Contributions reduce aggregate demand: US faces ‘disastrous’ .4tn pension funding hole (FT) — The US public pension system has developed a .4tn funding hole. The collective funding shortfall of US public pension funds is three times larger than official figures showed. Joshua Rauh, a senior fellow at the Hoover Institution, who carried out the study, said: “The pension problems are threatening to consume state and local budgets in the absence of some major changes. Currently, states and local governments contribute 7.3 per cent of revenues to public pension plans, but this would need to increase to an average of 17.5 per cent of revenues to stop any further rises in the funding gap, the research said.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

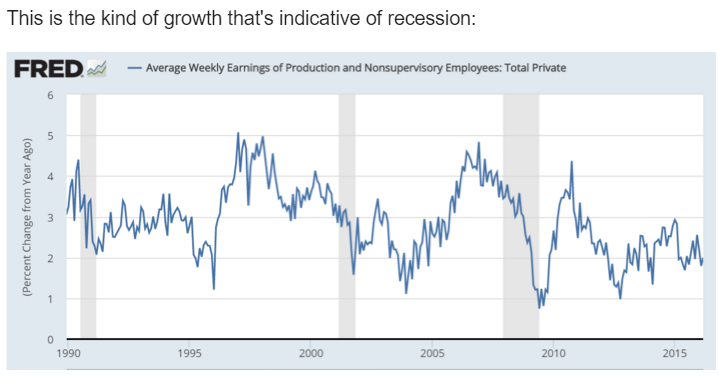

Contributions reduce aggregate demand:

US faces ‘disastrous’ $3.4tn pension funding hole

(FT) — The US public pension system has developed a $3.4tn funding hole. The collective funding shortfall of US public pension funds is three times larger than official figures showed. Joshua Rauh, a senior fellow at the Hoover Institution, who carried out the study, said: “The pension problems are threatening to consume state and local budgets in the absence of some major changes. Currently, states and local governments contribute 7.3 per cent of revenues to public pension plans, but this would need to increase to an average of 17.5 per cent of revenues to stop any further rises in the funding gap, the research said.

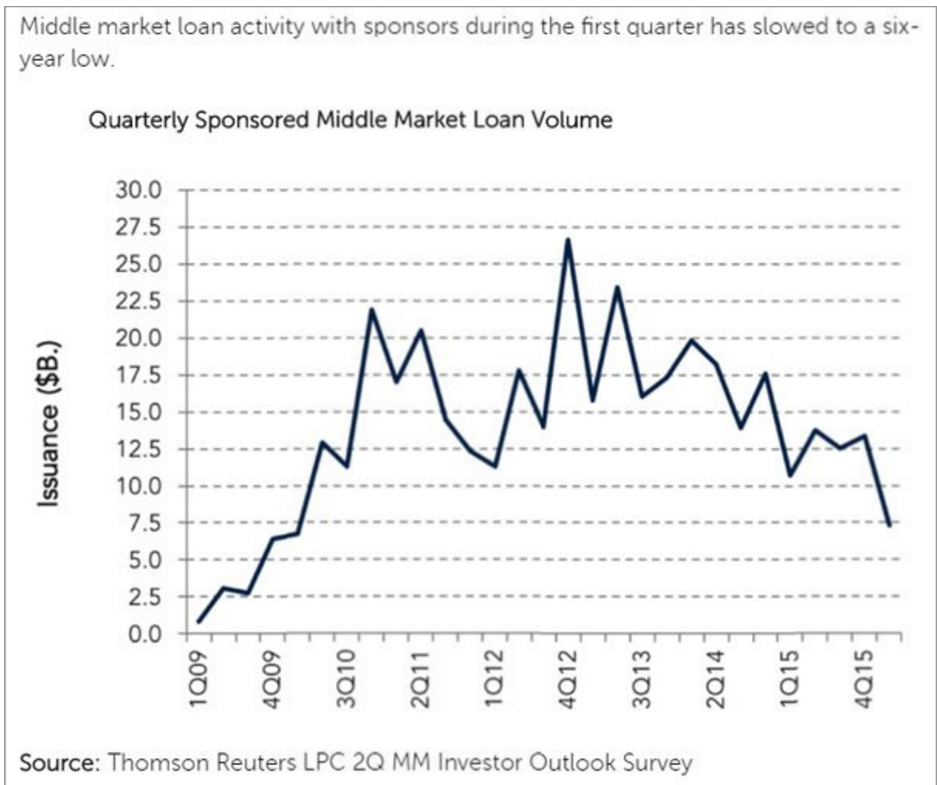

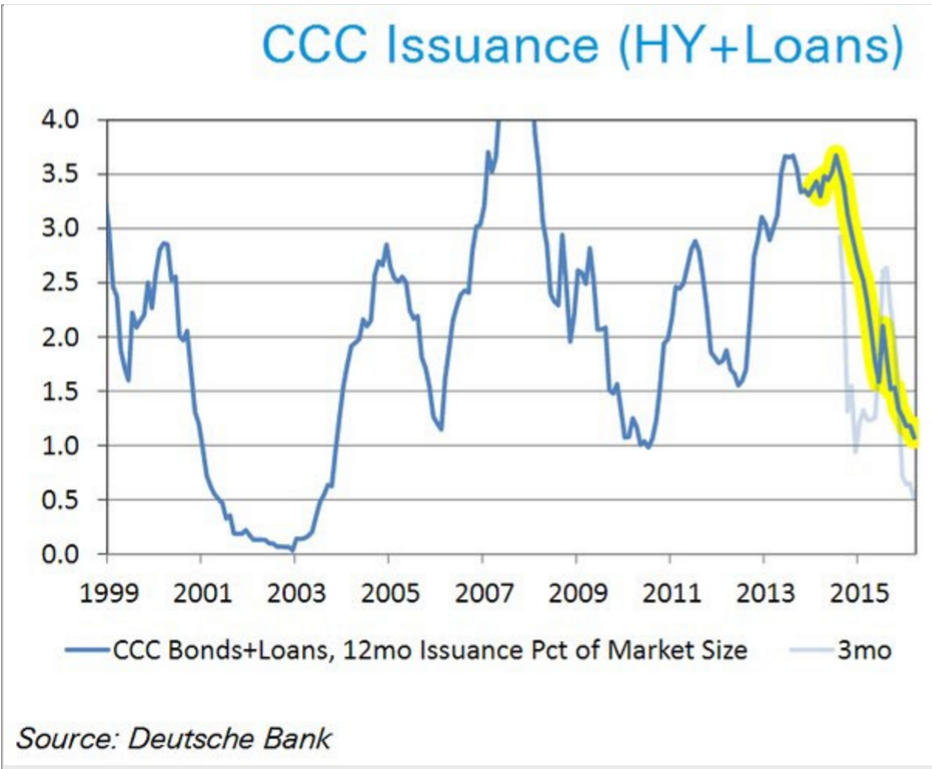

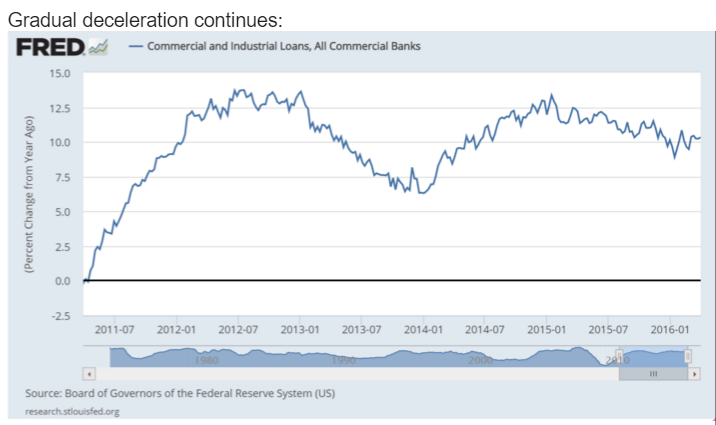

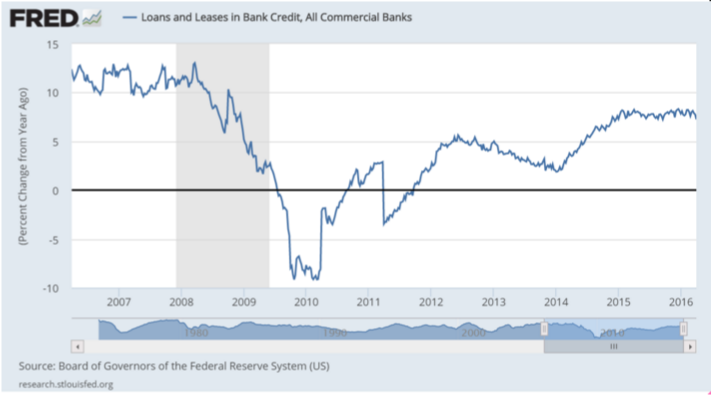

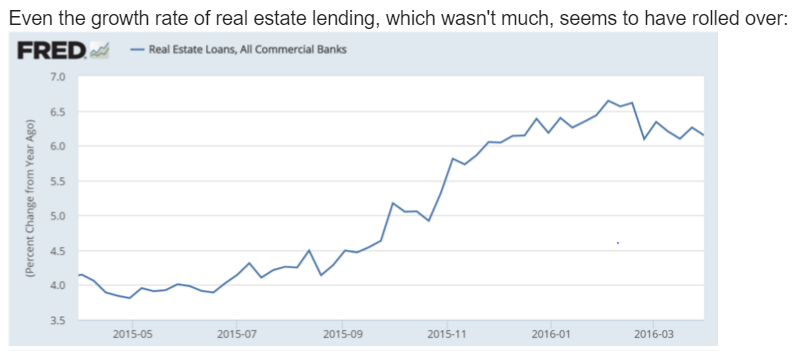

No growth in credit expansion here: