Larger than expected which also means q2 GDP will be revised down some: Highlights The nation’s trade deficit proved a little deeper than expected in June,, at .3 billion vs Econoday’s consensus for .6 billion. After a run of strength going back to February, exports posted a 0.7 percent decline to 3.8 billion in the month with a rise in service exports offset by a drop in goods exports where capital goods, vehicles and especially consumer goods posted declines. Imports, in special focus of course given the tariff situation, rose 0.6 percent to a monthly 0.2 billion with consumer goods, the sore spot in the nation’s deficit, rising a sharp .0 billion to .4 billion. Oil imports were also up, rising .2 billion to .1 billion. Country data show a

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

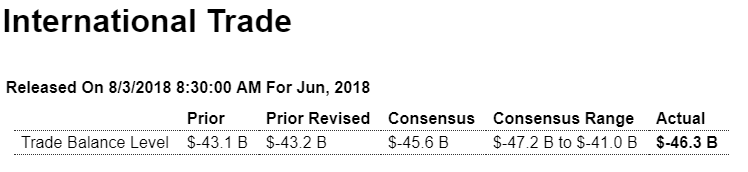

Larger than expected which also means q2 GDP will be revised down some:

Highlights

The nation’s trade deficit proved a little deeper than expected in June,, at $46.3 billion vs Econoday’s consensus for $45.6 billion.

After a run of strength going back to February, exports posted a 0.7 percent decline to $213.8 billion in the month with a rise in service exports offset by a drop in goods exports where capital goods, vehicles and especially consumer goods posted declines.

Imports, in special focus of course given the tariff situation, rose 0.6 percent to a monthly $260.2 billion with consumer goods, the sore spot in the nation’s deficit, rising a sharp $2.0 billion to $53.4 billion. Oil imports were also up, rising $1.2 billion to $14.1 billion.

Country data show a deepening deficit with China, at $33.5 billion in June with the year-to-date deficit 8.6 percent wider at $185.7 billion. Other year-to-date deficits include an 11 percent deepening with Europe at $77.6 billion, a 5.5 percent deepening with Mexico at $38.0 billion, and a 23.4 percent improvement with Canada at $8.1 billion.

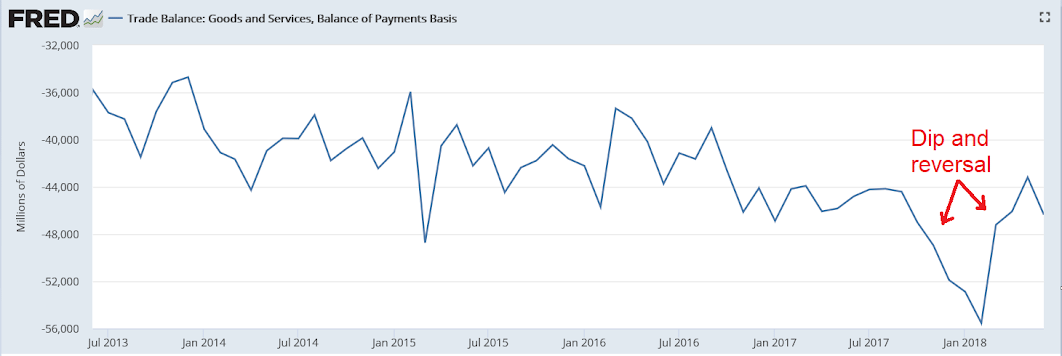

Though deeper than expected in June, the nation’s trade deficit has been improving though the outlook, given tit for tats on tariffs, is uncertain.

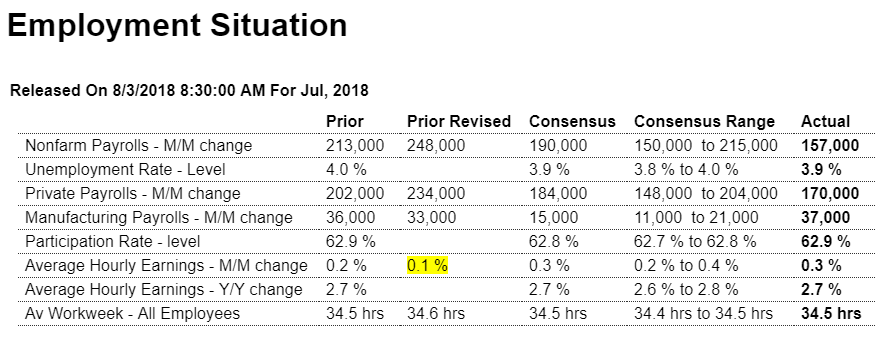

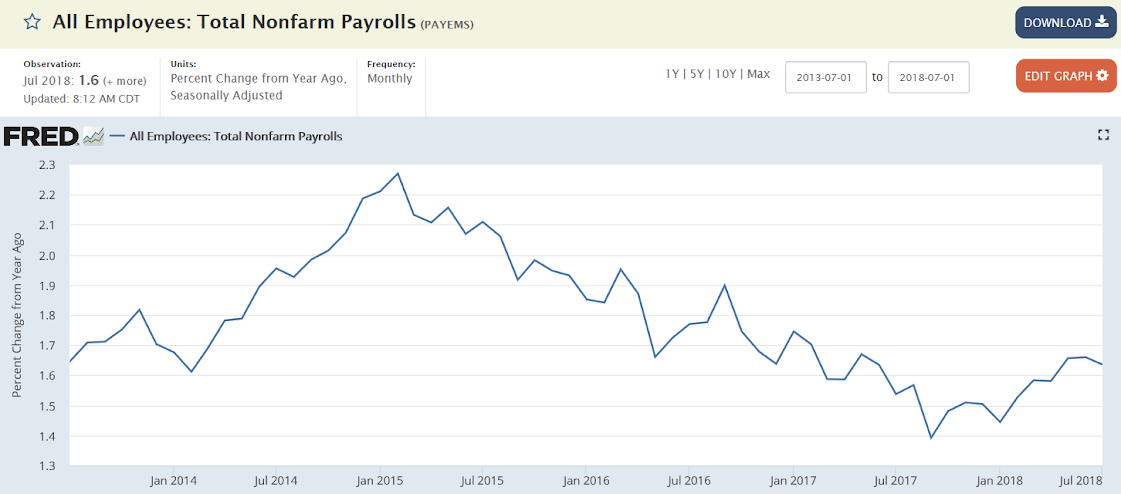

Chugging along as low participation rates and low wage growth tell me there’s still a lot of excess capacity:

Highlights

Slowing job growth may be a welcome outcome given the risk that economic activity may be pressing up against capacity limits. A 157,000 rise in nonfarm payrolls for July is at the low end of Econoday’s consensus range but is still healthy growth that is strong enough to absorb new entrants into the labor market. And revisions to prior months are favorable, a net 59,000 gain with June revised up to 248,000 and May higher at 268,000 in what were two very strong months for job growth.

The slowing in July is also favorable for the inflation outlook as average hourly earnings showed a little heat, up 0.3 percent which was expected but still firm. The year-on-year rate, at an as-expected 2.7 percent, has been steady which is a relief to Federal Reserve policy makers who are focused on keeping inflation stable at current rates.

The payroll breakdown is led by temporary help services which rose 28,000 in a very strong gain that indicates employers, stacked up with orders and backlogs, are scrambling to meet demand. Construction payrolls also standout with a strong 19,000 gain in the latest indication of strength in this sector. Manufacturing payrolls rose 37,000 to more than double Econoday’s consensus with trade & transportation, reflecting strong activity in the supply chain, up 15,000. Weakness in payrolls comes from mining, down 4,000 after a long series of gains, and also government payrolls which fell 13,000 to nearly reverse the prior month’s 14,000 jump.

The unemployment rate fell 1 tenth in July to 3.9 percent with the number of unemployed actively looking for a job down 284,000 to 6.280 million. The pool of available workers, which includes those wanting a job but aren’t looking, fell 379,000 to 11.443 million which hints at capacity limits in the labor force, again underscoring the risk of wage inflation. The participation rate holds at 62.9 percent.

Though the headline is softer than expected, this is yet another positive employment report that speaks to the strength of the labor market and the success, so far, of Federal Reserve policy.

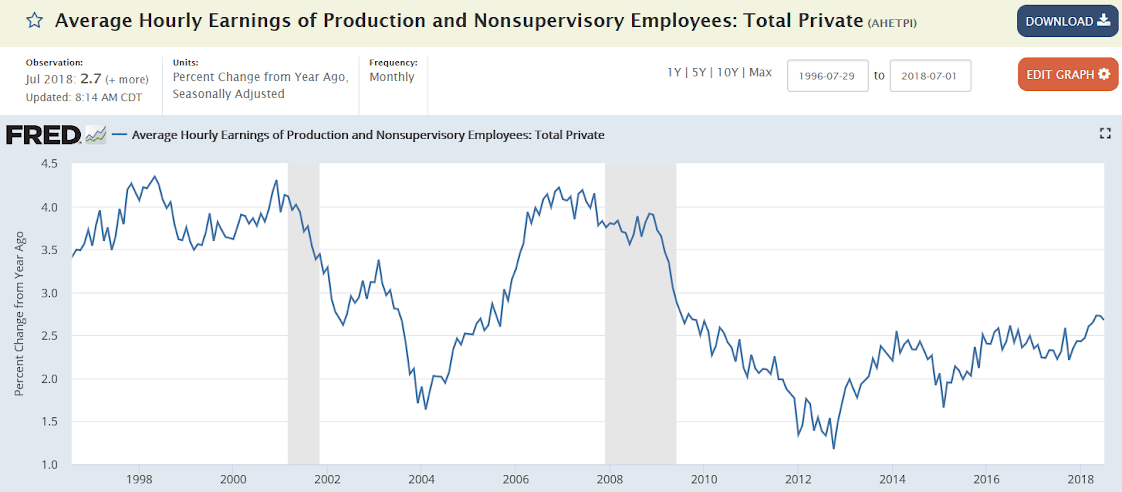

Analysts have been crying wolf on ‘wage inflation’ for several years now:

The deceleration had seemingly reversed a year ago, but in any case employment growth is modest at best:

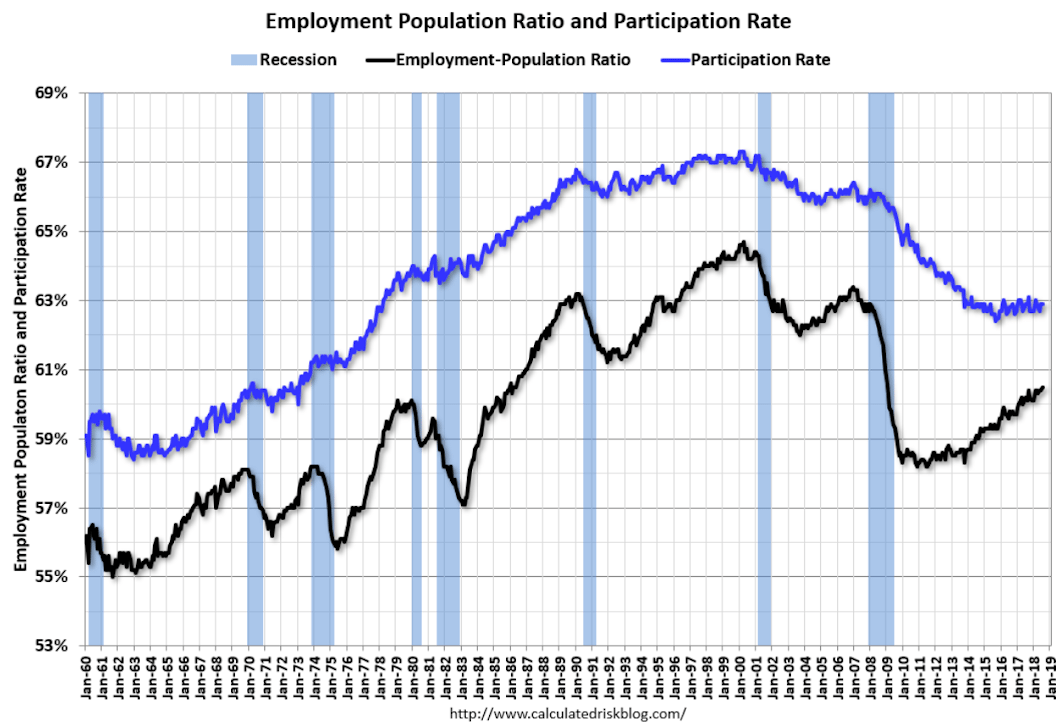

Hasn’t been much of a recovery:

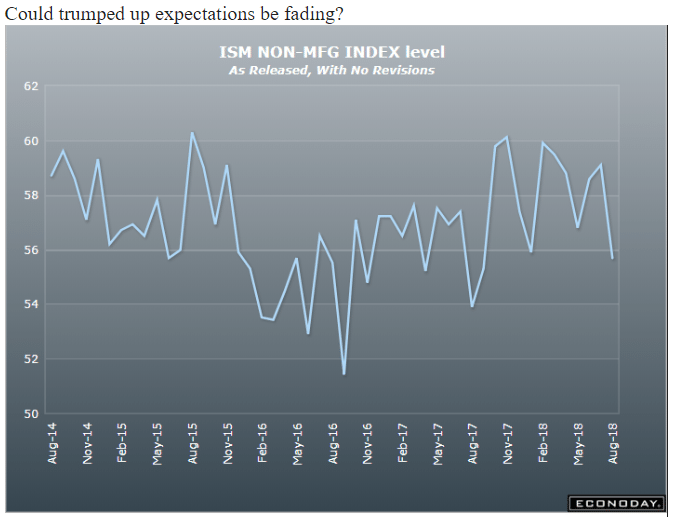

Fyi,

I don’t see the public purpose behind this at all, of course:

Japan plans sovereign wealth fund to finance US infrastructure

(Nikkei) The Japanese government intends to create a sovereign wealth fund to invest in American infrastructure projects. The state-backed fund will support infrastructure construction along with resource development and storage, as well as invest in joint U.S.-Japanese projects in other countries. It could work with a $113 million Indo-Pacific investment initiative announced this week by U.S. Secretary of State Mike Pompeo. Japan is expected to offer the fund as a concrete example of economic cooperation with the U.S. at the “free, fair and reciprocal” trade talks that the two sides will launch on Aug. 9.