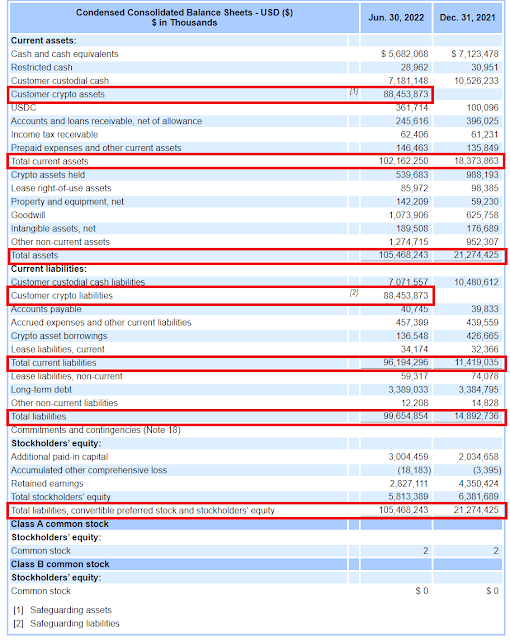

Coinbase recently filed its interim financial report. It makes pretty grim reading. A quarterly net loss of over bn, net cash drain of £4.6bn in 6 months, fair value losses of over 600k... To be sure, Coinbase is not on its knees yet. It still has bn of its own and customers' cash (both are on its balance sheet), and a whopping asset base. In fact its assets have increased - a lot. As have its liabilities. Coinbase's balance sheet is five times bigger than it was in December 2021. Here's Coinbase's balance sheet, as reported in its 10-Q filing. I've outlined the relevant items in red: There's a new asset called "customer crypto assets" worth some .45 bn, matched by a new liability called "crypto asset liabilities". This asset and its associated liability are by far the biggest

Topics:

Frances Coppola considers the following as important: accounting, balance sheet, crypto, full reserve banking

This could be interesting, too:

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

merijn knibbe writes The incredible cost of Bitcoin.

Angry Bear writes Crypto’s 5 million campaign finance operation filled airwaves with ads

Merijn T. Knibbe writes The 9th principle. Meticulous administration.

The explanation is in the same note (my emphasis):

"The Company safeguards crypto assets for customers in digital wallets and portions of cryptographic keys necessary to access crypto assets on the Company’s platform. The Company safeguards these assets and/or keys and is obligated to safeguard them from loss, theft, or other misuse. The Company records Customer crypto assets as well as corresponding Customer crypto liabilities, in accordance with recently adopted guidance, SAB 121."

So this is at the behest of the SEC. SAB 121 is a Staff Accounting Bulletin issued in March 2022. It's complex, technical and not easy to read. It's also very wide-ranging and has far-reaching implications not only for crypto exchanges like Coinbase, but for any company providing crypto-related services involving public blockchains. Yet it seems to have passed unnoticed by the crypto and financial press. How it slipped under the radar is a mystery.

SAB 121 (footnote 3) defines "crypto assets" broadly:

"the term “crypto-asset” refers to a digital asset that is issued and/or transferred using distributed ledger or blockchain technology using cryptographic techniques."

That could mean anything on a blockchain. Crowe LLP's handy explainer lists four types of crypto asset it thinks will be affected by this change:

Legal and regulatory risks arise from the fact that crypto is a relatively new field in which the legal and regulatory frameworks are as yet unclear. The legal risks are particularly interesting in the light of Coinbase's admission that customer cash on its balance sheet might not be bankruptcy remote, and the uncertainty over the status of both cash and crypto assets in certain high-profile crypto platform failures.

The SEC, it seems, is not satisfied that keeping customer assets off the platform's own balance sheet and those of its agents necessarily means the assets are either bankruptcy remote or protected from fraud, theft, technological failure or other losses beyond the customer's control. So, in the interests of protecting customers from these risks, it has simply decided to make the platforms and their agents liable for everything. The new accounting guidance says that the companies must carry on their own balance sheets a "safeguarding liability" equal to total customer crypto assets at fair value. So if anything happens to those crypto assets, the company, not the customer, will bear the losses.

Furthermore, to ensure that customers can always be reimbursed for any losses due to hacking, security failures, bugs, fraud and so forth, the companies must also carry a "safeguarding asset" whose fair value is equal to the fair value of the liability. In effect, the SEC is requiring 100% reserving of customer crypto assets. And to discourage crypto platforms and their agents from leveraging up the safeguarding liability by diversifying the safeguarding asset into a riskier mix of assets, thus putting customers at risk of losses, SAB 121 says that if the fair value of the safeguarding asset falls below the fair value of the liability, the company must take the fair value loss through its own P&L.

This means that its "safeguarding liability" is made up of 47.2% BTC, 21.2% ETH and 31.6% other coins. To be fully insulated from fair value losses, the "safeguarding asset" must be made up of the exact same proportions of BTC, ETH and other coins. But the "safeguarding asset" is Coinbase's own asset, not a customer asset. So, Coinbase could decide to reduce the proportion of low-yielding BTC and increase the proportion of higher-yielding but riskier coins. In a crypto market crash, the market price of riskier coins would be likely to fall more than the market price of BTC, so the fair value of Coinbase's "safeguarding asset" would fall below that of the "safeguarding liability". Coinbase would have to take that fair value loss directly to its own P&L, rather than dumping it on its customers by haircutting their assets. I hope this makes sense.

"If you buy cryptocurrency on a crypto exchange, it is immediately stored in your exchange-hosted wallet where, typically, the exchange controls your private key."

It will also apply to assets on other crypto platforms.