Why March’s big jump in real retail sales augurs well for big employment gains through summer Yesterday I wrote that the steep decline in new jobless claims in the past 4 weeks likely presages another big monthly employment gain, on the order of 1 million or more jobs. Another very big positive for the next few months in employment is the massive, stimulus-fueled jump in retail sales. As I have pointed out many times, real retail sales (blue in the graph below, /2 for scale) tend to lead employment (red) by about 3-4 months. Here’s the long term YoY look from 1993 on, averaged quarterly to cut down on noise:I ’ve also included aggregate hours (gold) in the above. Hours tend to be cut more than jobs in recessions and increase faster in

Topics:

NewDealdemocrat considers the following as important: Retail sales, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Why March’s big jump in real retail sales augurs well for big employment gains through summer

Yesterday I wrote that the steep decline in new jobless claims in the past 4 weeks likely presages another big monthly employment gain, on the order of 1 million or more jobs.

Another very big positive for the next few months in employment is the massive, stimulus-fueled jump in retail sales.

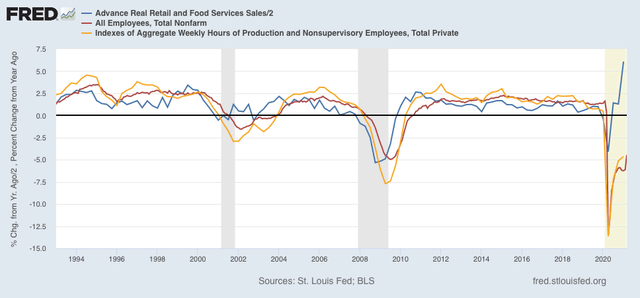

As I have pointed out many times, real retail sales (blue in the graph below, /2 for scale) tend to lead employment (red) by about 3-4 months. Here’s the long term YoY look from 1993 on, averaged quarterly to cut down on noise:

I

’ve also included aggregate hours (gold) in the above. Hours tend to be cut more than jobs in recessions and increase faster in recoveries. The pandemic has been somewhat unique in that, for obvious public health reasons, jobs were cut entirely rather than just hours. Note also the “China shock” in the first few years after 1999, when both jobs and hours continued to be cut, even after sales had rebounded.

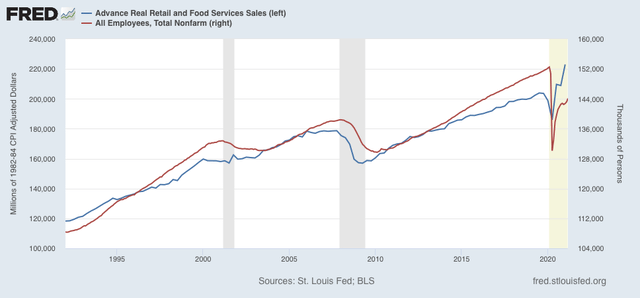

But saying that there is likely to be a big YoY jump in jobs in the next several months is hardly surprising, given the 22 million loss in jobs last April. So the below graph compares the absolute data, sales on the left scale, and employment on the right:

Again, the brief lag with which employment follows sales is obvious. The most important takeaway is that, if the big March gain in sales isn’t taken back in the next month or two, then there’s likely to be a similarly large jump in employment by the end of summer. A gain of another 4 to 6 million jobs, to close to the pre-pandemic peak, is quite possible.