More weakness: HighlightsThere is some weakness in the May trade report as the nation’s trade deficit widened sharply to .1 billion from April’s .4 billion. The net deficit for goods widened to .2 billion from April’s .6 billion while the net surplus for services narrowed slightly to .1 billion. In a negative indication on global demand, exports of both goods and services fell slightly in the month. But in a positive indication on domestic demand, imports rose a sharp 1.9 percent on top of April’s 2.3 percent gain. Much of the import gain is tied to the dollar effects of higher oil prices, which jumped nearly in the month, but not all of it as imports of consumer goods and autos show solid gains. The export side of this report, however, is decidedly weak with contraction sweeping capital goods and also civilian aircraft, two areas where weakness may be deepening. An offset to May’s widening is the narrowing in April where the deficit is unrevised at .4 billion. The deficit in April and May together is tracking lower than the first quarter which is a plus for second-quarter GDP. But this report will be most watched come July’s data which will offer early indications on both Brexit effects and the ongoing rise in dollar. Still very low: HighlightsNew orders picked up but only to a moderate pace for Markit Economics’ U.S.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

More weakness:

Highlights

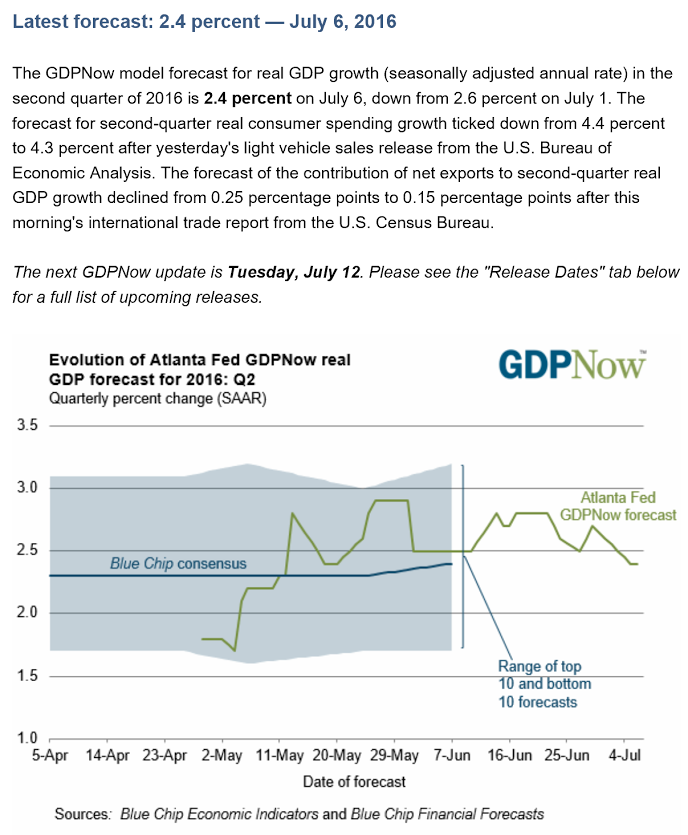

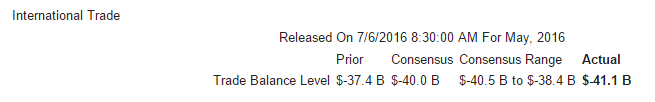

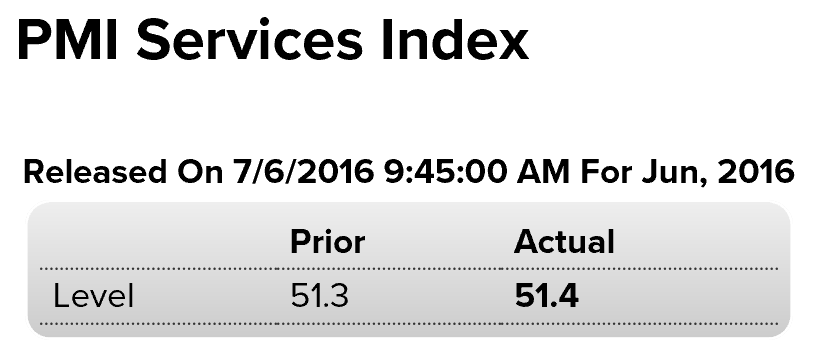

There is some weakness in the May trade report as the nation’s trade deficit widened sharply to $41.1 billion from April’s $37.4 billion. The net deficit for goods widened to $62.2 billion from April’s $58.6 billion while the net surplus for services narrowed slightly to $21.1 billion.In a negative indication on global demand, exports of both goods and services fell slightly in the month. But in a positive indication on domestic demand, imports rose a sharp 1.9 percent on top of April’s 2.3 percent gain. Much of the import gain is tied to the dollar effects of higher oil prices, which jumped nearly $5 in the month, but not all of it as imports of consumer goods and autos show solid gains.

The export side of this report, however, is decidedly weak with contraction sweeping capital goods and also civilian aircraft, two areas where weakness may be deepening.

An offset to May’s widening is the narrowing in April where the deficit is unrevised at $37.4 billion. The deficit in April and May together is tracking lower than the first quarter which is a plus for second-quarter GDP. But this report will be most watched come July’s data which will offer early indications on both Brexit effects and the ongoing rise in dollar.

Still very low:

Highlights

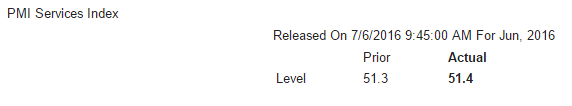

New orders picked up but only to a moderate pace for Markit Economics’ U.S. service sector sample where the final PMI for June came in at 51.4, little changed from 51.3 readings for both the June flash and May final. New orders are at their best reading of the year but are still below trend. And backlog orders continue to decline, down now for 11 straight months. Firms in the sample are hiring but not very much with job growth at a 17-month low. Optimism in the general outlook, down four of the last five months, is at a survey low. Price data are muted despite the rise in fuel costs. The bulk of the U.S. economy is chugging along at marginal rates of growth heading into Brexit fallout.

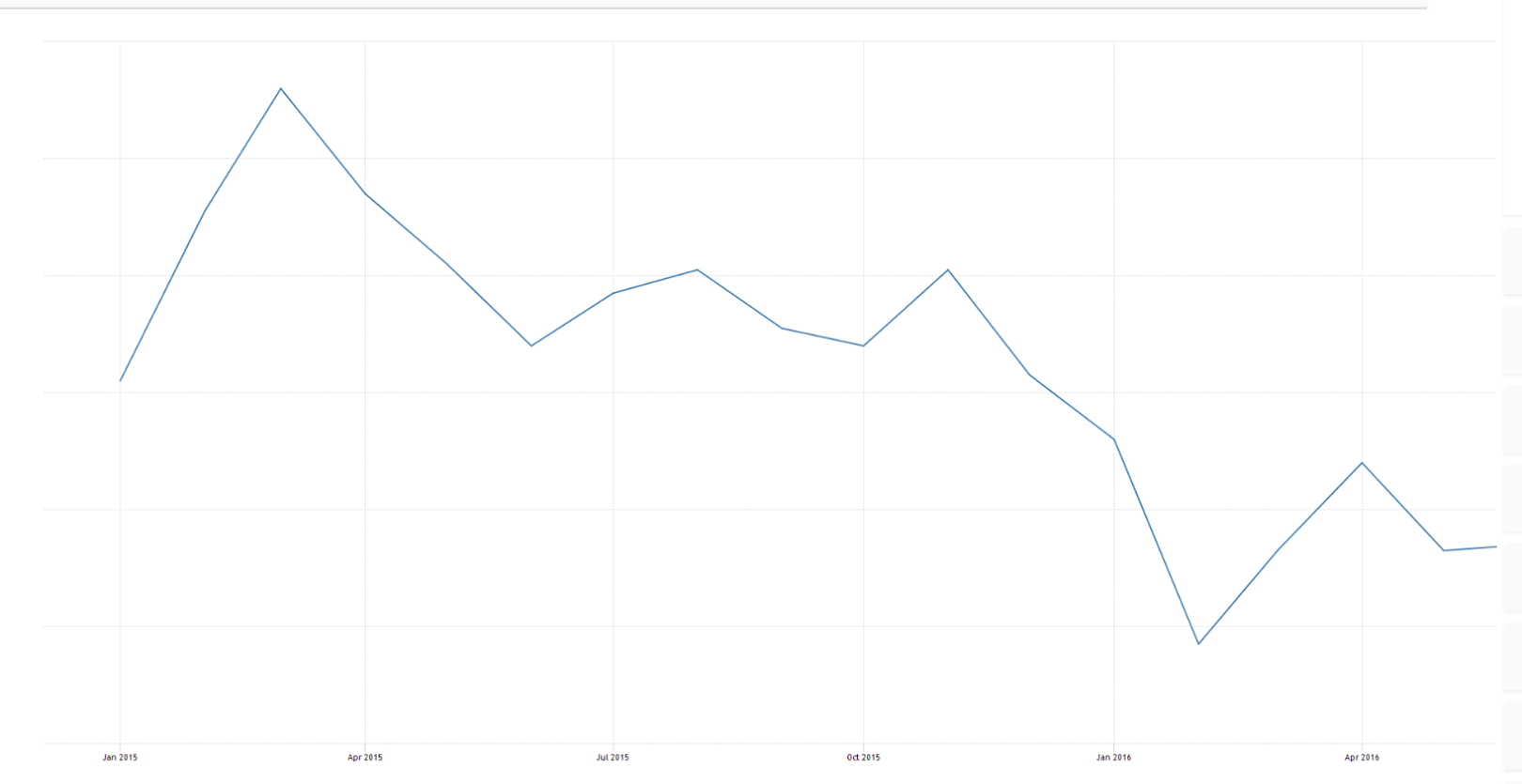

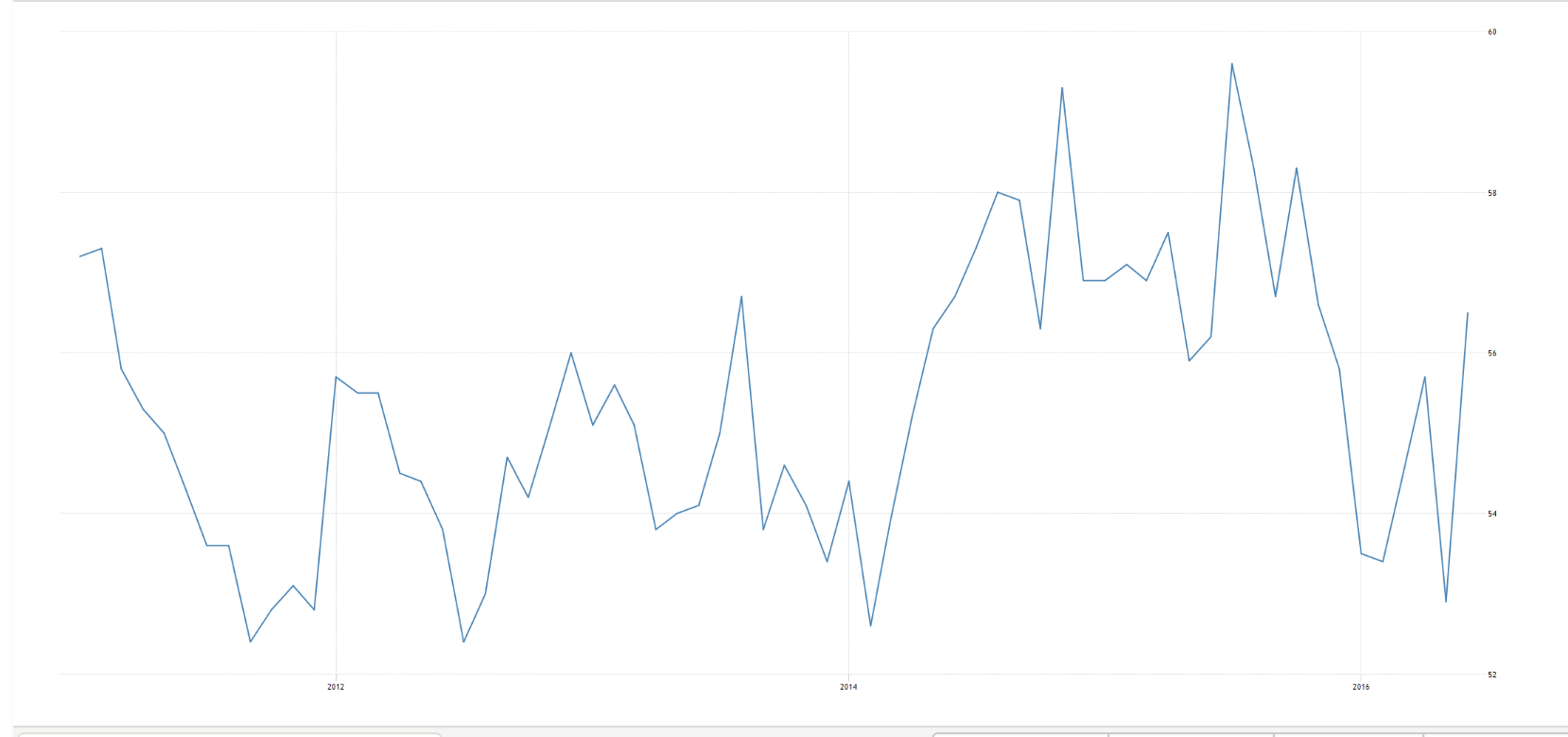

This service sector survey reports a large increase from May but my read of the chart tells me to wait another month before concluding it’s turned upwards:

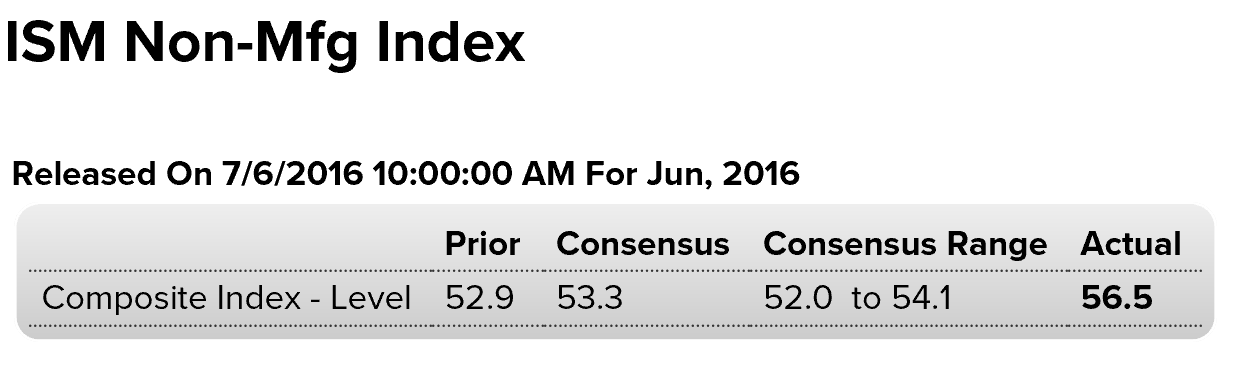

Highlights

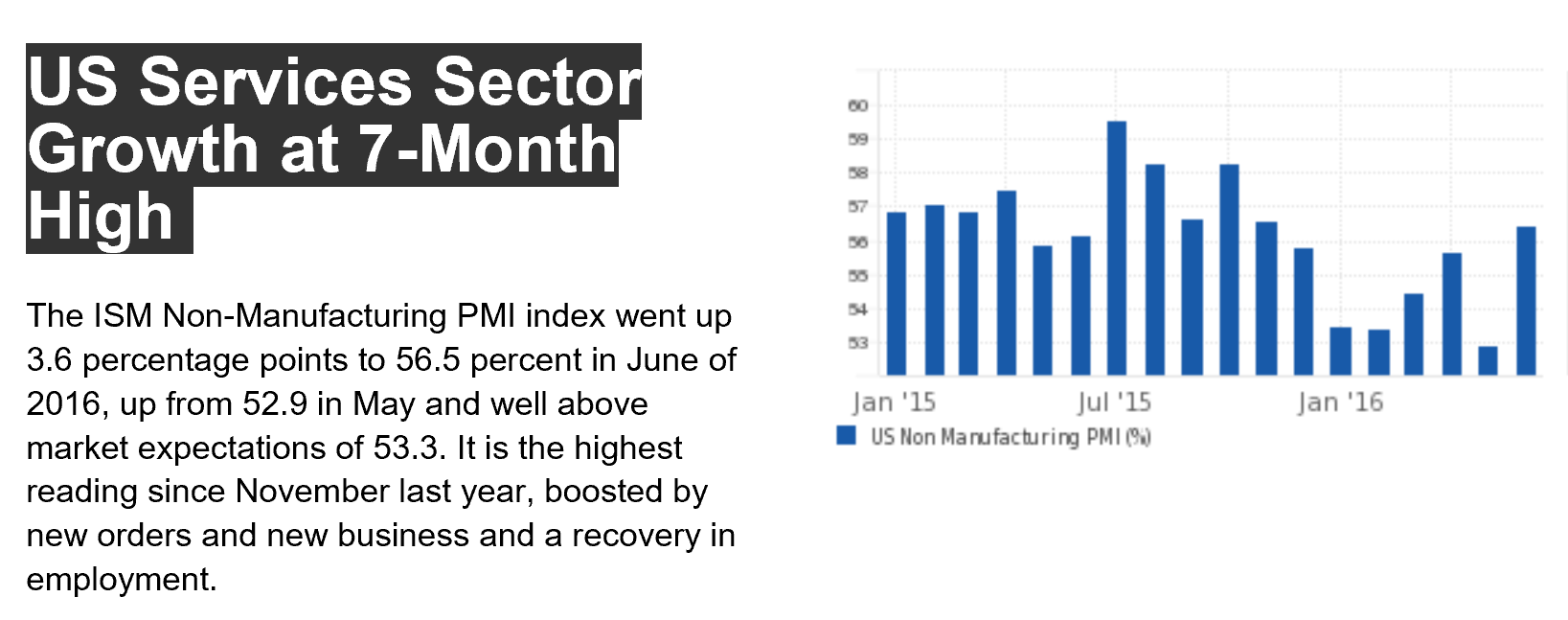

ISM’s non-manufacturing sample is reporting its strongest rates of growth of the year, headlined by a big 3.2 point jump in the composite index to 56.5. New orders are even further above break-even 50 at 59.9 with new export orders up 4 points to 53.0. Employment is also up, 3 points higher at 52.7 in a reading that hints at sizable improvement for Friday’s employment report.Deliveries are slowing which is a sign of rising demand and inventories are rising in what perhaps hints at restocking and new confidence in the outlook. Business activity, which is a measure of production, is also very strong, at 59.5 which points to strength for the June economy. To keep production up in the month, the sample worked down its backlogs which are in contraction for the first time in more than a year. But the rise in new orders should help fill backlogs back up while the strength in exports underscores global demand for the nation’s technical and managerial services.

This report historically is not volatile which makes June’s gains impressive. The bulk of the nation’s economy may very well be picking up steam heading to the Brexit fallout.

Starting to drift lower as somewhat stronger April data reverses in May and June: