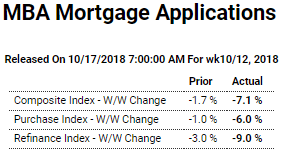

Gone from bad to worse: Highlights The highest interest rates in over 7 years took their toll on mortgage activity in the October 12 week, with purchase applications for home mortgages falling a seasonally adjusted 6 percent while applications for refinancing fell 9 percent. Despite the sizable seasonally adjusted decline, unadjusted purchase applications remained 2 percent higher than in the same week a year ago. The refinance share of mortgage activity decreased by 0.9 percentage points to 38.1 percent. After jumping 9 basis points in the previous week, the average interest rate on 30-year fixed rate conforming mortgages (3,100 or less) rose another 5 basis points to 5.10 percent, the highest level since February 2011. Gone from bad to worse: HighlightsHowever

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Gone from bad to worse:

Highlights

The highest interest rates in over 7 years took their toll on mortgage activity in the October 12 week, with purchase applications for home mortgages falling a seasonally adjusted 6 percent while applications for refinancing fell 9 percent. Despite the sizable seasonally adjusted decline, unadjusted purchase applications remained 2 percent higher than in the same week a year ago. The refinance share of mortgage activity decreased by 0.9 percentage points to 38.1 percent. After jumping 9 basis points in the previous week, the average interest rate on 30-year fixed rate conforming mortgages ($453,100 or less) rose another 5 basis points to 5.10 percent, the highest level since February 2011.

Gone from bad to worse:

Highlights

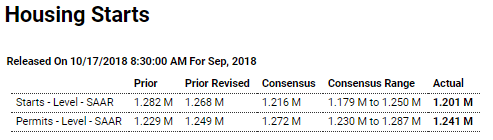

However strong third-quarter GDP may prove, it likely won’t be getting any lift from residential investment. Housing starts in September came in on the low side of expectations, down 5.3 percent to a 1.201 million annualized rate with completions very weak, down 4.1 percent to a 1.162 million rate that’s the lowest since November last year. Hurricane Florence certainly didn’t help the South where starts fell 13.7 percent but the Midwest, which was not affected by the hurricane, saw starts fall 14.0 percent in the month.Building permits, which should be less affected by weather, fell 0.6 percent in September to 1.241 million that is well below expectations and, like completions, is the weakest rate since November. Permits were pulled down by a sharp 7.6 percent drop for multi-units with single-family permits up a solid 2.9 percent. But even here, the year-on-year rates show the weakness, up only 2.4 percent for single-family permits, down 7.8 percent for multi-units with total permits down 1.0 percent.

Looking at quarter-to-quarter comparisons, starts averaged 1.218 million which is down from 1.261 million in the second quarter in what points to yet another quarter of trouble for residential investment — which is the weak link in the 2018 economy. Hurricane effects are a wildcard for housing data both for September and also for October when Michael hit the Florida panhandle but the ultimate impact on the nation’s statistics, judging by today’s results, may prove elusive.

Weakness here to as trade wars seem to be taking their toll: