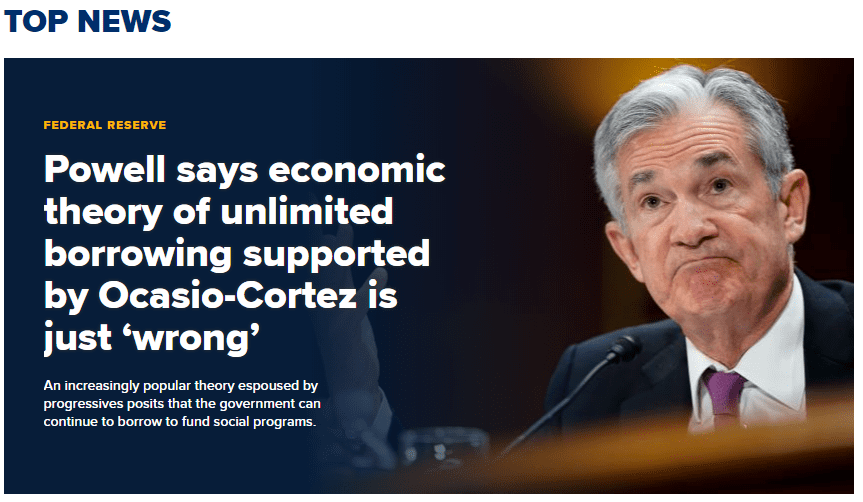

The notion behind what is called “Modern Monetary Theory,” or MMT, is that as long as the Fed can keep interest rates low without sparking inflation, the national debt and budget deficit won’t be an issue. MMT has been espoused by politicians including Rep. Alexandria Ocasio-Cortez, D-N.Y., and Democratic presidential candidate Sen. Bernie Sanders of Vermont. Powell conceded that he has not read up on the theory but said he has heard some “pretty extreme claims” about how it might be implemented. Highlights Housing starts proved unexpectedly weak in December and will pull back residential investment in Thursday’s GDP report. A strong offset, however, is steady strength in permits which are less impacted by weather or similar one-time effects. Starts fell 11.2 percent in

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

The notion behind what is called “Modern Monetary Theory,” or MMT, is that as long as the Fed can keep interest rates low without sparking inflation, the national debt and budget deficit won’t be an issue. MMT has been espoused by politicians including Rep. Alexandria Ocasio-Cortez, D-N.Y., and Democratic presidential candidate Sen. Bernie Sanders of Vermont.

Powell conceded that he has not read up on the theory but said he has heard some “pretty extreme claims” about how it might be implemented.

Highlights

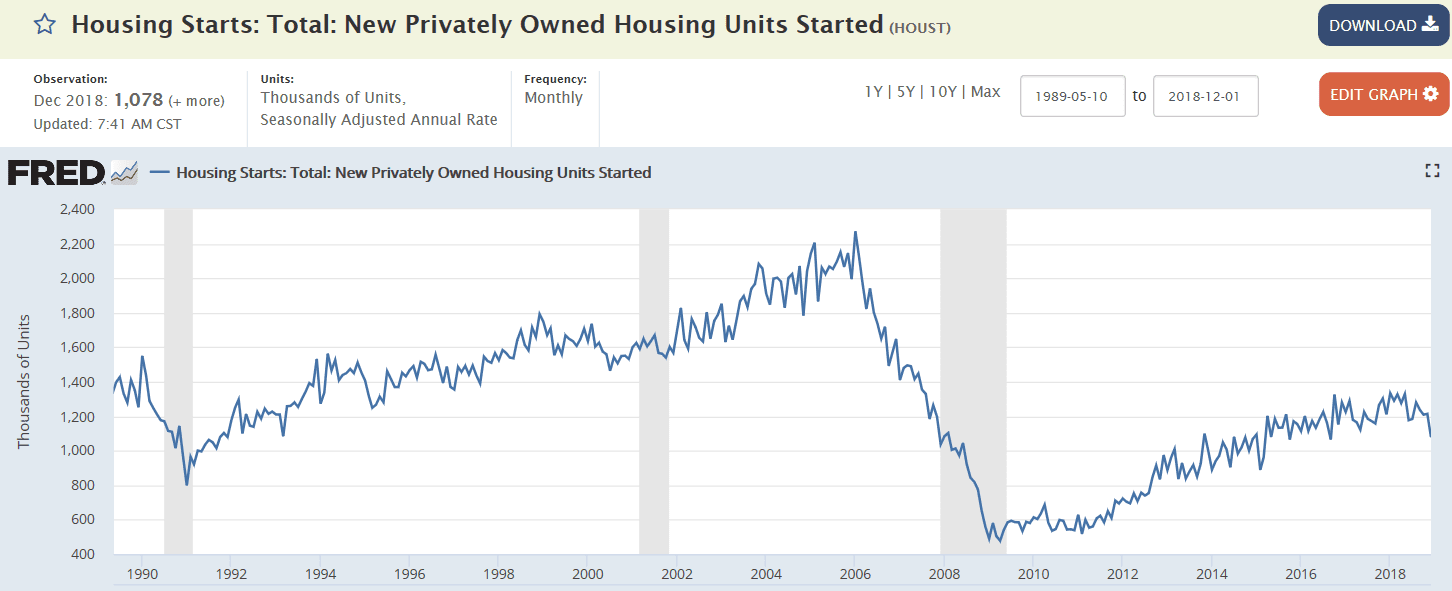

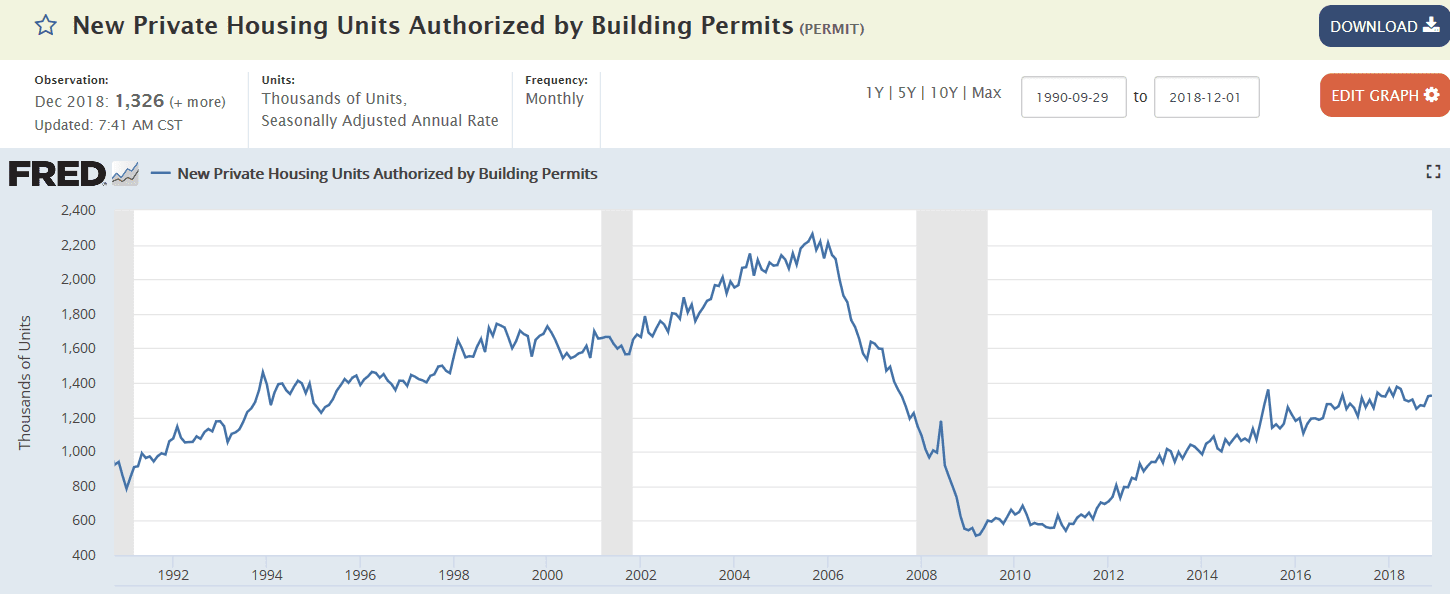

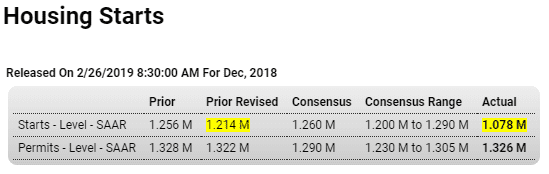

Housing starts proved unexpectedly weak in December and will pull back residential investment in Thursday’s GDP report. A strong offset, however, is steady strength in permits which are less impacted by weather or similar one-time effects.

Starts fell 11.2 percent in the month to a 1.078 million rate that is far below Econoday’s consensus range. This compares with a long trend in the 1.200 to 1.300 million range and is the weakest showing since September 2016.

Wildfires in the West may be at play and are likely responsible at least in part for a 26.3 percent monthly drop in starts in the region to a 216,000 rate. But starts were also down 13.2 percent in the Midwest to a 125,000 rate with the South down 6.0 percent to 630,000. The Northeast was unchanged at 107,000.

Starts of single-family homes, down 6.7 percent, fell less severely than multi-units, down 20.4 percent. This should limit the pull lower for residential investment as single units have higher per unit construction costs than multi-units.

Now the good news in the report. Permits rose 0.3 percent in December to a 1.326 million rate that exceeds Econoday’s high estimate for 1.305 million. Here, however, the single-family reading is down 2.2 percent to 829,000 while multi units are up 4.9 percent to 497,000. And here the West shows strength, up 17.1 percent to 383,000.

Bad: