When will housing construction turn down? A fuller consideration – by New Deal democrat No important economic news today. Also I am traveling this week, so there might be some light posting, as in, I might skip a day or two. But I very much want to see what is happening with house prices, which will be updated tomorrow in the FHFA and Case Shiller indexes, and Wednesday as part of the new home sales release. In the meantime, after I posted about housing permits, starts, and construction last week, I decided to take a closer look at that issue, because I was troubled by the “permitted but not started” statistic, which has continued at near record levels. Housing starts are down just as much as permits. If units not yet started were a supply

Topics:

NewDealdemocrat considers the following as important: Constuction, Hot Topics, Housing Prices, New Deal Democrat, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

When will housing construction turn down? A fuller consideration

– by New Deal democrat

No important economic news today. Also I am traveling this week, so there might be some light posting, as in, I might skip a day or two. But I very much want to see what is happening with house prices, which will be updated tomorrow in the FHFA and Case Shiller indexes, and Wednesday as part of the new home sales release.

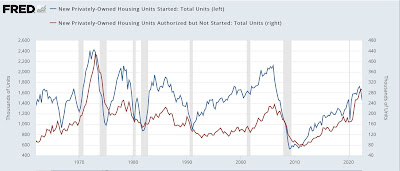

In the meantime, after I posted about housing permits, starts, and construction last week, I decided to take a closer look at that issue, because I was troubled by the “permitted but not started” statistic, which has continued at near record levels. Housing starts are down just as much as permits. If units not yet started were a supply chain issue, starts should have continued near peak until it was cleared. Obviously they haven’t which suggests there is some other explanation.

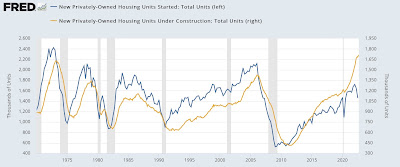

Units under construction follow starts almost like clockwork:

In the past, within about 6 months after starts peak, units under construction do as well. We’re now 6 months out past the 3 month average peak (Feb-Apr), and construction has continued to rise. There probably is some supply chain tightness left, because as you can see above, this is the biggest disconnect ever.

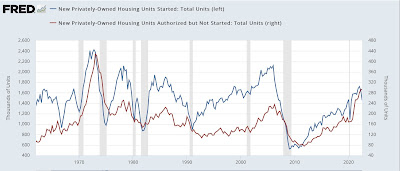

But “units permitted but not started” has not historically followed a reliable pattern. Sometimes it peaks simultaneously with starts, sometimes with a considerable delay:

So that suggests something else is going on, and the most likely candidate is cancellations after the permit is issued but before construction begins.

And, helpfully, in small print at the very bottom of the Permits and Starts release there is the following note:

“These data represent the number of housing units authorized in all months up to and including the last day of the reporting period and not started as of that date without regard to the months of original permit issuance. Cancelled, abandoned, expired, and revoked permits are excluded”

And relatedly there’s a similar note in the New Home Sales release:

“If the respondent reports that the unit has been sold, the survey does not follow up in subsequent months to find out if it is still sold or if the sale was cancelled. The house is removed from the “for sale” inventory and counted as sold for that month. If the house it is not yet started or under construction, it will be followed up until completion and then it will be dropped from the survey.

“Since we discontinue asking about the sale of the house after we collect a sale date, we never know if the sales contract is cancelled or if the house is ever resold….

“As a result of our methodology, if conditions are worsening in the marketplace and cancellations are high, sales would be temporarily overestimated.”

A couple of months ago there were several articles about increasing cancellations; for example, here and here.

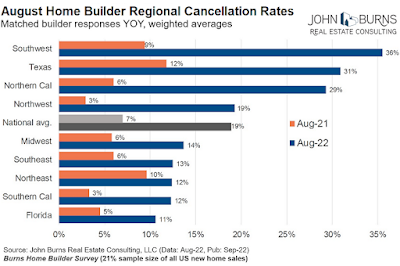

And last week, via Rick Palacios Jr., Director of Research at John Burns research consulting, nationwide, the cancellation rate in August jumped to 19%, the highest in years, up from 17.6% in July:

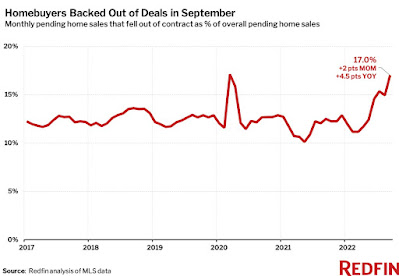

And for September, according to Redfin, they really soared:

So I think we have our answer as to why “units permitted but not started” remains so high. A very high number of people are backing out of deals before construction is started.

But that doesn’t resolve the issue of the delay in the peak in construction, and how quickly – or not – a recession happens afterward. I suspect whether a recession happens sooner vs. later depends upon how much mortgage rates have risen, and how much they continue to rise after the peak in construction. There’s no good way to show this, but here’s the graph anyway:

My suspicion is that units under construction will fall off relatively quickly, because the Fed rate hikes this year have been so abrupt (I won’t show the graph, but in the past week, mortgage rates have risen *even further, to 7.38%! – this is going to absolutely kill housing), and the more they hike from here on in, the quicker the recession will hit.

At this point there are only two classic long leading indicators of recession that haven’t rolled over: the short end of the yield curve between 3 months and 2 years; and corporate profits, which are flat but not declining significantly yet. Everything else in that time frame has been negative for half a year or more already.

“September manufacturing new orders and August construction spending both turn down.” Angry Bear