Record lows, particularly population adjusted, for record periods of time, and no one even suggests it might be because they’ve become that much harder to get? Meanwhile, the consequence is less govt. spending than otherwise potentially making this recession that much worse: Note the peak was just after oil capital expenditures collapsed: The Italian bank crisis isn’t going away. There is no way under current policy to recapitalize. The EU considers any funds from the Italian govt. to be additions to the public debt, so that avenue is closed. At the same time, the economy is slowing, so loan performance is likely to deteriorate further. That leaves the depositors as the only ‘source of funds’, with even the possibility of that likely to trigger a further run on deposits. And at this point in time, the German banks don’t look to me like much of a ‘safe haven’, so there’s no where to go without taking some kind of currency risk, while liabilities are almost entirely payable in euro. As long as EU policy is to use the liability side of banking for market discipline, the entire payments system faces collapse. So looks to me like it’s a rerun of events that led up to the ECB’s declaration to ‘do what it takes to prevent default’ in 2012.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

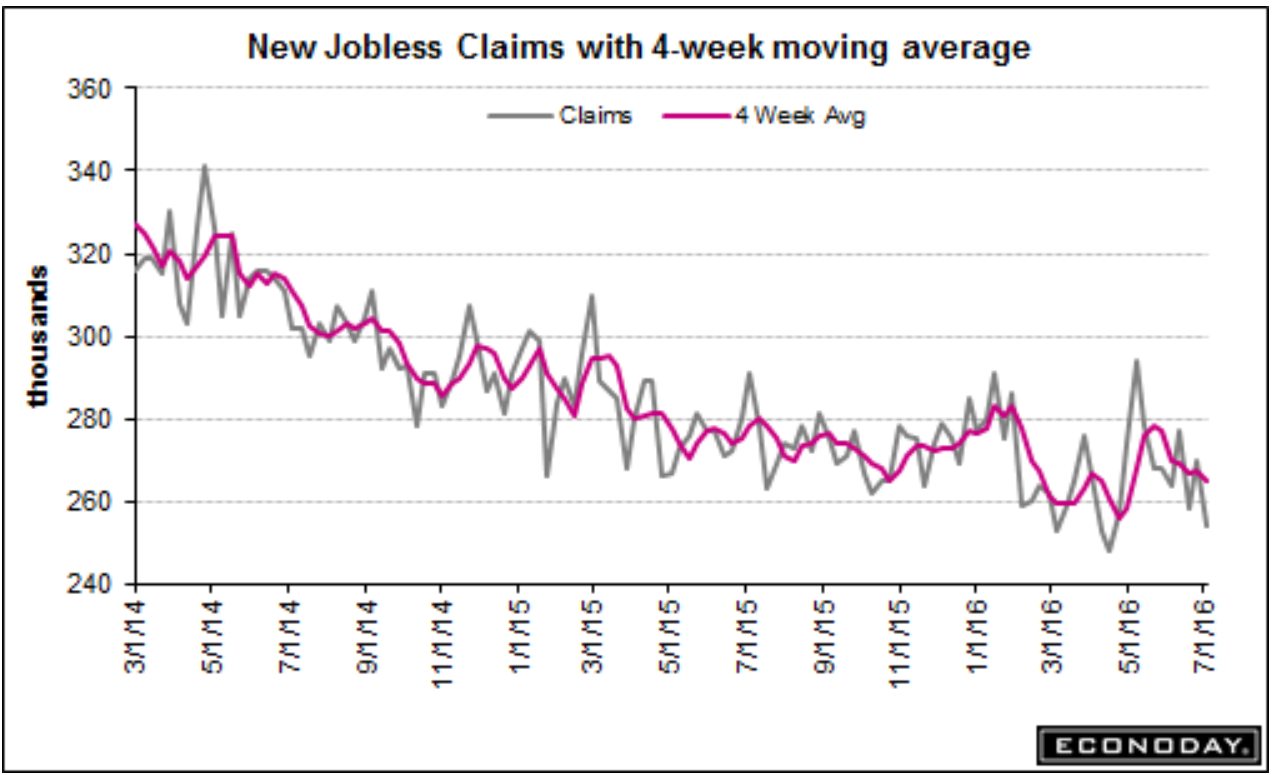

Record lows, particularly population adjusted, for record periods of time, and no one even suggests it might be because they’ve become that much harder to get? Meanwhile, the consequence is less govt. spending than otherwise potentially making this recession that much worse:

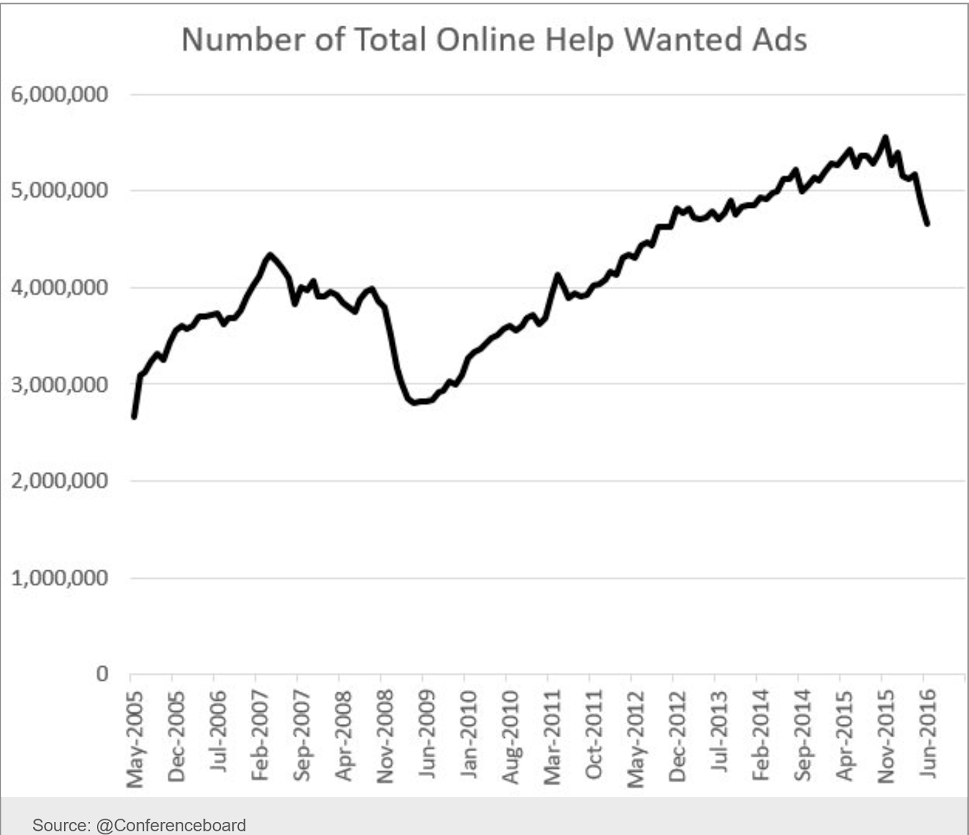

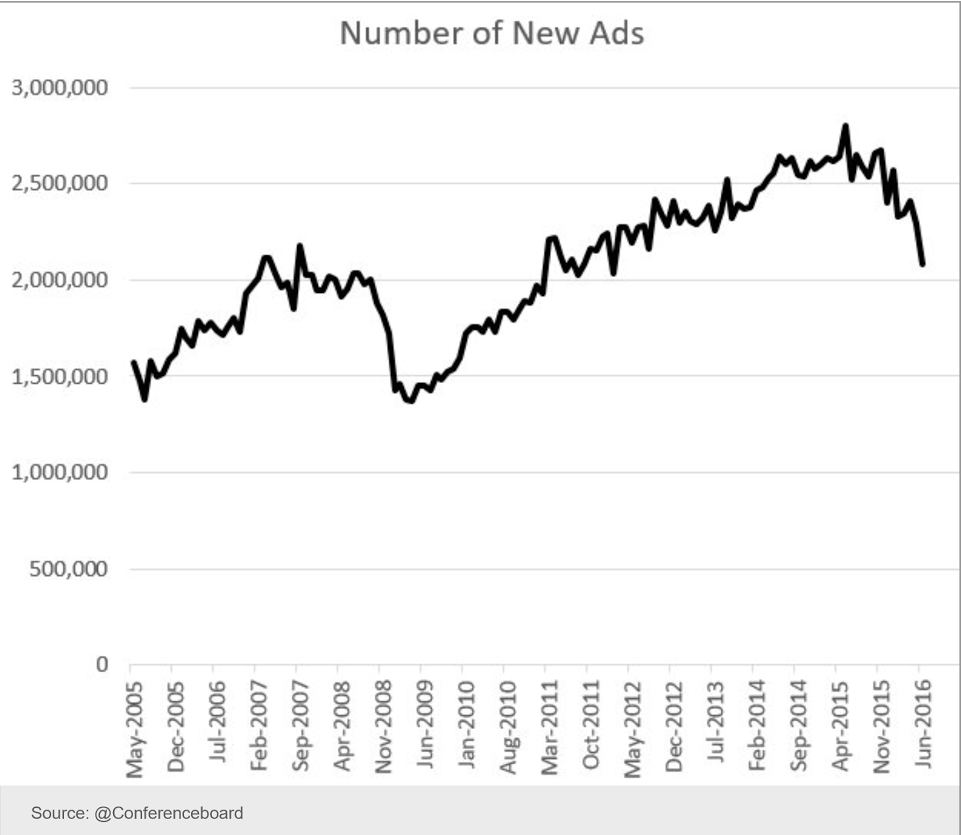

Note the peak was just after oil capital expenditures collapsed:

The Italian bank crisis isn’t going away. There is no way under current policy to recapitalize. The EU considers any funds from the Italian govt. to be additions to the public debt, so that avenue is closed.

At the same time, the economy is slowing, so loan performance is likely to deteriorate further. That leaves the depositors as the only ‘source of funds’, with even the possibility of that likely to trigger a further run on deposits. And at this point in time, the German banks don’t look to me like much of a ‘safe haven’, so there’s no where to go without taking some kind of currency risk, while liabilities are almost entirely payable in euro.

As long as EU policy is to use the liability side of banking for market discipline, the entire payments system faces collapse.

So looks to me like it’s a rerun of events that led up to the ECB’s declaration to ‘do what it takes to prevent default’ in 2012. Up to that point the (failed) policy was to use the liability side- private debt markets- to discipline national govts and bring them back into compliance with deficit and debt limits.

The ‘answer’ is the same this time. Nothing short of an ECB liability guarantee will do the trick. This guarantee could take the form of ECB deposit insurance, unlimited and unsecured ECB bank liquidity provision, some kind of permission of national govts. to support bank liquidity, directly or indirectly, regardless of deficit and debt limits, maybe some kind of ‘euro bonds’, or whatever else they may dream up that removes the use of the liability side of banking for market discipline.

As described in 2001:

http://www.mosler.org/docs/docs/rites_of_passage.htm