expenditures to PR tax revenues, which supports a downward spiral:

Trump warns Iran’s President Rouhani: ‘NEVER, EVER THREATEN THE UNITED STATES AGAIN’

President Donald Trump threatens his Iranian counterpart in a Twitter post. Monday morning, Trump’s hawkish national security advisor, John Bolton, backed the president’s rhetoric. Tensions between Iran and the U.S. have grown since Trump withdrew America from a nuclear deal struck during President Obama’s administration.