Scenes from the July employment report First things first: I’m on a vacation for part of this week, so don’t be surprised if there are no postings for a few days. The July employment report continued a string of good headline numbers with weak leading internals. Let’s take a look. In the good news department, the U6 underemployment rate declined to yet another new expansion low of 7.0%. This is mainly due to the continuing decline in the involuntarily part time employed. The only three months it has been better than that since the modern series started were three months in the year 2000: When we go further and take a look at those who aren’t even in the labor force, because they aren’t looking for a job, but say they want a job now, we’re about 0.2%

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Scenes from the July employment report

First things first: I’m on a vacation for part of this week, so don’t be surprised if there are no postings for a few days.

The July employment report continued a string of good headline numbers with weak leading internals. Let’s take a look.

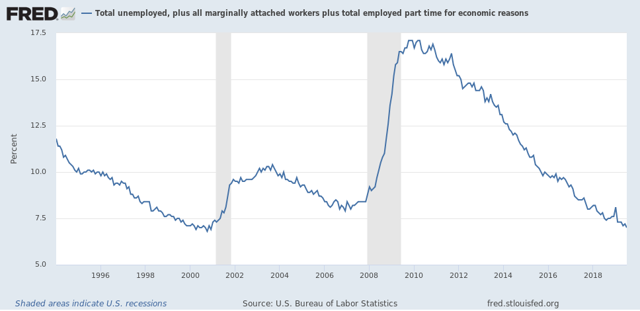

In the good news department, the U6 underemployment rate declined to yet another new expansion low of 7.0%. This is mainly due to the continuing decline in the involuntarily part time employed. The only three months it has been better than that since the modern series started were three months in the year 2000:

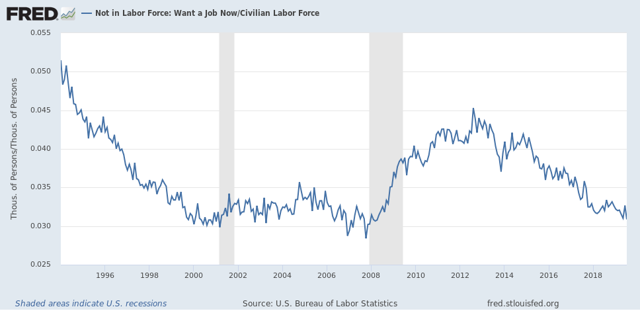

When we go further and take a look at those who aren’t even in the labor force, because they aren’t looking for a job, but say they want a job now, we’re about 0.2% above the 2000 lows and about 0.5% above the all-time lows in 2007:

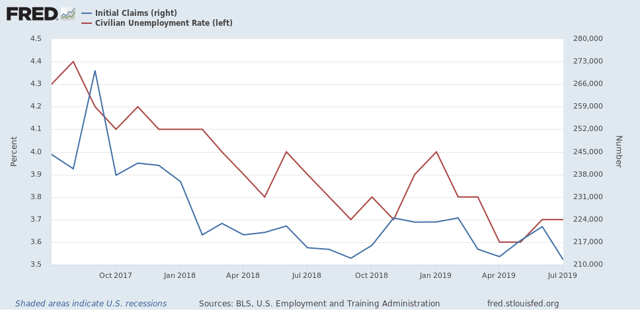

Also, as initial jobless claims continue to trend slightly downward YoY, the U3 unemployment rate is likewise trending slightly downward as well (remember that the former generally leads the latter by a month or two):

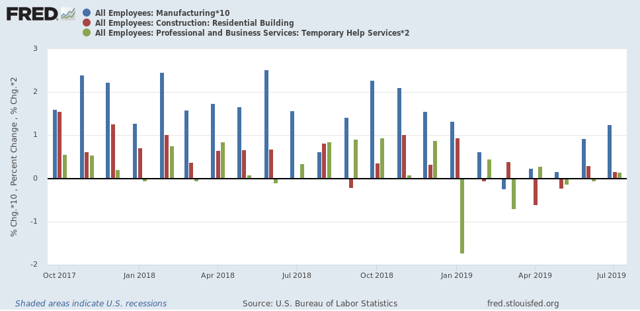

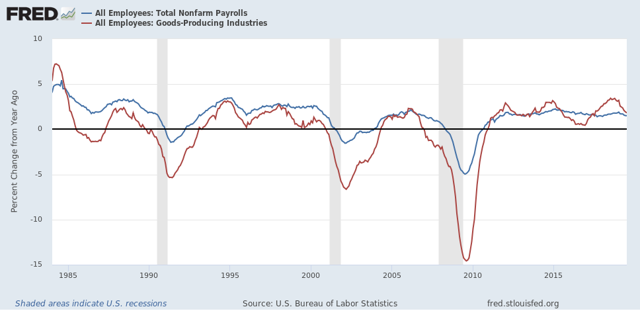

Now to the bad news. I’ve been tracking manufacturing, residential construction, and temporary jobs since the beginning of the year, since these three sectors tend to lead the rest. While manufacturing employment has picked up in the last two months – something of a puzzle, because the ISM readings have been down – construction and temp employment continue close to zero gains, which are way down compared with last year:

Gains in the broader goods producing category has also decelerated sharply, although they are still positive YoY. I would expect this to turn negative before any recession were to begin:

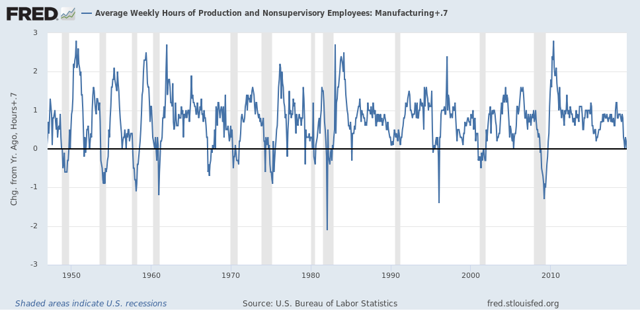

Finally, the average manufacturing work week is one of the ten items in the Index of Leading Indicators. These are down -0.9 hours since their peak in April of last year. In the past this has almost always meant a recession. The best way to show you this graphically is the YoY comparison, which is down -0.7 hours, so I’ve added +0.7 to make that the zero line:

Hours have been down this much or more for 10 of the last 11 recessions. There are only three false positives (1952, 1966, and 1995) for readings this low for more than one month.

In summary we have good present conditions, with leading indications of at very least a slowdown still ahead.