Nice rebound as Verizon workers return to work, but the year over year deceleration continues and, of course, this number will be revised next month. And the lower average hourly earnings gains could put off fears of the US turning into Zimbabwe and Weimar for several hours: The payroll gain in June is what is striking in this report. Yet smoothing the big ups and downs, second-quarter payroll growth averaged a monthly 147,300 vs a more substantial 195,700 in the first quarter. The labor market is solid but perhaps slowing, this and still subpar wage growth (not to mention Brexit) may not be pointing to any urgency for a new Federal Reserve rate hike. This chart is the change in the 3 month average payroll growth this year vs the same period last year: Employment isn’t currently keeping up with population growth: Apparently the ‘conspiracy theory’ of the CB’s ‘helping the banks’ at the expense of the macro economy needs a bit of rethinking? Maybe policy has been drilling holes in the boat to let the water out, and it’s all going down? ;) The Big-Bank Bloodbath: Losses Near Half a Trillion Dollars By David ReillyJuly 6 (WSJ) — Since the start of 2016, 20 of the world’s bigger banks have lost a quarter of their combined market value. Added up, it equals about 5 billion, according to FactSet data.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

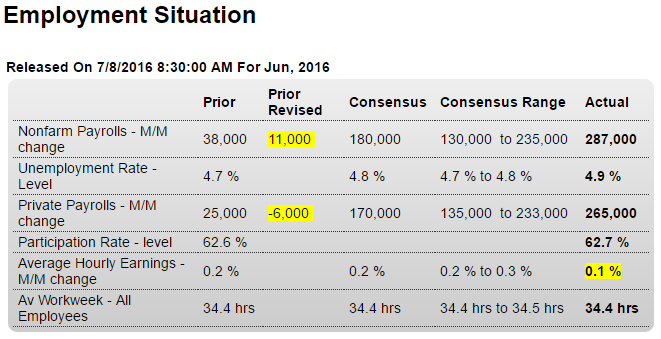

Nice rebound as Verizon workers return to work, but the year over year deceleration continues and, of course, this number will be revised next month. And the lower average hourly earnings gains could put off fears of the US turning into Zimbabwe and Weimar for several hours:

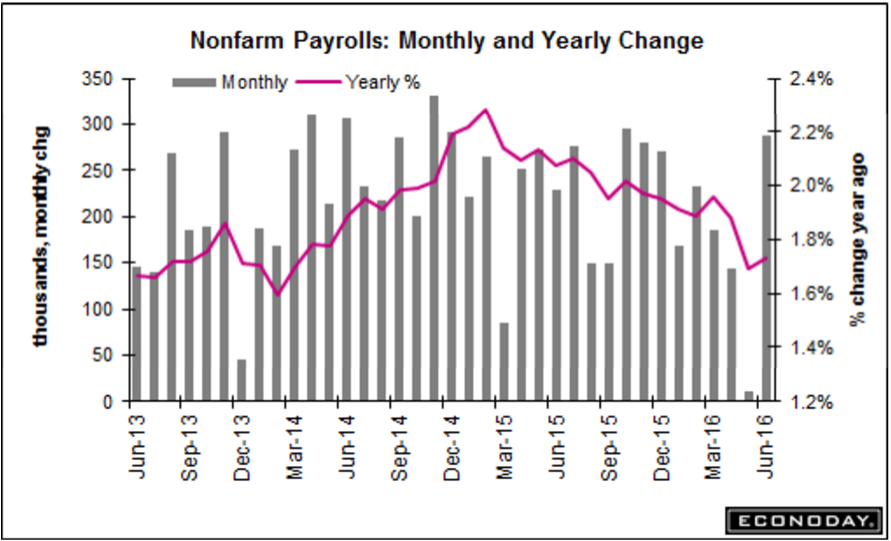

The payroll gain in June is what is striking in this report. Yet smoothing the big ups and downs, second-quarter payroll growth averaged a monthly 147,300 vs a more substantial 195,700 in the first quarter. The labor market is solid but perhaps slowing, this and still subpar wage growth (not to mention Brexit) may not be pointing to any urgency for a new Federal Reserve rate hike.

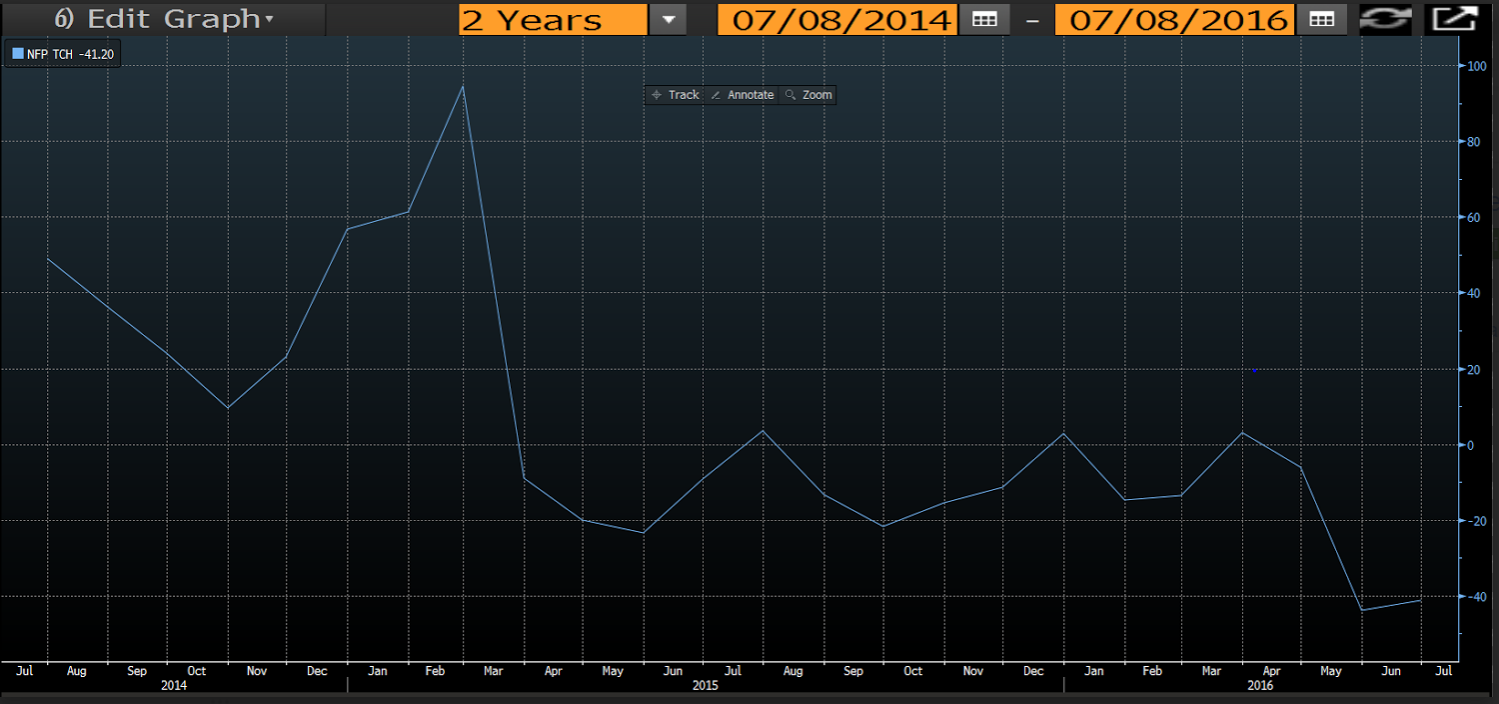

This chart is the change in the 3 month average payroll growth this year vs the same period last year:

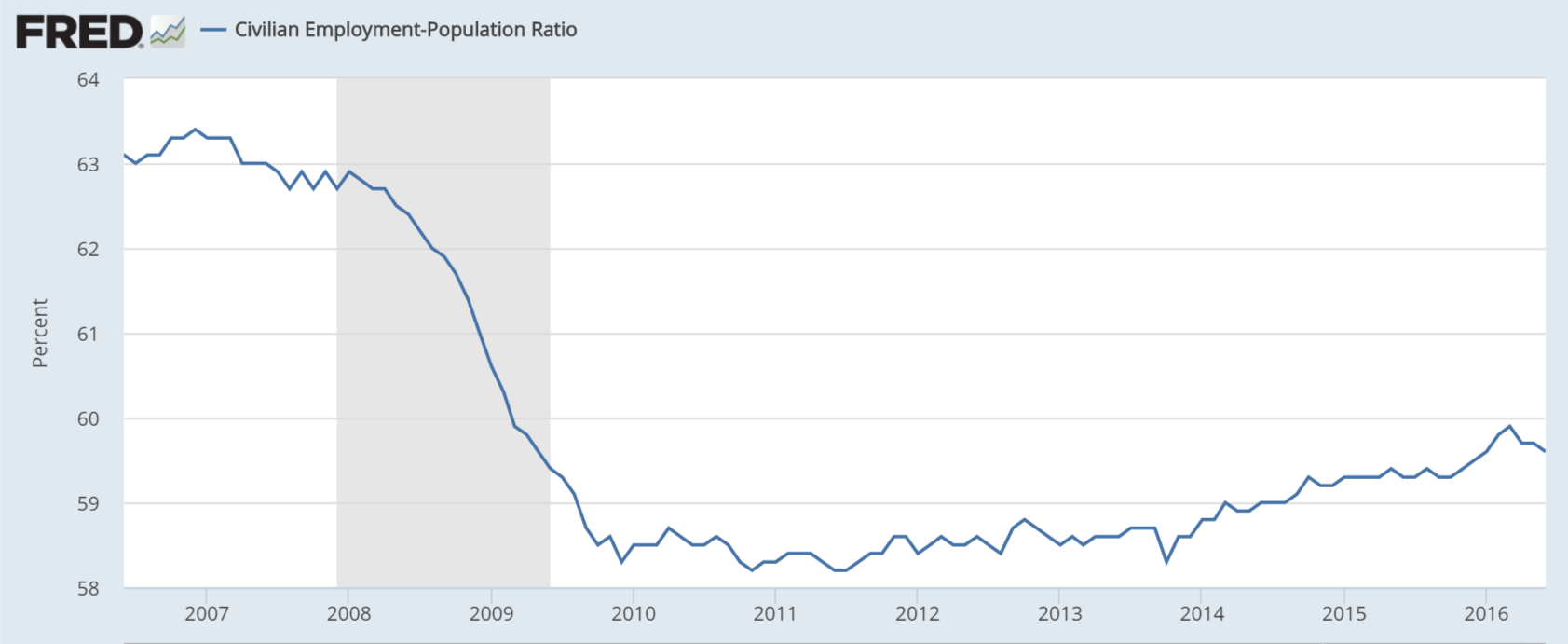

Employment isn’t currently keeping up with population growth:

Apparently the ‘conspiracy theory’ of the CB’s ‘helping the banks’ at the expense of the macro economy needs a bit of rethinking? Maybe policy has been drilling holes in the boat to let the water out, and it’s all going down? ;)

The Big-Bank Bloodbath: Losses Near Half a Trillion Dollars

By David Reilly

July 6 (WSJ) — Since the start of 2016, 20 of the world’s bigger banks have lost a quarter of their combined market value. Added up, it equals about $465 billion, according to FactSet data. In fact, among the group of 20 big banks only one bank—Wells Fargo—trades at a premium to its book value. Only one other, J.P. Morgan Chase, trades near book value. The fact that some banks are trading at less than half their book value flags even deeper concerns. Among the likely issues: A brewing battle within the EU over rules curtailing governments’ ability to bail out banks and whether those could be put on hold.

The problem with bank issues is when lending is cut back which directly reduces spending/output/employment:

Europe’s Bank Crisis Arrives In Germany: €29 Billion Bremen Landesbank On The Verge Of Failure.