Deceleration continues- see chart: Highlights How far along the rate-cut path will the Fed go? Maybe a bit further given a middling employment report where an important detail is pointing to big trouble for the next industrial production report. First the headlines as nonfarm payroll rose 164,000 which is actually 13,000 above Econoday’s consensus for 151,000. But much of the strength came for a second month from government payrolls which, reflecting the heavy government spending that’s underway, rose 16,000 to top June’s 14,000 rise. Private payrolls, which exclude government payrolls, rose 148,000 which, in contrast to the nonfarm headline, is 12,000 under Econoday’s consensus. But a key detail is a decline in manufacturing hours, at 40.4 hours in the weeks and down

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

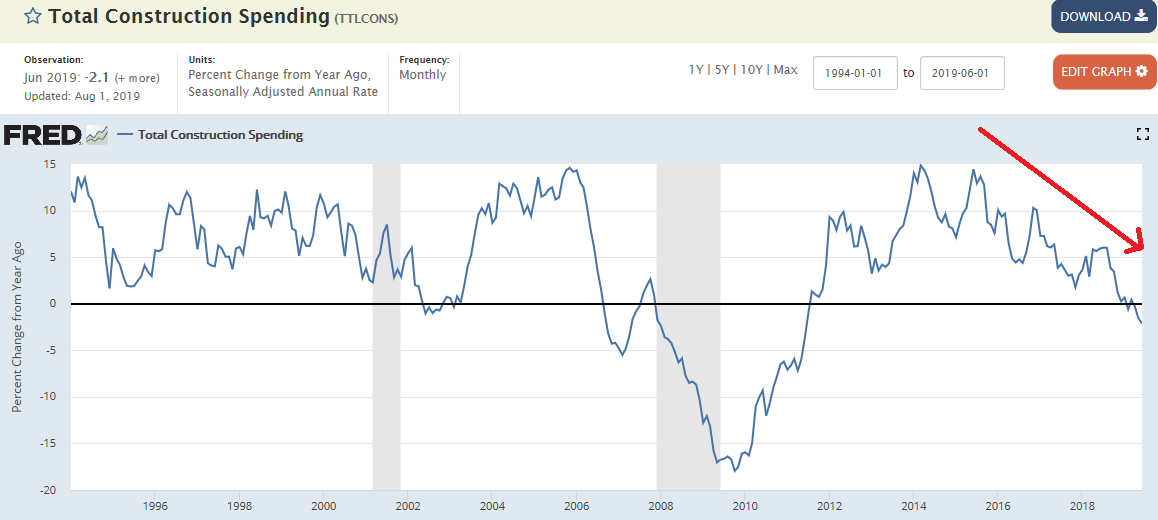

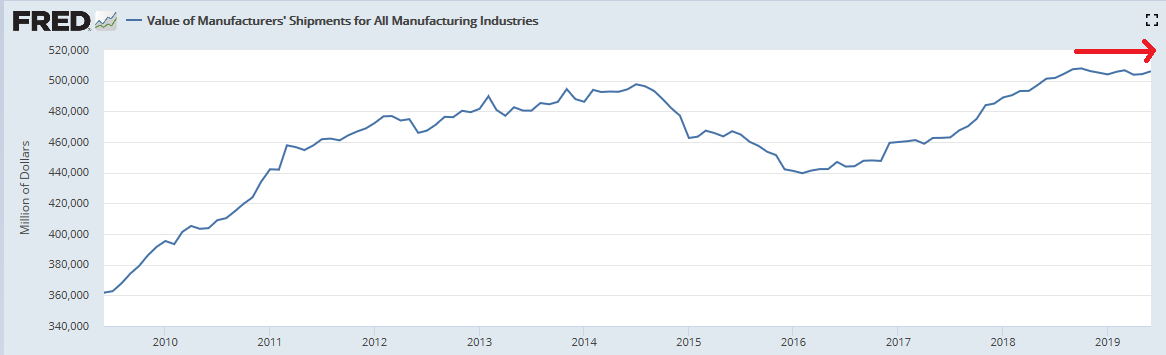

Deceleration continues- see chart:

Highlights

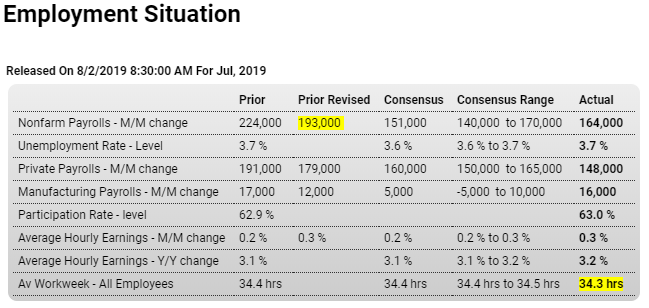

How far along the rate-cut path will the Fed go? Maybe a bit further given a middling employment report where an important detail is pointing to big trouble for the next industrial production report. First the headlines as nonfarm payroll rose 164,000 which is actually 13,000 above Econoday’s consensus for 151,000. But much of the strength came for a second month from government payrolls which, reflecting the heavy government spending that’s underway, rose 16,000 to top June’s 14,000 rise. Private payrolls, which exclude government payrolls, rose 148,000 which, in contrast to the nonfarm headline, is 12,000 under Econoday’s consensus.

But a key detail is a decline in manufacturing hours, at 40.4 hours in the weeks and down from 40.7 hours in June, with manufacturing overtime also down, at 3.2 hours from 3.4 hours. These are inputs into the manufacturing component of the July industrial production report and point to a quick reversal from June’s strength, one that would no doubt focus new attention on the weakness of the sector and the effects of slowing global trade.

Yet wage pressures may be dulling at least some of the Fed’s stimulus bias, especially for the two FOMC members who voted against Wednesday’s rate cut. Average hourly earnings rose 0.3 percent which is at the top-end of Econoday’s consensus range while June’s rise is revised 1 tenth higher and now also stands at 0.3 percent. Year-on-year, earnings rose 1 tenth to 3.2 percent and though moving upward in the month have been higher, at 3.4 percent back in February this year.

Even if wages aren’t rising that much, the availability of labor does show some tightening. The unemployment rate held steady at a very low 3.7 percent but the participation rate did rise 1 tenth to 63.0 percent. The pool of available workers fell nearly 200,000 in the month to 11.1 million.

Turning back to payrolls, manufacturing posted a strong gain of 16,000 which easily tops the consensus range even if the hours in the sector fell in the month. Payroll gainers aren’t eye popping but do include a second straight 38,000 rise for business services which points to demand for contractors and temporary workers, as well as an 18,000 rise for financial activities. On the downside is yet again retail which fell 4,000 in the month to extend its very severe contraction.

Manufacturing is the focus right now and today’s report points squarely at an unfavorable reading for the sector in the next industrial production report which will be posted Thursday, August 15. Otherwise today’s report is mixed showing a solid and sustainable pace for overall payroll growth fed in part by government workers and incremental but not excessive tightening in labor conditions.

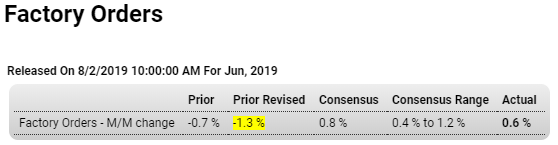

Lower than expected and downward revisions:

Highlights

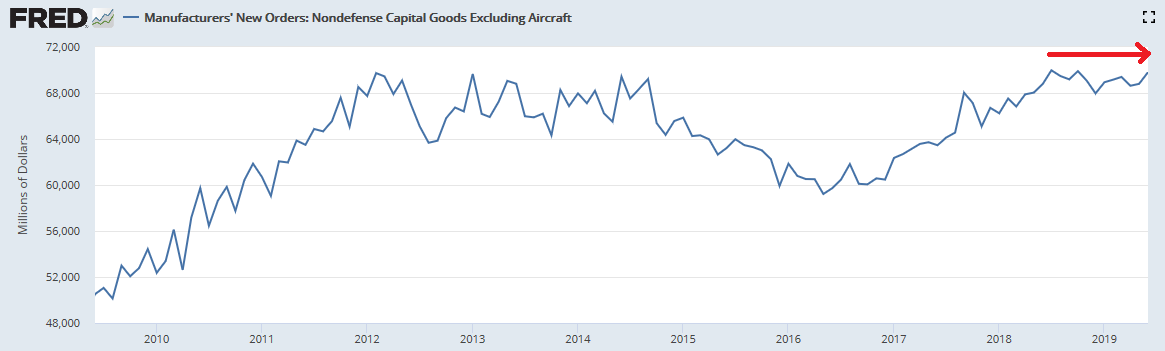

Capital goods that surged in last week’s advance data are revised down a bit in the factory orders report, limiting June’s monthly headline increase to 0.6 percent which is inside of Econoday’s consensus range but misses the consensus by 2 tenths. New orders for core capital goods (nondefense ex-aircraft) are trimmed back 4 tenths to what is still a very strong 1.5 percent monthly gain in June. May is also trimmed back, by 1 tenth to 0.2 percent. Shipments for this category, which are inputs into GDP business investment, are also trimmed back several tenths over June and May to gains of 0.3 and 0.4 percent.

Orders for nondurable goods are the fresh data in today’s report and, pulled down by the effects of lower oil as well as coal prices, fell 0.5 percent in June following a 0.3 percent dip in May. The second estimate for June’s durable goods orders is shaved 1 tenth to a 1.9 percent gain, a very strong showing boosted by capital goods.

Inventories rose a thin 0.2 percent for a third straight month to pull the inventory-to-shipment ratio down to 1.37 from 1.38. If manufacturing is slowing, and year-on-year total new orders in June were down 1.2 percent, at least inventories are being kept in check.

Capital goods orders had been softening and duly raising concern at the Federal Reserve over the health of business investment; June’s jump does not fit into this pattern. If strength continues to appear in this reading, then a central concern for the Fed and its policy shift will be less pressing.

Continuing deceleration, no growth in orders or shipments:

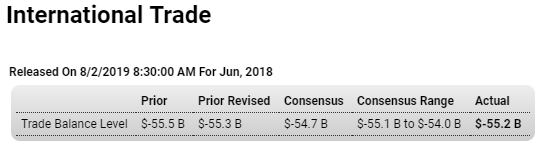

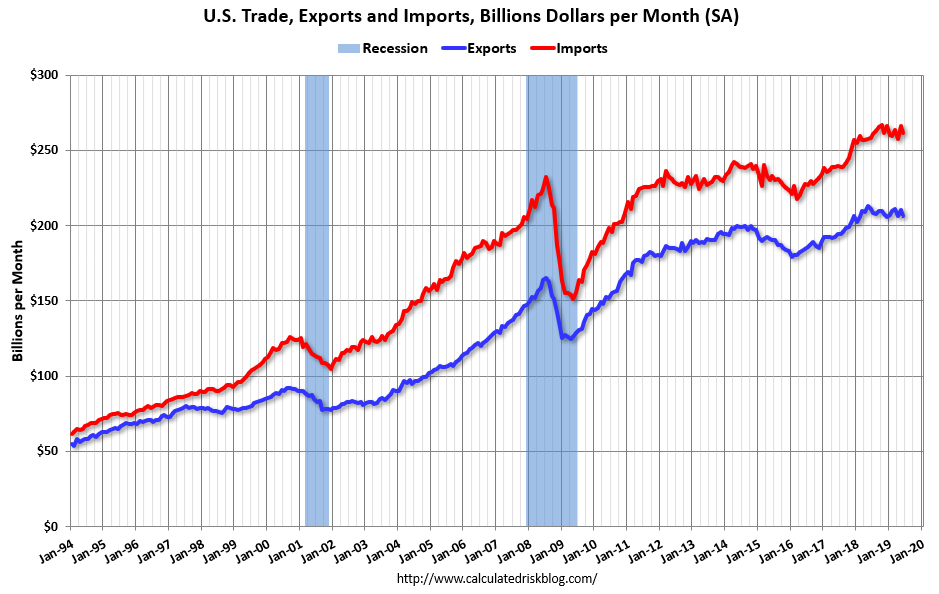

Imports and exports contracting as the global trade collapse continues:

Highlights

June was a very soft month for US trade and though the month’s headline does show marginal improvement from May, at an adjusted deficit of $55.2 billion versus a revised $55.3 billion, both imports and exports contracted, down a monthly 1.7 percent and 2.1 percent respectively.

And not only did goods exports fall, down 2.8 percent to $137.1 billion, but services exports which are usually solid also fell, down 0.7 percent in the month to $69.2 billion. Imports of goods fell 2.2 percent to $212.3 billion with imports of services up 0.2 percent to $49.2 billion.

Turning to details on goods, the deficit with China in June was $30.0 billion versus May’s $30.2 billion in country data that may be unadjusted but are still indicative of a deep and persistent bilateral deficit. The deficit with Mexico also remains very deep, at $9.9 billion from May’s $9.6 billion.

By categories, exports of consumer goods were the weakest posting a $1.9 billion monthly decline in adjusted data to $16.2 billion with exports of capital goods, despite a welcome rise of $0.6 billion in civilian aircraft exports, down $1.2 billion to $44.9 billion. Exports of agricultural products rose slightly in the month to $12.1 billion. On the import side, oil price effects made for a $3.2 billion decline in industrial supplies while consumer goods, the heaviest category for imports, fell $0.9 billion to a still steep $54.7 billion.

June’s trade report edges the trade debate deeper on the troubled side, but only slightly. Yet if the pattern continues and both exports and imports contract, the Federal Reserve’s concerns over the effects of slowing global trade, expressed by this week’s rate cut, will look more and more justified.

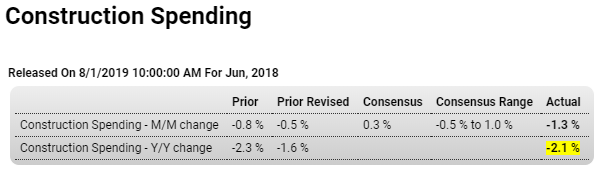

In contraction:

Highlights

The construction sector has been a stubborn disappointment all year, failing to show much life despite strong conditions in the domestic economy and favorable financing rates. Construction spending in June fell 1.3 percent to miss the low end of the Econoday’s consensus range. Year-on-year, spending is down 2.1 percent.

The one positive for the sector has been public spending which, however, fell sharply in June for both educational building and highways & streets. Yet year-on-year, both of these categories are still rising at solid mid-single digit rates reflecting what are strong yearly increases in state & local spending of 5.9 percent and federal spending of 9.7 percent.

When turning to data on the private side of construction the story changes. Private nonresidential construction is down 0.4 percent on the year and June was another soft month with the transportation and power sectors both lower. Manufacturing is showing some life, up in the month and up 10.5 percent year-on-year while commercial building did improve in June but is still down 12.0 percent on the year.

The worst news in the report continues to come from the residential sector where spending is down 8.1 percent from June last year. This despite strong gains in multi-family construction which are being offset by contraction in single-family construction, falling 0.7 percent on the month and down 8.5 percent on the year. And home improvements have likewise been weak, down again in the month and for yearly contraction of 5.1 percent.

This report brings up questions of possible contraction in foreign investment in US real estate and whether construction, like manufacturing, is being pulled down by global slowing and related tariff effects. Watch for construction payrolls in tomorrow’s employment report for the first indication on July conditions in the sector.