WARNING: another “debt ceiling debacle” is looming, and could cause nearly immediate recession It’s time to start to get seriously worried about another “debt ceiling debacle.” In 2011, the GOP refused to authorize a “clean” debt ceiling hike. The hike in the debt ceiling, for those who may not know, is necessary for the US government to pay debts that *it has already incurred.* In 2011, as a result of the impasse, US creditworthiness was downgraded from AAA to AA. Consumer confidence plummeted: Note the next largest spike downward occurred during the government shutdown at the beginning of this year. In both cases – the debt ceiling debacle and the government shutdown – Long bond rates (mortgages, shown in blue below) plunged in a “flight to

Topics:

NewDealdemocrat considers the following as important: Featured Stories, politics, Taxes/regulation, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

WARNING: another “debt ceiling debacle” is looming, and could cause nearly immediate recession

It’s time to start to get seriously worried about another “debt ceiling debacle.” In 2011, the GOP refused to authorize a “clean” debt ceiling hike. The hike in the debt ceiling, for those who may not know, is necessary for the US government to pay debts that *it has already incurred.*

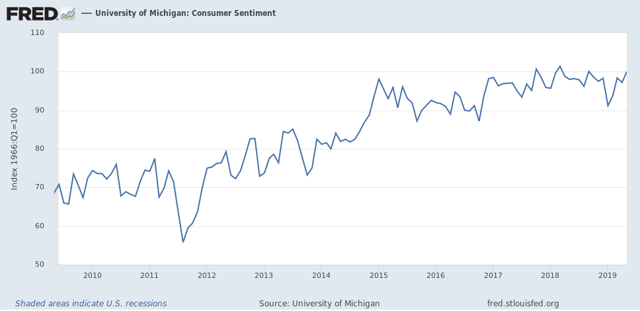

In 2011, as a result of the impasse, US creditworthiness was downgraded from AAA to AA. Consumer confidence plummeted:

Note the next largest spike downward occurred during the government shutdown at the beginning of this year.

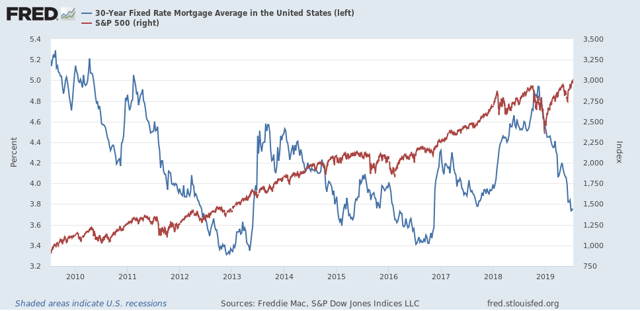

In both cases – the debt ceiling debacle and the government shutdown – Long bond rates (mortgages, shown in blue below) plunged in a “flight to safety,” and stock prices (red) also plunged about 15%:

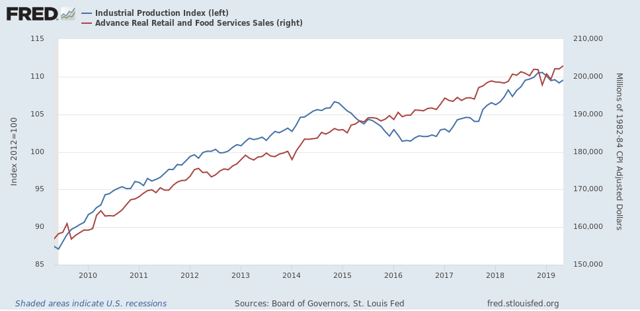

We know, of course, that the stock market is not the “real” economy. In 2011, consumers nevertheless continued to spend (red in the graph below) and industry continued to expand (blue), but during the government shutdown at the beginning of this year, both went sideways or declined:

As I write this, it is almost certain that the economy is already in a slowdown. It is dicey enough that, although I see slowdown as the most likely scenario, I already am on “Recession Watch” for a possible downturn centered on Q4 of this year. Another knock like the “mini-recession” we had from December through February as the result of the government shutdown is the last thing we need.

But we may be about to get it. Congress is scheduled to go on recess after August 2, and not return until after Labor Day in September. According to various news organizations,

Treasury Secretary Steven Mnuchin put his request on paper for Congress to act on the debt ceiling before the August recess, writing to congressional leaders Friday that there’s a chance Treasury could run out of cash in early September.

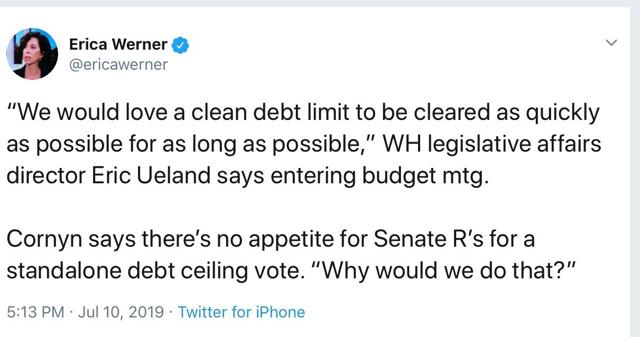

There have been some negotiations:

Pelosi and Republican leaders are looking to strike a multi-year deal to lift the nation’s $22 trillion debt limit and nix Congress’ stiff spending caps, which threaten billions of dollars of cuts at year’s end.

“I am personally convinced that we should act on the caps and the debt ceiling,” Pelosi told reporters on Thursday evening, adding that it should be done “prior to recess.”

But here is a giant sticking point:

Meanwhile, Mitch McConnell, who may be evil but is nevertheless by far the shrewdest operator in Washington, is keeping his cards close to his vest:

[telling] a weekly leadership press conference that lawmakers wouldn’t let the United States default on its debt, but he didn’t offer a clear pathway to approving a debt ceiling increase.

“Time is running out, and if we’re going to avoid having either short- or long-term CR or either a short- or long-term debt ceiling increase, it’s time that we got serious on a bipartisan basis to try to work this out […]” McConnell said. A CR, or continuing resolution, would fund the government at current spending levels.

Asked if Congress had to raise the debt ceiling before the August recess, McConnell sidestepped the question, saying lawmakers are in close contact with Mnuchin about the timeline but that he doesn’t “think there’s any chance that we’ll allow the country to default.”

Way back in 2011 I railed against Obama enabling the GOP’s debt brinksmanship, arguing that it only set a precedent for further blackmail. And here we are.

But as cagey as McConnell may be, as we saw with the government shutdown, Trump is not only willing to hold hostages, but to execute some in order to try to get his way and please his base. All it will take is a few segments on Fox TV for him to once again blow up any deal McConnell brokers.

There are three workweeks left until Congress’s summer recess. If for any reason we actually go over the brink this time, there is an excellent chance that the slowdown almost immediately tips into recession.