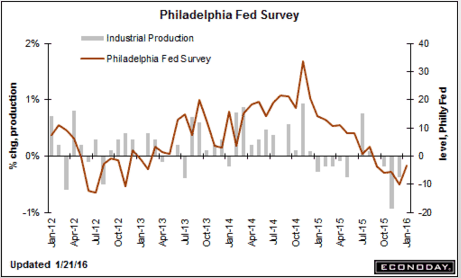

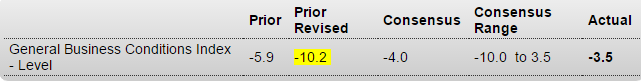

Possible bottom and now moving higher:This month’s negative reading doesn’t look so bad because the revised last month’s down so much…;) Philadelphia Fed Business Outlook SurveyHighlightsThe factory sector continues to slow this month though, in good news, the rate of contraction is flattening out. The Philly Fed’s general business conditions index for January is minus 3.5, a little better than the Econoday consensus for minus 4.0 and the best reading since all the back in August. The new orders index likewise is improving, at minus 1.4 for the best reading since September. And shipments, for the first time also since September, are positive, at a strong 9.6.But most readings in this report are in the negative column including employment, unfilled orders, the workweek, and also inventories where destocking is becoming more aggressive. And judging by the six-month outlook, down 5 points to 19.1 for the softest level since 2012, the destocking is defensive and intentional.Price data are also negative but less so than prior months. And this is the clear theme from this report, that the factory sector may be beginning to level out following a very flat 2015 that was held down by weak global demand and weak energy markets.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Possible bottom and now moving higher:

This month’s negative reading doesn’t look so bad because the revised last month’s down so much…

;)

Philadelphia Fed Business Outlook Survey

Highlights

The factory sector continues to slow this month though, in good news, the rate of contraction is flattening out. The Philly Fed’s general business conditions index for January is minus 3.5, a little better than the Econoday consensus for minus 4.0 and the best reading since all the back in August. The new orders index likewise is improving, at minus 1.4 for the best reading since September. And shipments, for the first time also since September, are positive, at a strong 9.6.But most readings in this report are in the negative column including employment, unfilled orders, the workweek, and also inventories where destocking is becoming more aggressive. And judging by the six-month outlook, down 5 points to 19.1 for the softest level since 2012, the destocking is defensive and intentional.

Price data are also negative but less so than prior months. And this is the clear theme from this report, that the factory sector may be beginning to level out following a very flat 2015 that was held down by weak global demand and weak energy markets.