Long leading indicators embedded in Q2 GDP suggest a recession is near at hand – by New Deal democrat Where does the economy go from here? If it’s not in recession, it isn’t doing much better. There are two components of GDP which are helpful in finding out what lies ahead: real residential fixed investment (housing) and proprietors income (a proxy for business profits). Both of these have long and good track records as helping forecast the economy one year in advance. Let’s start with real residential fixed investment. As was indicated in the BEA’s accompanying graph this morning, it was one of the two worst sectors of the economy in the 2nd Quarter, down -3.7%: Nominal and real residential fixed investment as a share of GDP (the

Topics:

NewDealdemocrat considers the following as important: New Deal Democrat, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Long leading indicators embedded in Q2 GDP suggest a recession is near at hand

– by New Deal democrat

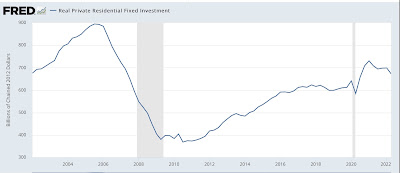

Where does the economy go from here? If it’s not in recession, it isn’t doing much better. There are two components of GDP which are helpful in finding out what lies ahead: real residential fixed investment (housing) and proprietors income (a proxy for business profits). Both of these have long and good track records as helping forecast the economy one year in advance.

Let’s start with real residential fixed investment. As was indicated in the BEA’s accompanying graph this morning, it was one of the two worst sectors of the economy in the 2nd Quarter, down -3.7%:

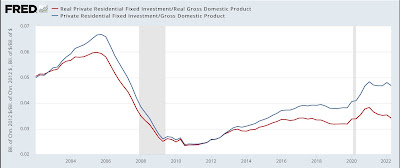

Nominal and real residential fixed investment as a share of GDP (the actual measurement that is part of the long leading indicators) also both declined sharply:

Recessions have typically happened on average 7 quarters after the last peak in this measure, which took place in Q1 2021. This puts the most likely onset of a recession in Q4 of this year.

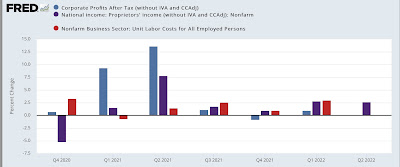

The news is much more equivocal when it comes to proprietors’ income.

Frequently both corporate profits and proprietors’ income turn together, but sometimes proprietors’ income lags by 1 or 2 Quarters. But the actual leading metric deflates for unit labor costs, which also aren’t known yet for Q2. So here is a bar diagram for the last 21 months of the Quarterly % change in corporate profits (blue), proprietors’ income (dark purple), and unit labor costs (red):

If unit labor costs rise in accord with their last 3 quarters, then proprietors’ income will still be slightly positive for the Quarter, but still below their peak in Q2 2021. In other words, our proxy for corporate profits indicates that a recession could begin at any time, since the last peak was 1 year ago.

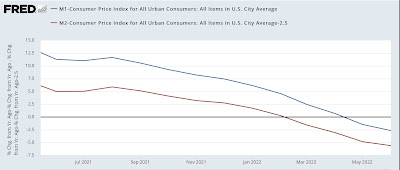

In addition to the above two long leading components of GDP, real money supply for June was reported on Tuesday, and the news wasn’t good there, either.

Recessions have typically occurred one year or more after real M1 turns negative, or real M2 is up by less than 2.5% from one year previous. Here’s what they look like now:

Real M1 and M2 are consistent with an onset of recession next spring.

In short, the long leading indicators that were updated this week suggest that a recession, if not here now, is nevertheless likely near at hand.