April Industrial Production slightly disappoints – but only due to supply chain bottlenecks Industrial production is the King of Coincident Indicators, and is the one whose peaks and troughs most frequently mark the beginning and end of recessions. It had been bouncing back strongly, but in the last several months, has hit something of a snag. In April, total production increased 0.7%, while manufacturing production increased 0.4%: Both of these, however, remain slightly below January’s levels, and -2.7% and -1.4% respectively below their February 2020 peak just before the pandemic hit. The good news in April was that the declines from February’s Big Texas Freeze have been largely resolved. The bad news is that shortages in

Topics:

NewDealdemocrat considers the following as important: industrial production, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

April Industrial Production slightly disappoints – but only due to supply chain bottlenecks

Industrial production is the King of Coincident Indicators, and is the one whose peaks and troughs most frequently mark the beginning and end of recessions. It had been bouncing back strongly, but in the last several months, has hit something of a snag.

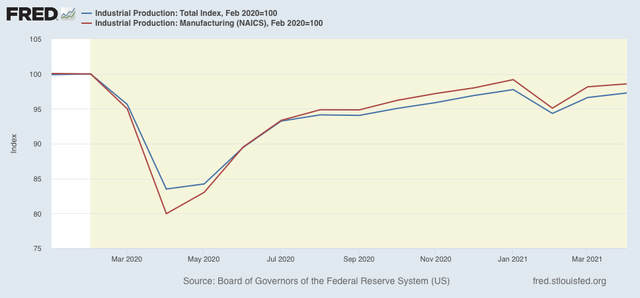

In April, total production increased 0.7%, while manufacturing production increased 0.4%:

Both of these, however, remain slightly below January’s levels, and -2.7% and -1.4% respectively below their February 2020 peak just before the pandemic hit.

The good news in April was that the declines from February’s Big Texas Freeze have been largely resolved. The bad news is that shortages in some supplies continue to create bottlenecks holding back production.

The Fed’s news release notes the important following issues:

[T]he index for manufacturing rose 0.4 percent despite a drop in motor vehicle assemblies that principally resulted from shortages of semiconductors. An important contributor to the gain in factory output was the return to operation of plants that were damaged by February’s severe weather in the south central region of the country and had remained offline in March.

Most market groups posted gains in April, with the principal exceptions being those related to motor vehicles and parts. Automotive products, transit equipment, and consumer parts all recorded losses, as shortages of semiconductors held back motor vehicle assemblies. Among the other market groups, chemical materials and consumer energy products posted strong gains of 6.7 percent and 3.8 percent, respectively.

The index for motor vehicles and parts fell 4.3 percent; excluding the motor vehicle sector, factory output advanced 0.7 percent, primarily reflecting a further recovery in chemicals as additional factories that had sustained weather-related damage during February reopened. Elsewhere, industry results were mixed, with supply chain difficulties possibly hindering production….

The output of utilities moved up 2.6 percent in April after dropping substantially in March, when unseasonably warm weather reduced demand for heating….

The good news for the near future is that these supply chain difficulties are going to be resolved, and as they are resolved, production can be expected to pick up swiftly, given the surge in demand. The important issue will be that the issues get resolved quickly enough so that there is not an episode of “stagnation” caused by resource constraints (a la the gas-fueled stagflation of the 1970s).