Highlights Unit vehicle sales proved surprisingly weak in July, at a 16.8 million annualized rate vs 17.2 million in June. This is the lowest rate since August last year but it will be the comparison with June that will pull down forecasts for July’s retail sales report. Vehicles were a valuable contributor to the monthly retail sales reports throughout the second quarter, but today’s results point to a flat opening for the third-quarter. Vehicle sales make up about one-fifth of total retail sales. Weakness was split between imports, at a 3.7 million rate vs June’s 3.8, and domestic-made, at 13.1 million vs 13.4. Highlights Factory orders for June rose a sharp 0.7 percent but miss Econoday’s consensus by 2 tenths in a report that does include some slowing. Orders for

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Highlights

Unit vehicle sales proved surprisingly weak in July, at a 16.8 million annualized rate vs 17.2 million in June. This is the lowest rate since August last year but it will be the comparison with June that will pull down forecasts for July’s retail sales report. Vehicles were a valuable contributor to the monthly retail sales reports throughout the second quarter, but today’s results point to a flat opening for the third-quarter. Vehicle sales make up about one-fifth of total retail sales. Weakness was split between imports, at a 3.7 million rate vs June’s 3.8, and domestic-made, at 13.1 million vs 13.4.

Highlights

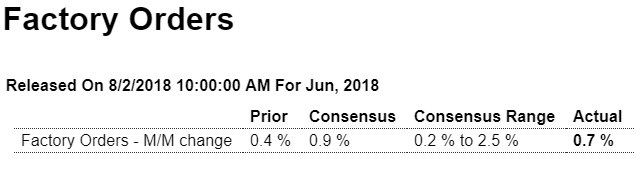

Factory orders for June rose a sharp 0.7 percent but miss Econoday’s consensus by 2 tenths in a report that does include some slowing. Orders for commercial aircraft were a plus in the month as were orders for vehicles excluding which, as well as all other transportation equipment, orders in June rose 0.4 percent and are unchanged from last week’s advance estimate.

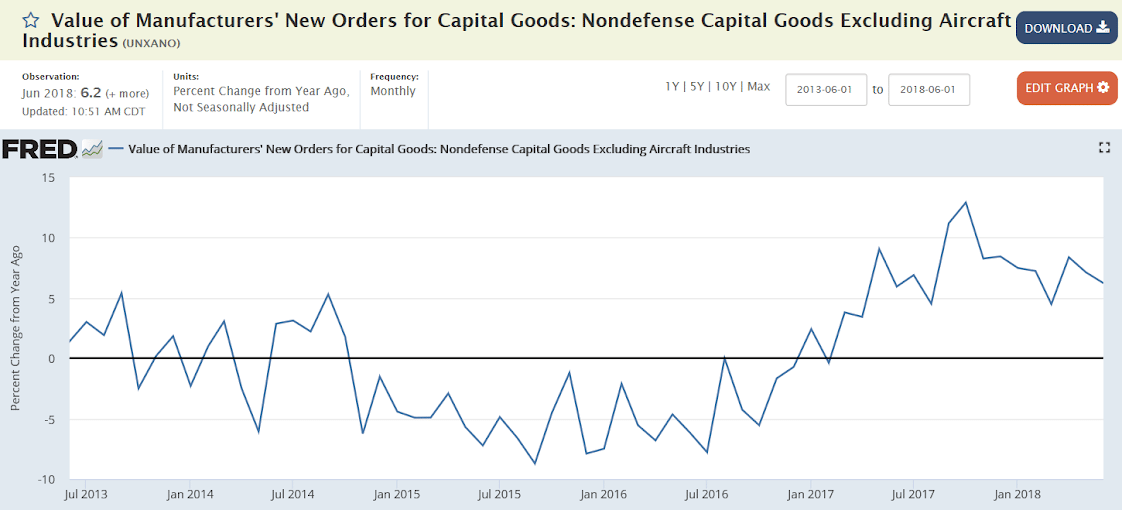

What are changed are orders for core capital goods (nondefense ex-aircraft) which are revised to only a 0.2 percent gain vs a 0.6 percent rise in last week’s advance data. Shipments for this reading are revised 3 tenths lower to a 0.7 percent gain in a downgrade that will weigh slightly on forecasts for the second estimate of second-quarter GDP.

Orders for steel and aluminum fell back in June though unfilled orders are up and related inventories continue to rise sharply. Total orders for durable goods rose 0.8 percent, revised 2 tenths lower from the advance report, with orders for non-durable goods, the fresh information in today’s report, up 0.5 percent on strength in chemicals vs May’s 1.1 percent gain which was fed by strength in petroleum and coal.

Other data include a useful build in total unfilled orders which extended recent gains with a 0.4 percent rise. Total shipments were very strong, up 1.0 percent despite wide reports in the month of trucking snags. Inventories are low in the factory sector, up only 0.1 percent in June to drive down the inventory-to-shipments ratio to 1.33 from 1.35.

Today’s strong headline aside, June wasn’t that great of a month for the factory sector which perhaps was held down to a degree by tariff-related disruptions. Year-on-year growth in orders is very positive, at 6.1 percent, but down from 9.2 and 7.9 percent in the two prior months. Nevertheless, indications including strong readings in regional and private manufacturing reports point to second-half acceleration for the sector and second-half leadership for the 2018 economy.

Growth is slowing and on an inflation adjusted basis we aren’t even back up to levels of two decades ago: