May retail sales decline, but 10%+ gain in retail sales since the onset of the pandemic remains intact [Note: I’ll comment on industrial production in a separate post later]I feel like I could simply repost my retail sales piece from one month ago, because the story is the same: at first glance, May’s retail sales report, like April’s, looks like a big miss, as sales declined -1.3% nominally, and after adjusting for inflation, declined -2.0%.But the important point is that the big jump in March didn’t get taken back. As I wrote then: “if the big March gain in sales isn’t taken back in the next month or two, then there’s likely to be a similarly large jump in employment by the end of summer.” Further, I have fully expected the big jump in sales

Topics:

NewDealdemocrat considers the following as important: Retail sales, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

May retail sales decline, but 10%+ gain in retail sales since the onset of the pandemic remains intact

[Note: I’ll comment on industrial production in a separate post later]

I feel like I could simply repost my retail sales piece from one month ago, because the story is the same: at first glance, May’s retail sales report, like April’s, looks like a big miss, as sales declined -1.3% nominally, and after adjusting for inflation, declined -2.0%.

But the important point is that the big jump in March didn’t get taken back. As I wrote then: “if the big March gain in sales isn’t taken back in the next month or two, then there’s likely to be a similarly large jump in employment by the end of summer.” Further, I have fully expected the big jump in sales and income fueled by stimulus payments to peter out. In fact, some significant declines for a few months might actually be a *good* thing. Let’s take a look, and I’ll explain why.

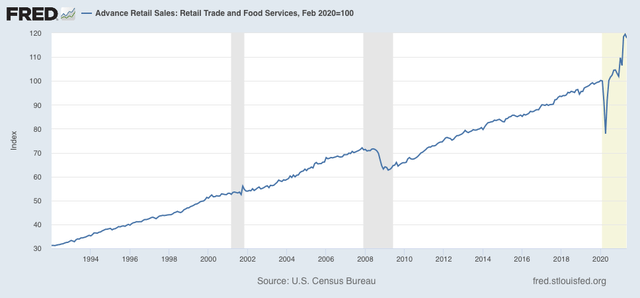

Here are nominal retail sales since the modern series started in 1994:

Figure 1

Figure 1

It’s impossible to miss that there is a huge break to the trend – to the upside – due to the stimulus payments last year, and especially, this year. Retail sales are 18% higher than they were in February 2020. That kind of abrupt, huge increase is going to lead to shortages, which in turn are going to lead to rationing by price – i.e., inflation. A decrease to closer to the long-term trend is still going to be better than the situation before February 2020, and won’t give rise to so much inflationary pressure.

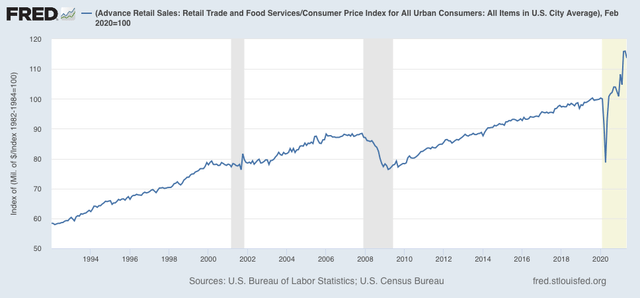

The big jump still exists even after we figure in consumer inflation, up 12% since February 2020:

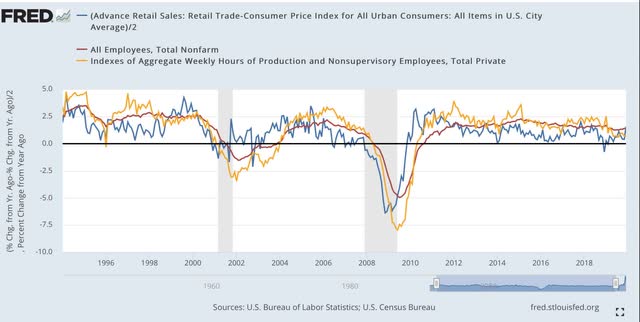

Now, let’s turn to employment, because as I have pointed out many times, real retail sales (blue) tend to lead employment (red) and aggregate hours (gold) by about 3-4 months. Here’s the long term YoY look from 1993 through the end of 2019:

The long lags after the 2001 and 2008 recessions reflected the “China shock” as manufacturing jobs, in particular, were re-sourced to China in large wages after both recessions.

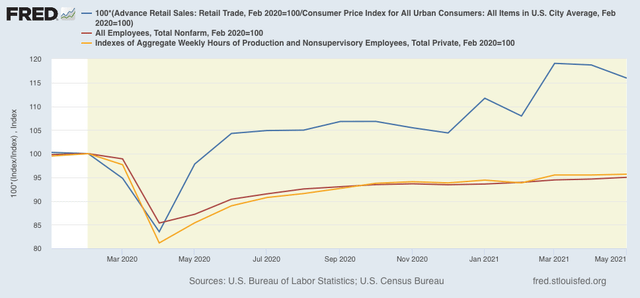

Next, here is the monthly update since the beginning of 2020 (note the huge difference in scale!):

But that there is likely to be a continuing big YoY jump in jobs in the next several months is hardly surprising, given the 22 million loss in jobs in April 2020. So the below graph compares the absolute data, normed to 100 as of February 2020:

The most important takeaways are that, with the stimulus gains “sticking” so far, the large monthly jumps in employment are likely to continue. At the same time, there are legitimate inflationary pressures, as (1) there has been a quick, continuing 10%+ jump in demand; and (2) demand for new employees as indicated by the JOLTS reports of record job openings have remained unfulfilled for a variety of reasons (including lack of child care during in-home schooling) that is requiring big jumps in wages to attract applicants.