Chinese state company defaults offshore, first time in 20 years (FT) A Chinese state-owned enterprise from the country’s remote north-west has failed to repay a US dollar bond in Hong Kong, the first offshore default in 20 years and the latest sign investors can no longer rely on Chinese authorities to bail out state groups. Qinghai Provincial Investment Group defaulted on a .9m interest payment due on the Hong Kong note on Friday, then missed a separate principal and interest payment on a Rmb20m (m) onshore renminbi bond that matured on Monday, according to Caixin. Tariff Fears Led U.S. Manufacturers to Trim Spending (WSJ) Private-sector companies said increased tariffs and trade tensions have led them to reduce capital expenditures by an average of 1.2%,

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Chinese state company defaults offshore, first time in 20 years

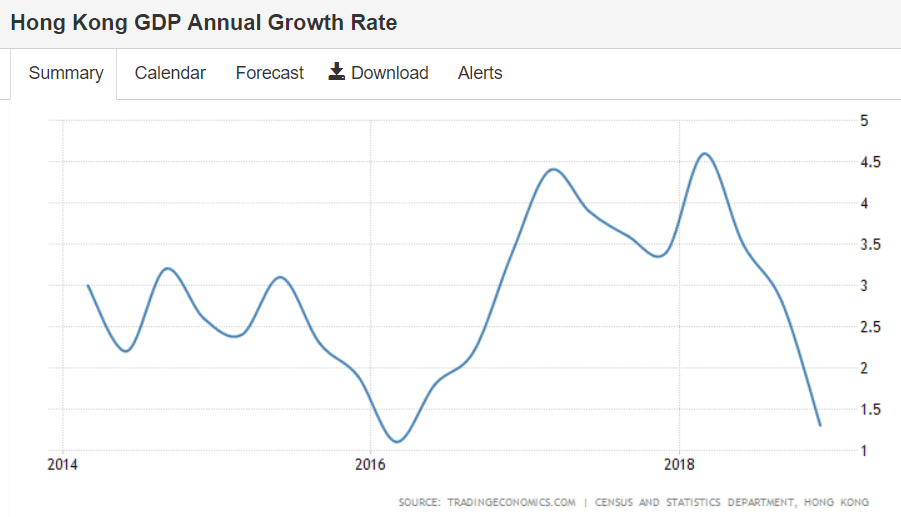

(FT) A Chinese state-owned enterprise from the country’s remote north-west has failed to repay a US dollar bond in Hong Kong, the first offshore default in 20 years and the latest sign investors can no longer rely on Chinese authorities to bail out state groups. Qinghai Provincial Investment Group defaulted on a $10.9m interest payment due on the Hong Kong note on Friday, then missed a separate principal and interest payment on a Rmb20m ($3m) onshore renminbi bond that matured on Monday, according to Caixin.

Tariff Fears Led U.S. Manufacturers to Trim Spending

(WSJ) Private-sector companies said increased tariffs and trade tensions have led them to reduce capital expenditures by an average of 1.2%, according to the Survey of Business Uncertainty. For manufacturers, the impact was larger, with a 4.2% impact on capital expenditures, according to the survey. The Atlanta Fed study finds that a rising proportion of businesses are trimming spending in response to tariff concerns, with 52% either postponing or dropping spending plans in the January survey, compared with 31% in a July questionnaire.

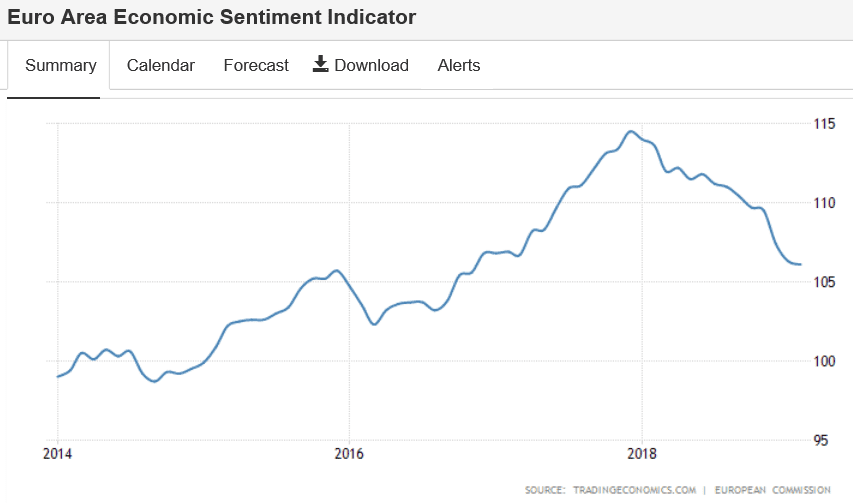

Euro zone business lending growth slows sharply: ECB

(Reuters) Corporate lending expanded by 3.3 percent in January, well below December’s 3.9 percent reading and its post-crisis peak of 4.3 percent hit in September. Credit growth to households meanwhile held steady at 3.2 percent, the ECB data showed. The ECB last month warned that the growth outlook is deteriorating quickly, suggesting that the bloc’s biggest slowdown in half a decade may be longer and deeper than feared. The annual growth rate of the M3 measure of money supply, which often foreshadows future activity, slowed to 3.8 percent from 4.1 percent in December.