Still decelerating on a year over year basis: United States Consumer Credit ChangeConsumer credit in the United States increased by .56 billion in May 2016 following a downwardly revised .4 billion rise in April and above market expectations of a billion gain. This was decelerating and below stall speed when the boom in oil capex reversed that trend early in 2014. Then in late 2014 oil capex collapsed and bank lending growth reversed and resumed its deceleration: And rising delinquency necessarily leads to restrictive tighter standards which slows spending growth, which causes further delinquency, until the curve ‘goes vertical’:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

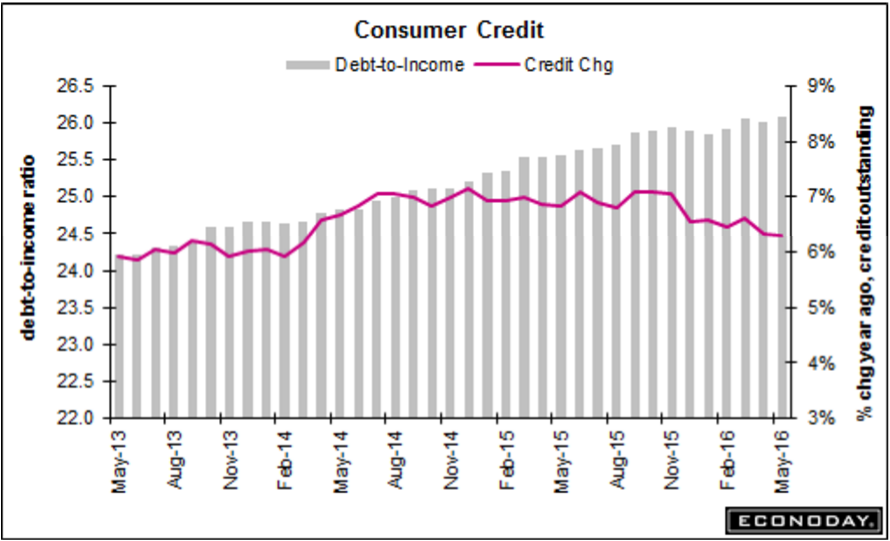

Still decelerating on a year over year basis:

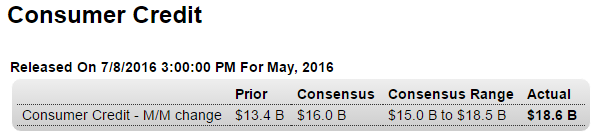

United States Consumer Credit Change

Consumer credit in the United States increased by $18.56 billion in May 2016 following a downwardly revised $13.4 billion rise in April and above market expectations of a $16 billion gain.

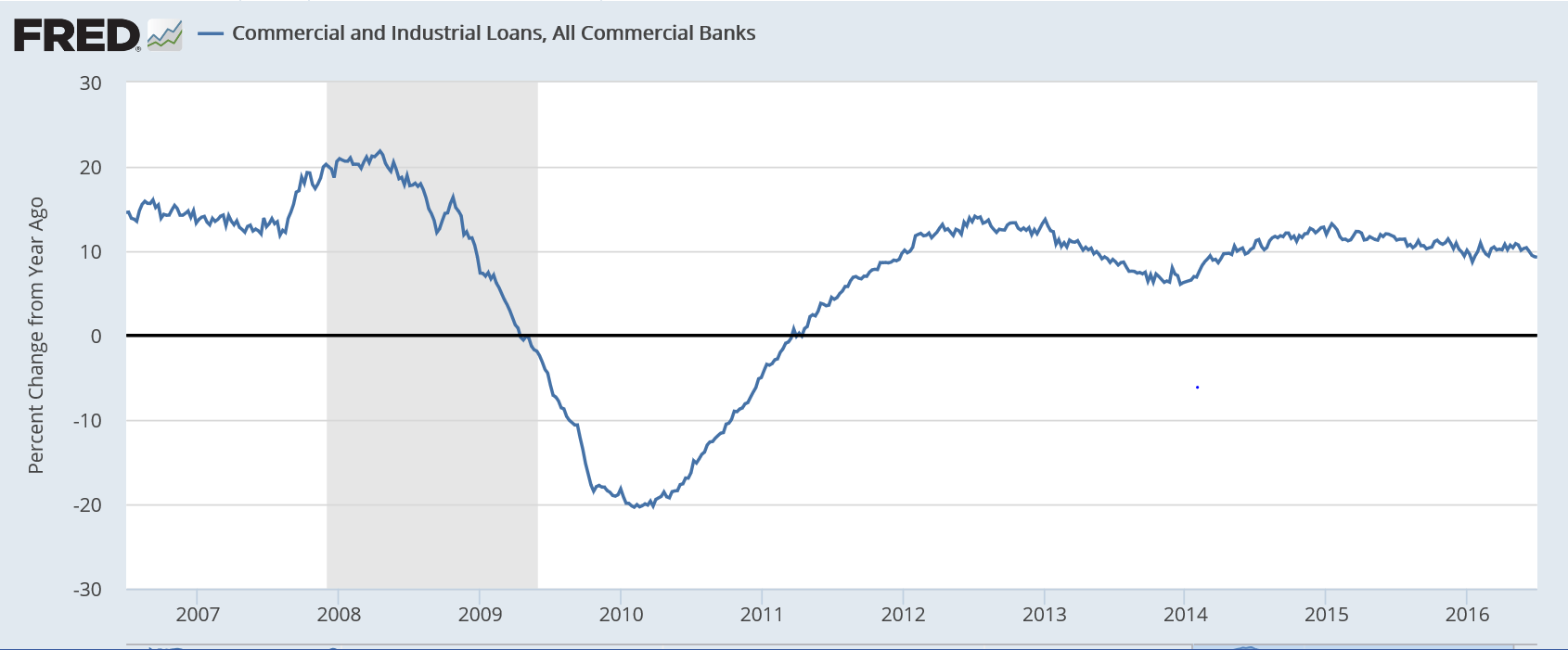

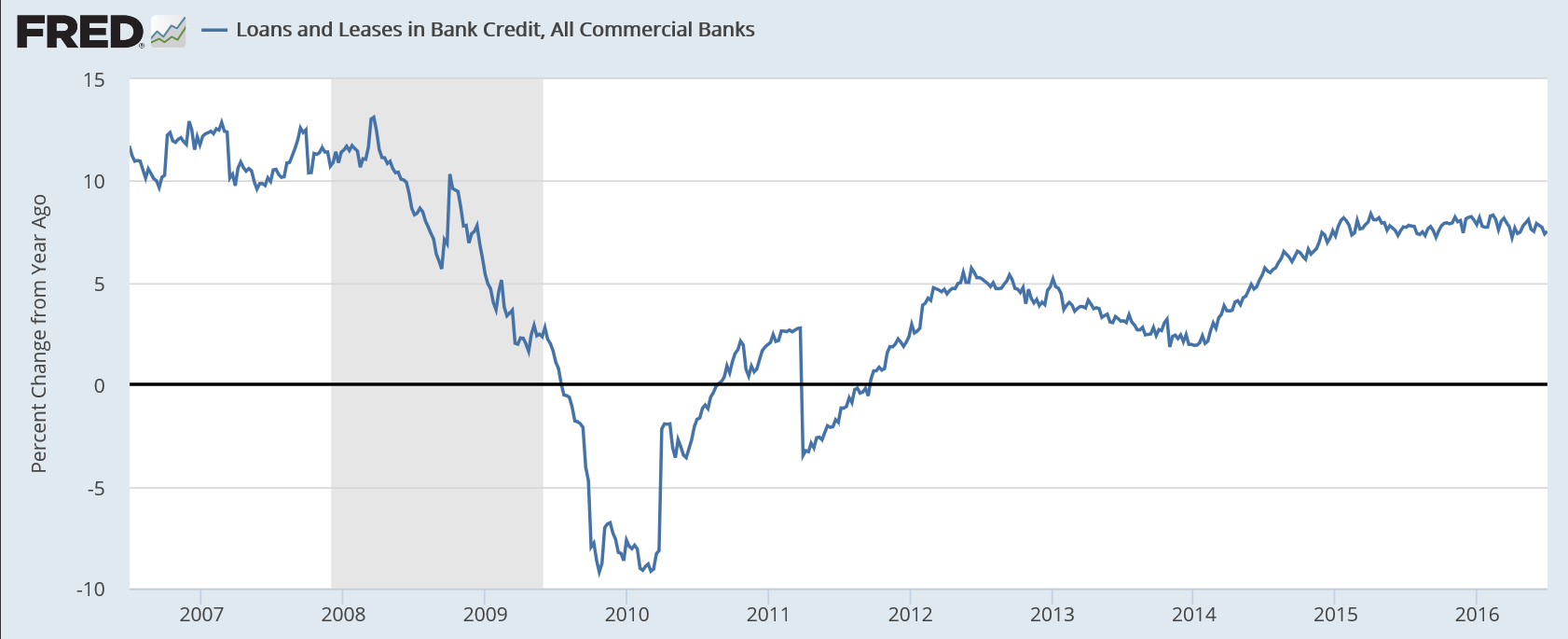

This was decelerating and below stall speed when the boom in oil capex reversed that trend early in 2014. Then in late 2014 oil capex collapsed and bank lending growth reversed and resumed its deceleration:

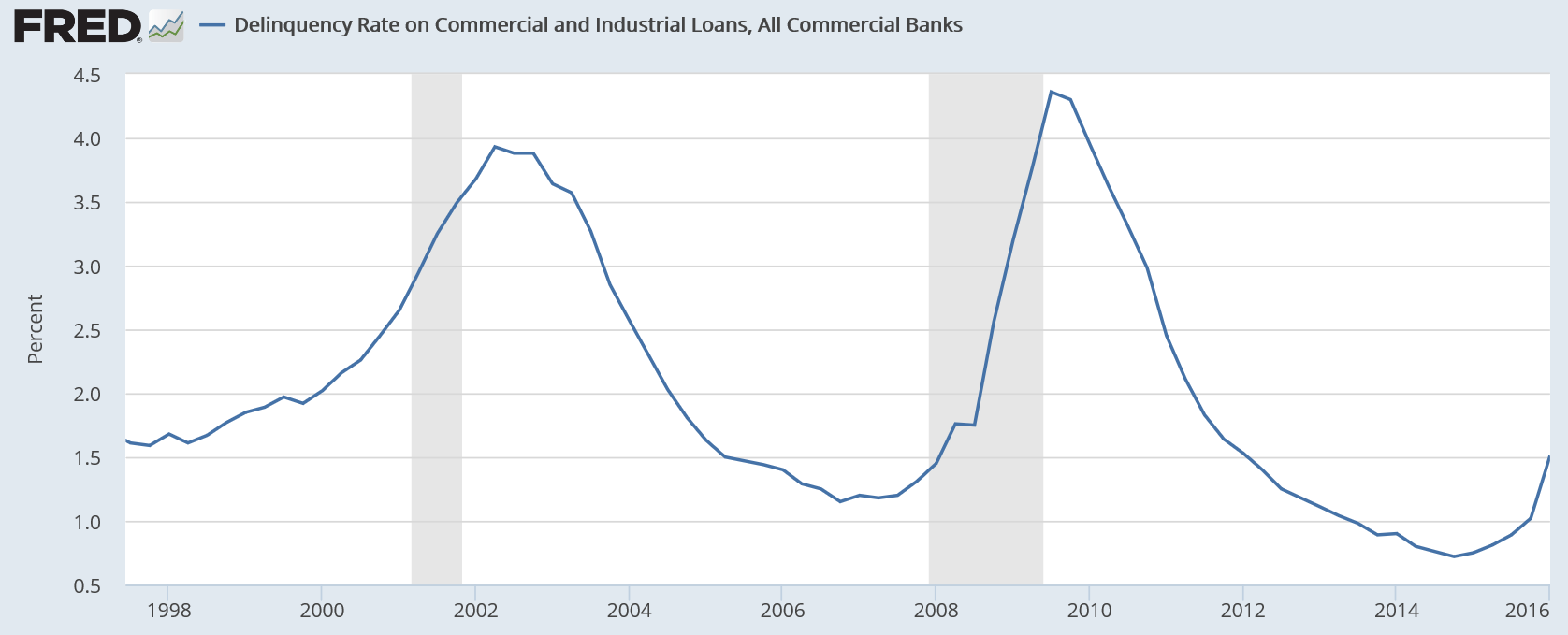

And rising delinquency necessarily leads to restrictive tighter standards which slows spending growth, which causes further delinquency, until the curve ‘goes vertical’: