Looks like it’s turned up a bit with the tax cuts? Looks like this source of private sector deficit spending has gone flat again: Looks to me a lot more like a deficiency of demand than a demographic shift: This is a source of $US deficit spending that ‘offsets’ unspent incomes: China to raise billions in rare US debt deal as trade tensions persist (Nikkei) China is planning to sell billion in U.S. dollar bonds this month. China is planning to sell bonds that mature in five, 10 and 30 years, and become a regular issuer of sovereign debt. In October 2017, China issued billion in five- and 10-year bonds at slightly higher interest rates than what the U.S. Treasury was paying to borrow at the time. Asian companies outside of Japan have sold 5 billion in U.S.

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

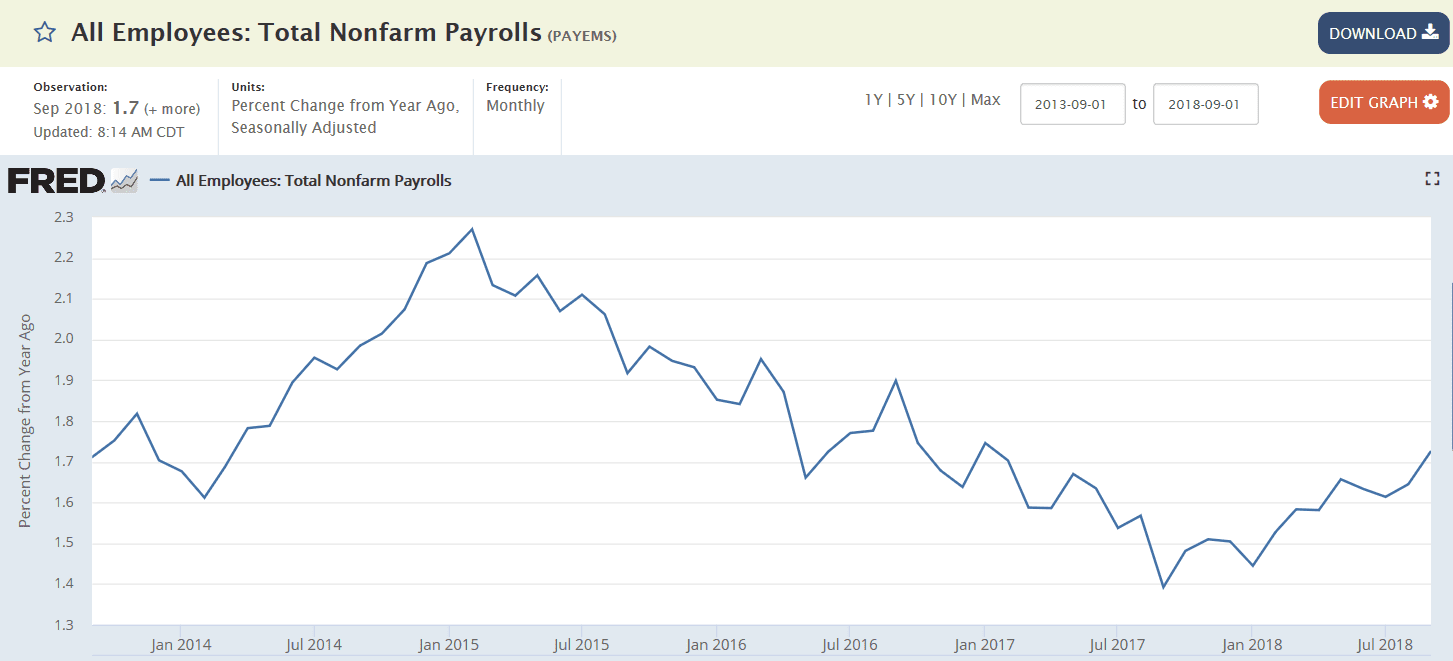

Looks like it’s turned up a bit with the tax cuts?

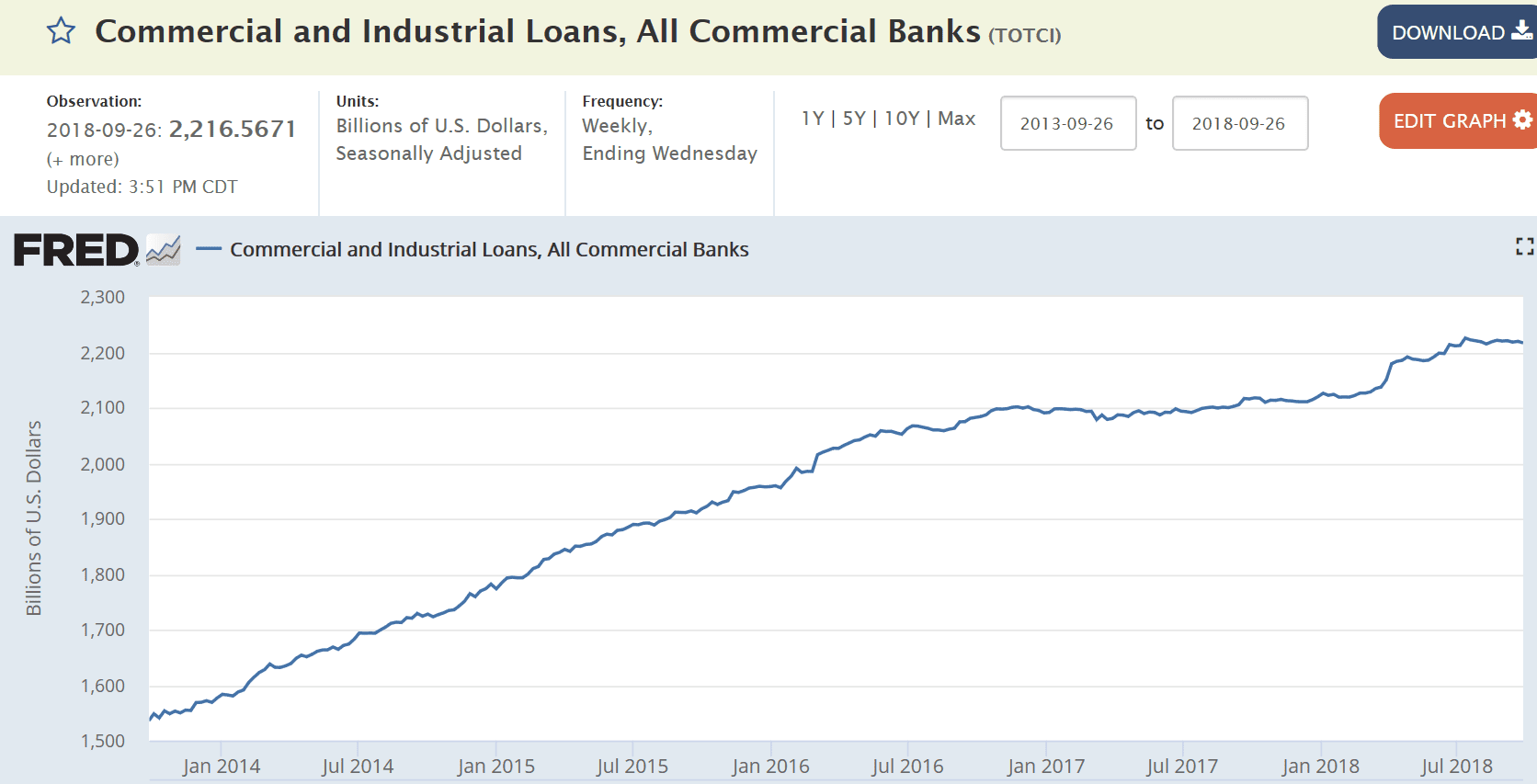

Looks like this source of private sector deficit spending has gone flat again:

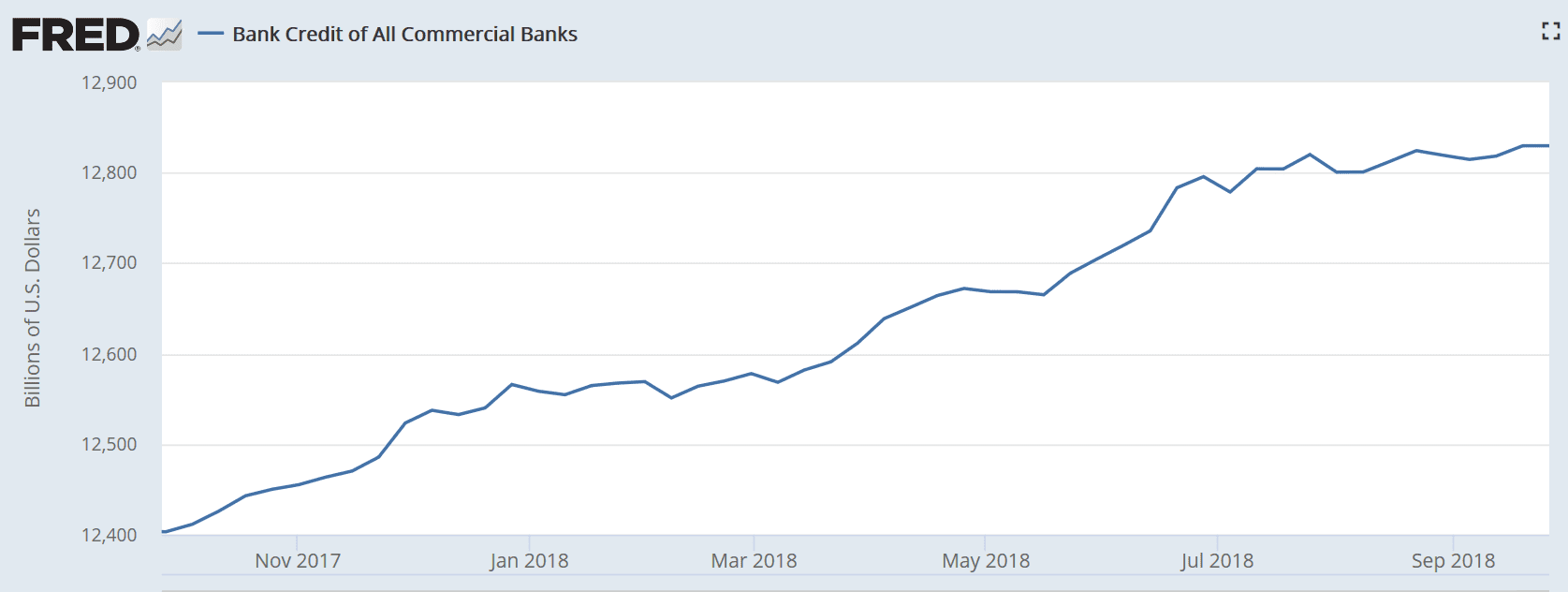

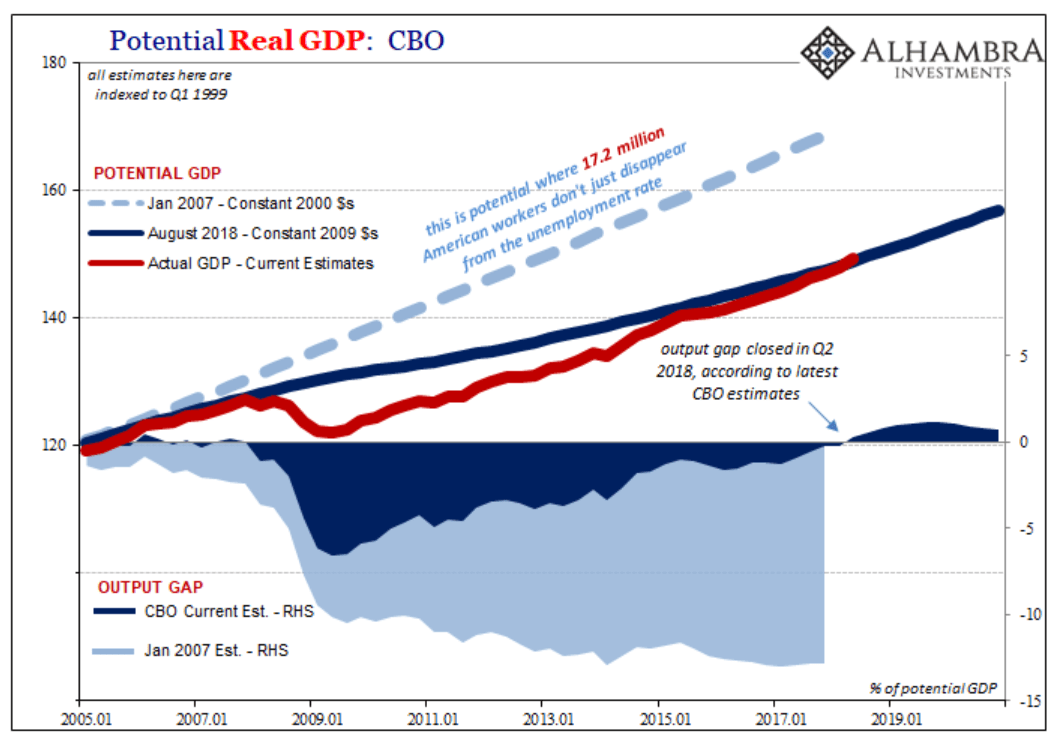

Looks to me a lot more like a deficiency of demand than a demographic shift:

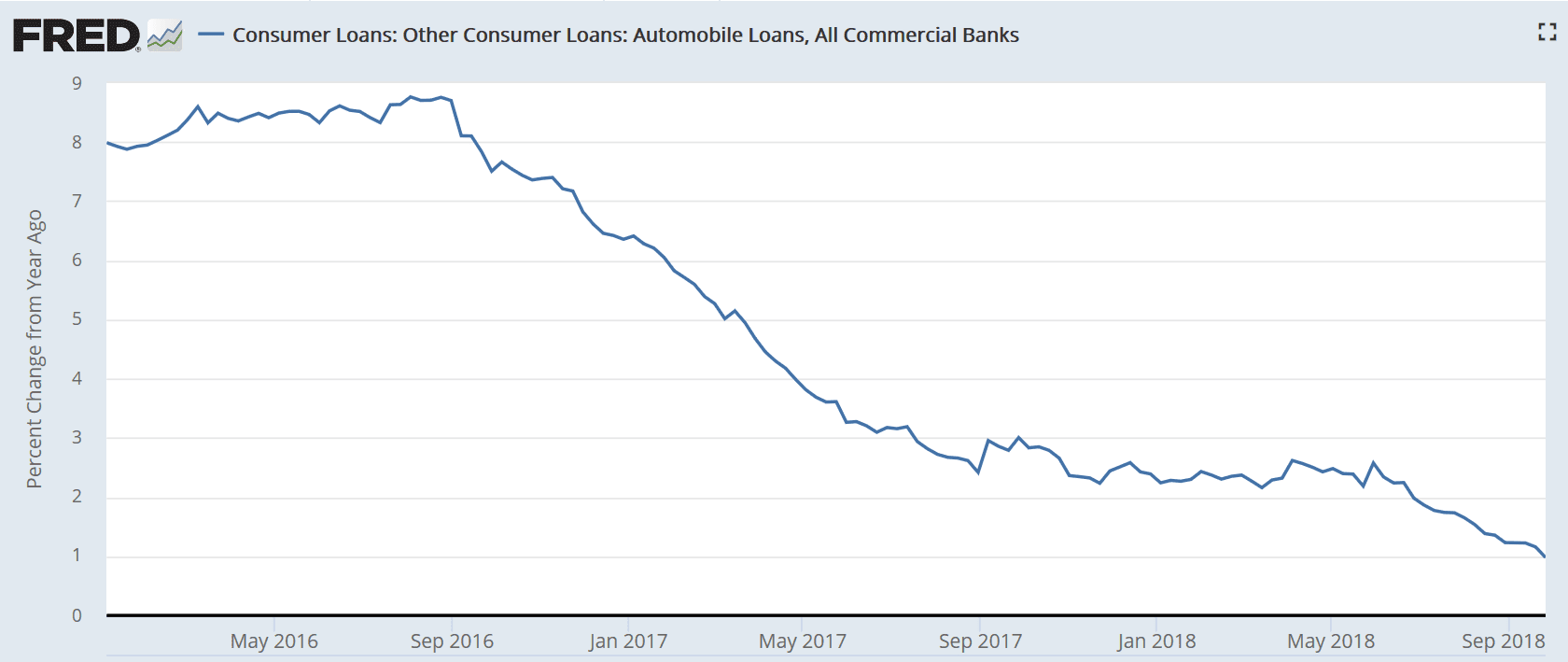

This is a source of $US deficit spending that ‘offsets’ unspent incomes:

China to raise billions in rare US debt deal as trade tensions persist

(Nikkei) China is planning to sell $3 billion in U.S. dollar bonds this month. China is planning to sell bonds that mature in five, 10 and 30 years, and become a regular issuer of sovereign debt. In October 2017, China issued $2 billion in five- and 10-year bonds at slightly higher interest rates than what the U.S. Treasury was paying to borrow at the time. Asian companies outside of Japan have sold $185 billion in U.S. dollar bonds so far in 2018, of which roughly half has come from Chinese firms, according to ANZ Research. Overall Asia ex-Japan corporate debt issuance is down 17% from a year ago.