The current spike in gas prices is not sufficient to bring about a recession (at least, not yet!) [Well, I never got around to a COVID update last week. Since most States don’t report over the weekend, I am going to wait until tomorrow. But the bullet point hint is: it increasingly looks like Omicron did what I expected Delta to do last fall. Stay tuned . . . ] Gas prices in my neck of the woods hit over the weekend, and seem to be center stage on the news this morning. So, let’s take a little look and put this in perspective. Gas prices have indeed spiked. Here’s GasBuddy’s chart of prices for the past 12 months, showing the nationwide average price at .09 this morning: That’s a 50% increase in prices YoY, and a 25% increase –

Topics:

NewDealdemocrat considers the following as important: Featured Stories, gas prices, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

The current spike in gas prices is not sufficient to bring about a recession (at least, not yet!)

[Well, I never got around to a COVID update last week. Since most States don’t report over the weekend, I am going to wait until tomorrow. But the bullet point hint is: it increasingly looks like Omicron did what I expected Delta to do last fall. Stay tuned . . . ]

Gas prices in my neck of the woods hit $4 over the weekend, and seem to be center stage on the news this morning. So, let’s take a little look and put this in perspective.

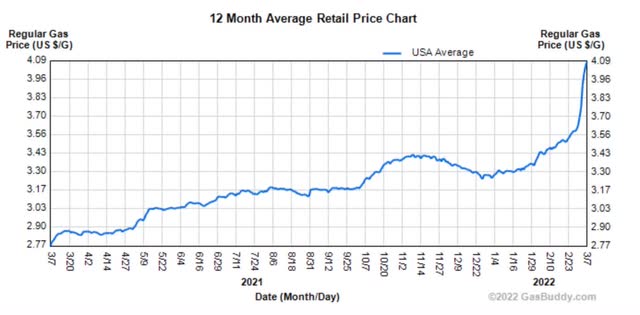

Gas prices have indeed spiked. Here’s GasBuddy’s chart of prices for the past 12 months, showing the nationwide average price at $4.09 this morning:

That’s a 50% increase in prices YoY, and a 25% increase – close to $1/gallon – just in the past two months.

That is certainly going to get consumers’ attention, and for some people, it is going to really pinch their ability to buy some daily necessities.

But, this isn’t the first time a sudden spike has happened. There is no certainty that the spike will be durable over the next 3 or 6 months, and there have been a number of such spikes in the past that did not result in recessions.

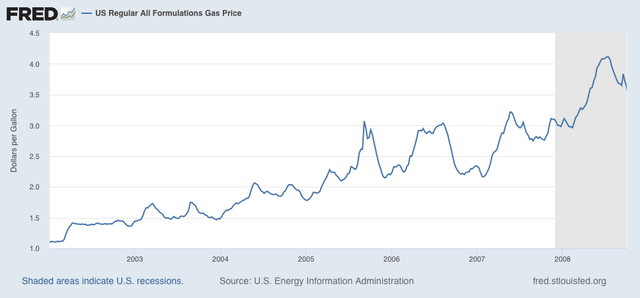

Here’s a graph of gas prices from 2002 through their peak in 2008:

Before 2003, gas prices had never been higher than $1.75/gallon. Not only did they rise past that, but in 2005 there was a sudden spike to over $3/gallon after Hurricane Katrina knocked out some production and transport of gas in Louisiana and the Gulf of Mexico. That spike only lasted about 45 days. There were similar spikes in spring 2006 and 2007, and in neither case did a recession immediately ensue. Gas prices did help bring about a recession when they remained above $3/gallon during most of the rest of 2007, and certainly as they spiked to $4.25/gallon in 2008.

So – point 1: unless the current spike in gas prices is durable, it is not going to bring about a recession.

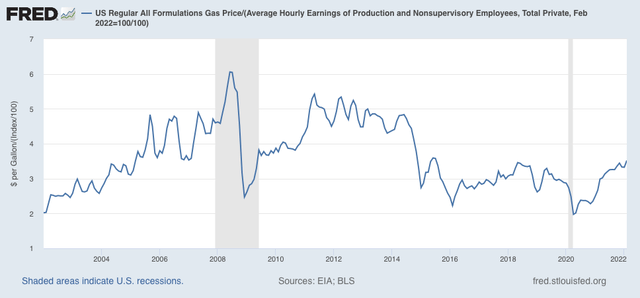

Now, let’s adjust gas prices by consumers’ ability to pay for it. The below graph divides gas prices by average hourly earnings for nonsupervisory workers:

Since this graph ends a month ago, and current wages are normed to “1,” the current price would be just over $4. But even so, the current price of gas is not equivalent to where it was in 2006 or 2007, or for most of 2011 through much of 2014 for that matter.

In short, the current value is not enough on its own to bring about a recession. Keep in mind that in almost all previous cases of oil shocks bringing about a recession, the other long leading indicators kicked in as well, with vigorous Fed rate hikes inverting the yield curve, tightening of bank credit, a downturn in corporate profits, and consumers cutting back on purchases well beyond a $1 for $1 substitution for gas prices. None of that has happened yet.