Consumer prices rise 1% in May alone; owners’ equivalent rent at 30 year high; expect the Fed to keep stomping on the brakes Today is a travel day for me, so I’ll keep this relatively brief. People who were hoping inflation would abate did not get the news they wanted from the May CPI. Consumer prices rose 1.0% in that month alone. Inflation less energy rose 0.7%, and “core” inflation less food and energy rose 0.6%. On a YoY basis, prices are up 8.5%, tied for a multi-decade high with a few months ago. Core prices are up 6.0%, down slightly from their February and March peak: The news was relatively “good” in the prices of used cars and trucks, up 1.8% for the month, but “only” up 1.6.1% YoY, down from 45% half a year ago: Finally,

Topics:

NewDealdemocrat considers the following as important: consumer prices, Featured Stories, Journalism, New Deal Democrat, politics, rents, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Consumer prices rise 1% in May alone; owners’ equivalent rent at 30 year high; expect the Fed to keep stomping on the brakes

Today is a travel day for me, so I’ll keep this relatively brief.

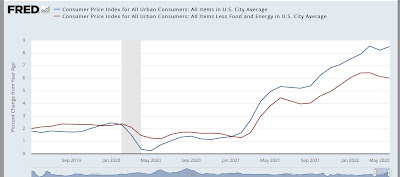

People who were hoping inflation would abate did not get the news they wanted from the May CPI. Consumer prices rose 1.0% in that month alone. Inflation less energy rose 0.7%, and “core” inflation less food and energy rose 0.6%. On a YoY basis, prices are up 8.5%, tied for a multi-decade high with a few months ago. Core prices are up 6.0%, down slightly from their February and March peak:

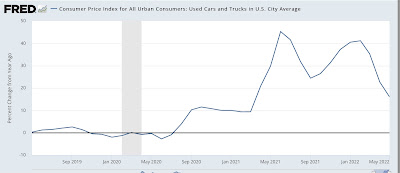

The news was relatively “good” in the prices of used cars and trucks, up 1.8% for the month, but “only” up 1.6.1% YoY, down from 45% half a year ago:

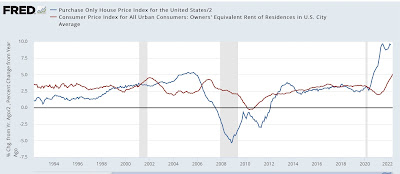

Finally, as expected, house prices (as shown via the FHFA Index in blue below) have continued to bleed over into owner’s equivalent rent, which rose 0.6% for the month, and is up 5.0% YoY, a 30 year high:

Bottom line: the Fed is going to continue stomping on the brakes. The only issue will be whether we get an old-fashioned “bust” before short term rates get raised high enough to invert the yield curve, a la the late 1940s and early 1950s.