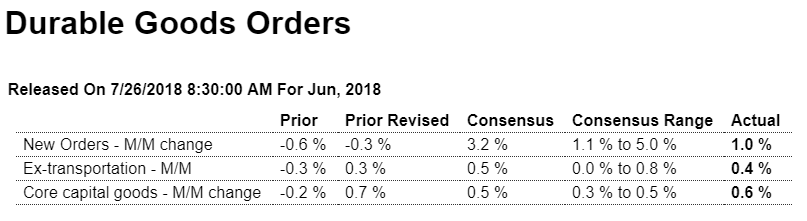

The tax cuts helped the economy though they were relatively small and largely low multiple, but tariffs are tax increases and work to reduce real consumption if income doesn’t also adjust. Also, there could have been some front running ahead of the dates the tariffs go into effect. This adds volatility to the data. Highlights Helping to give a 1.0 percent boost to durable goods orders, aircraft orders did in fact rise sharply in June but still not nearly as much as expected given Econoday’s consensus for a 3.2 percent surge. Civilian aircraft orders rose 15.7 percent in the month but follow sharp declines of 21.0 percent and 39.4 percent in the prior two months. Excluding transportation, durable goods orders managed a moderate 0.4 percent rise to just miss expectations

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

The tax cuts helped the economy though they were relatively small and largely low multiple, but tariffs are tax increases and work to reduce real consumption if income doesn’t also adjust. Also, there could have been some front running ahead of the dates the tariffs go into effect. This adds volatility to the data.

Highlights

Helping to give a 1.0 percent boost to durable goods orders, aircraft orders did in fact rise sharply in June but still not nearly as much as expected given Econoday’s consensus for a 3.2 percent surge. Civilian aircraft orders rose 15.7 percent in the month but follow sharp declines of 21.0 percent and 39.4 percent in the prior two months. Excluding transportation, durable goods orders managed a moderate 0.4 percent rise to just miss expectations for 0.5 percent.

Strength in the report is centered in core capital goods (nondefense ex-aircraft) where orders rose 0.6 percent to just exceed Econoday’s consensus. Shipments for this reading, which are inputs into GDP, rose a sharp 1.0 percent which should raise estimates for second-quarter nonresidential investment.

Orders for primary metals fell 0.4 percent following May’s 0.1 percent dip, with fabrications, which are indirectly affected by tariffs, up only 0.1 percent in June after a 1.2 percent May decline. These two components make up more than 20 percent of total durable orders. In contrast to the soft new order data, inventories and unfilled orders for both primary metals and fabrications are building sharply.

Total unfilled orders, which have been building in recent months, rose a useful 0.4 percent in June which is another positive for the factory employment outlook. Total shipments surged 1.7 percent while inventories, which were already lean, slipped 0.1 percent. This mismatch drives the inventory-to-shipments ratio down sharply, to 1.60 vs 1.63 in both May and April.

Though aircraft is soft, this is otherwise a very positive report showing solid strength for capital goods. Manufacturing remains one of this year’s top performing sectors.

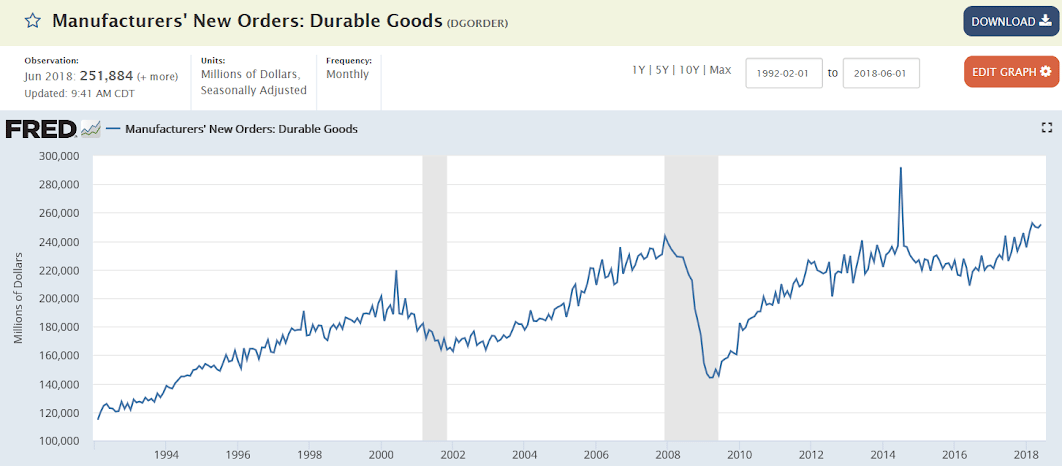

This is not adjusted for inflation, so just chugging along at modest levels;

Highlights

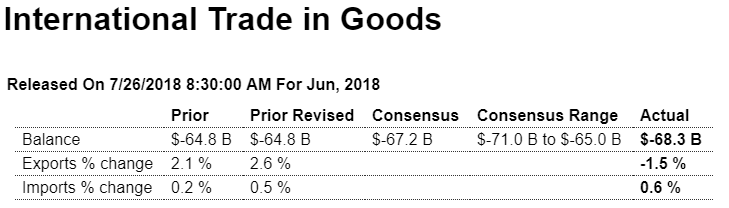

The goods portion of June’s trade deficit is a bit deeper than expected, at $68.3 billion vs Econoday’s consensus for $67.2 billion. Exports fell 1.5 percent in the month but follow an upward revised 2.6 percent gain in May. Imports rose 0.6 percent and very near an upward revised May increase of 0.5 percent.

There was a very steep decline in exports of consumer goods in June, down 8.5 percent to $16.3 billion, as well as vehicles, down 6.1 percent to $12.7 billion. Capital goods exports, a key U.S. strength, also fell, down 1.8 percent to $47.3 billion. Exports of foods & feeds, which are in focus given trade troubles, dipped 0.5 percent to $14.0 billion.

Imports of consumer goods, the nation’s sore point on trade, jumped 3.6 percent to $53.3 billion with vehicle imports up 1.6 percent to $30.2 billion. Imports of capital goods fell 2.7 percent to $57.4 billion with food & feed imports down 1.7 percent to $12.2 billion.

These results may trim back estimates for net exports in tomorrow’s second-quarter GDP report but they follow very positive results in May and April.

Highlights

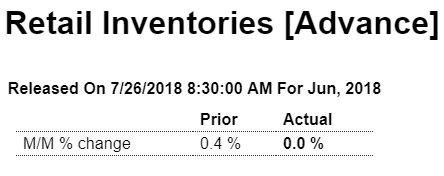

Retail inventories were unchanged in June following an unrevised 0.4 percent build in May. The lack of a retail build, together with no change for wholesale inventories in June and a 0.1 percent decline for durable inventories, both also released morning, will be trimming back inventory estimates for tomorrow’s second-quarter GDP report.