Germany's Finance Minister Wolfgang Schaueble has long been critical of ECB monetary policy,. But now, as Reuters says, the gloves are off. In a speech at a prizegiving for an ordoliberal economics foundation last Friday, Dr. Schaeuble demanded that the ECB raise interest rates.The justification? Very low interest rates hurt Germany's savers, which are the bedrock of its economy.There is a political dimension to this. Dr. Schaueble's party, the CDU, is losing popularity and desperate for pensioner votes. Dr. Schauble even went so far as to blame ECB monetary policy for the rise of the right-wing eurosceptic AfD: "I said to Mario Draghi...be very proud: you can attribute 50% of the results of a party that seems to be new and successful in Germany to the design of this [monetary] policy," Mr. Schäuble said. This is outrageous. Dr. Schaueble is a politician, not a central banker.

Topics:

Frances Coppola considers the following as important: Capital, ECB, euro, Eurozone, Germany, Interest rates, investment, saving, savings

This could be interesting, too:

Merijn T. Knibbe writes Monetary developments in the Euro Area, september 2024. Quiet.

Lars Pålsson Syll writes Central bank independence — a convenient illusion

Merijn T. Knibbe writes How to deal with inflation?

Matias Vernengo writes Sharing Central Banks’ costs and profits of monetary policy in the euro area

The justification? Very low interest rates hurt Germany's savers, which are the bedrock of its economy.

There is a political dimension to this. Dr. Schaueble's party, the CDU, is losing popularity and desperate for pensioner votes. Dr. Schauble even went so far as to blame ECB monetary policy for the rise of the right-wing eurosceptic AfD:

This is outrageous. Dr. Schaueble is a politician, not a central banker. His attempt to influence the conduct of ECB monetary policy to gain domestic political advantage breaks both the spirit and the letter of Article 130 of the Lisbon Treaty:"I said to Mario Draghi...be very proud: you can attribute 50% of the results of a party that seems to be new and successful in Germany to the design of this [monetary] policy," Mr. Schäuble said.

When exercising the powers and carrying out the tasks and duties conferred upon them by the Treaties and the Statute of the ESCB and of the ECB, neither the European Central Bank, nor a national central bank, nor any member of their decision-making bodies shall seek or take instructions from Union institutions, bodies, offices or agencies, from any government of a Member State or from any other body.

It seems that Dr. Schaueble no longer respects the Lisbon Treaty. Deutschland für Deutschland, and to hell with the rest. The cracks in the Eurozone are widening.The Union institutions, bodies, offices or agencies and the governments of the Member States undertake to respect this principle and not to seek to influence the members of the decision-making bodies of the European Central Bank or of the national central banks in the performance of their tasks.

But leaving aside the political implications, is he right? Are ECB interest rates too low for Germany?

Representatives of German banks, pension funds and life insurers say they are too low. The Sparkassen association has long complained that very low interest rates threaten their meagre profitability, because they are unwilling to pass on zero or negative rates to retail customers. And pension funds and life insurers have promised income to their savers that they cannot deliver. Financial institutions are trapped, and savers are angry.

But in its October 2015 monthly report, the Deutsche Bundesbank cast doubt upon both the worries of financial institutions and the anger of savers. Firstly, financial institutions. It seems that German household saving preference is pretty inelastic to price:

So German households save firstly because they are (relatively) wealthy, secondly because they are ageing and thirdly because they are worried about the future. Real returns on savings are much less significant. Financial institutions may have promised savers the moon, but failing to deliver it is not going to stop people saving....there is quite some evidence to suggest that real returns are not a major driver of the saving and investment behaviour of households in Germany. In actual fact, this behaviour has probably, in recent decades, been shaped chiefly by developments in (expected) disposable income, changes in the institutional framework (especially the tax and social security system), demographics, wealth levels and households’ preferences and (risk) attitudes. It appears unlikely that the – clearly volatile – real return(s) should be a dominant factor influencing saving and investment behaviour given that the latter has displayed constant patterns over time and been subject to only gradual changes.

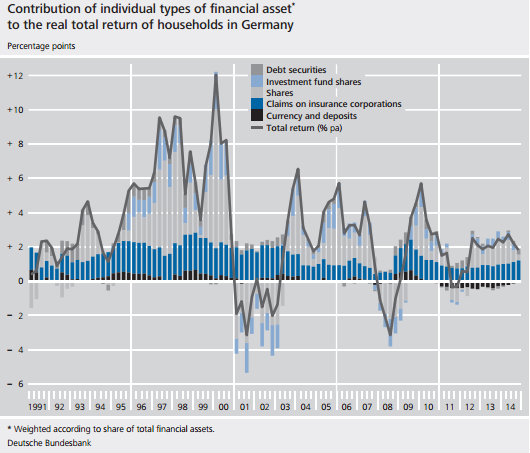

The Deutsche Bundesbank also points out that the returns to savers are not that low:

Indeed there have. This chart shows that real returns are currently around 2%, which is historically not bad at all:...the return on households’ financial assets – measured in real terms and taking into consideration all the major financial assets in the portfolio – is not as meagre as the low nominal interest rates on bank deposits would initially suggest. Alongside the currently low rate of inflation, this can be attributed in large part to the fact that households hold not only comparatively low-yielding bank deposits but also financial assets that generate strong returns. The total return since the outbreak of the financial and economic crisis may be down on average compared to pre-crisis levels, but since the early 1990s there have been repeated spells in which the real total portfolio return has been far lower still.

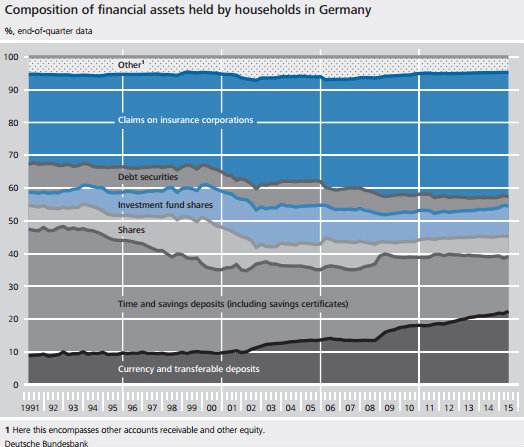

This chart does however show that since 2011, the return on currency and deposits has been negative. So people who keep their savings in bank accounts are feeling the squeeze. And it seems that use of bank accounts is growing. This fascinating chart shows the change in German household investment behaviour over time:

Saving in "currency and transferable deposits" (physical cash and demand deposit accounts) has more than doubled since 2001, at the expense of more risky, higher-yielding investments. German households are accepting lower returns on savings in return for lower risk and greater liquidity - a clear sign of risk aversion. They are more concerned about the return OF their money than the returns ON it.

This is typical of an ageing society with a large middle class who cannot easily replace savings lost due to asset price falls. Germany is one of the fastest-ageing societies on the planet, and has one of the lowest dependency ratios, which does not bode well for the support of its elderly in the future.

The real return on a balanced portfolio being about 2% suggests that interest rates in Germany are not excessively low. Savers who are getting lower returns are paying the price of their own risk aversion. Though this doesn't stop them being angry. Understandably, they do not want to pay that price.

As we have already seen with Japan - which is even further along the ageing-society curve - the faster a society ages, the more risk-averse its population becomes and the more it tends to save. German households are unquestionably increasingly risk-averse. But they don't appear to be saving more. The German personal savings ratio has hovered at around 9% of GDP for a long time - and was even higher during the 1980s.

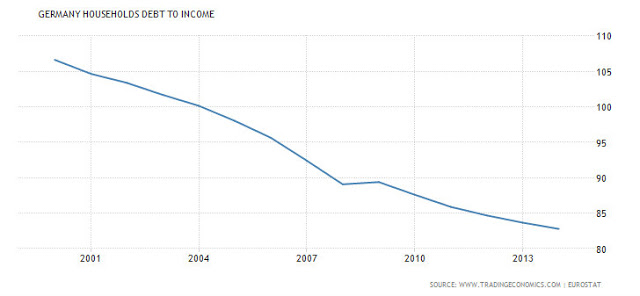

However, German households also have a horror of debt. The ratio of household debt to income has been falling for well over ten years:

This does of course to some extent reflect rising income among German middle-class households. But it also suggests that Germans are largely immune to wealth effects. Even with rising income and today's very low interest rates, they are reducing their household leverage, which is economically equivalent to yet more saving. Borrowing for consumption isn't something they want to do. They want to accumulate wealth.

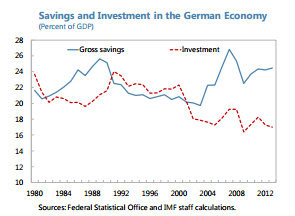

Overall, the German household sector is a rising net lender. Guess what, so is the German corporate sector. And because both the household and corporate sectors are net lenders (i.e. running surpluses), and the German government is also trying to be a net lender (run a surplus), this adds up to FALLING domestic investment, since is not possible for a sector to be both a net lender and a net borrower. This chart from the IMF shows the widening gap between savings and investment:

(the chart only goes up to 2012, but the situation has not materially changed since then).

Now, saving = investment is an identity, so this gap must be closed somehow. This is the driver of the German current account surplus, currently 8% of GDP and rising. The inverse of the current account is the capital account. Germany's capital account is running a deficit equivalent to 8% of GDP. That means Germany is investing 8% of its GDP abroad, rather than at home. We should correctly view the German current account surplus as an inevitable consequence of an excess of saving over investment by all three domestic sectors - household, corporate and government. It has little do with wonderful German industrial production and everything to do with wonderful German thrift.

This is also where the ECB's low interest rates come from. Although the ECB looks across the whole Eurozone when setting monetary policy, Germany's economy is so dominant that conditions there inevitably have a very large influence. The excess of domestic saving over domestic investment puts downwards pressure on real interest rates in Germany, which inevitably flows through into central bank policy settings. This would still be the case even if Germany were not part of the Eurozone.

However, the other side of this is currency effects. Large and growing capital exports put UPWARDS pressure on the currency. Indeed the Eurozone's own capital deficit, which is itself partly due to Germany's capital deficit, is having exactly that effect: the Euro remains strong despite persistent attempts by the ECB to weaken it. But Germany's capital deficit does not respond to Euro strength, because Germany exports its capital mainly in Euros. So the ECB is fighting a battle on two fronts - externally, where it is trying to prevent the currency rising in response to Eurozone capital exports, and within the Eurozone, where it is forced to respond to the deflationary effects of German capital exports. This is a battle it cannot win.

The truth is that very low interest rates in Germany are not caused by ECB monetary policy. They are the result of a structural excess of saving over investment by German private AND public sectors. The prized "schwarze null" entrenches zero or negative interest rates. So if Schauble wants interest rates to rise, he should look to his own fiscal policy, not to the ECB.

To correct its capital account deficit, Germany needs to run a sizeable fiscal deficit, devoted principally to domestic investment but also to supporting the elderly (to improve household confidence and thus discourage excess saving). So what if this means breaking the Stability and Growth Pact. If Schauble can renounce the Lisbon Treaty over central bank independence, he can renounce the Maastricht Treaty over fiscal debt and deficits too. Bring it on.

Related reading:

A current account surplus is obviously a good thing, isn't it? - Notes On The Next Bust