December real retail sales: the worst in almost two years – by New Deal democrat Real retail sales, one of my favorite indicators, was updated this morning for December, and it was significant. It’s not just that retail sales declined -1.1% for the month both in nominal and real terms; it’s that both October and November were revised downward by -0.2% and -0.4% respectively, so the ultimate number is considerably worse than would otherwise have been expected. How so? First, here are real retail sales in absolute terms for the past 25+ years: Note that in the year before both the 2001 and 2008 recessions, real retail sales went flat. As shown in the below close-up of the past two years, last month was the worst showing since February

Topics:

NewDealdemocrat considers the following as important: December Retail Sales, Hot Topics, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

December real retail sales: the worst in almost two years

– by New Deal democrat

Real retail sales, one of my favorite indicators, was updated this morning for December, and it was significant.

It’s not just that retail sales declined -1.1% for the month both in nominal and real terms; it’s that both October and November were revised downward by -0.2% and -0.4% respectively, so the ultimate number is considerably worse than would otherwise have been expected.

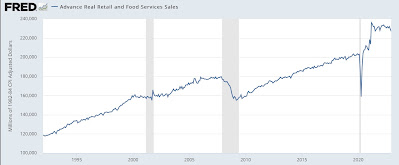

How so? First, here are real retail sales in absolute terms for the past 25+ years:

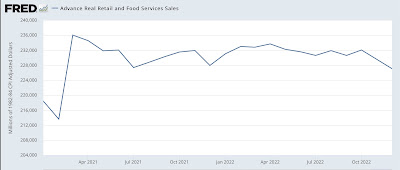

Note that in the year before both the 2001 and 2008 recessions, real retail sales went flat. As shown in the below close-up of the past two years, last month was the worst showing since February 2020, before the last pandemic stimulus was passed:

This shows up as the second month in a row of a negative YoY reading (which is pretty impressive in a negative sense, because December 2021 was *awful* due to the original Omicron COVID mega-wave) (I’ll come back to the red line showing the YoY% change in payrolls in a moment):

Here’s the longer term YoY view:

As I’ve noted many times, real retail sales going negative YoY, at least for more than one or two months, has been an excellent harbinger of incoming recession. In fact, the relationship goes back about 75 years. While I’ve discounted the negative numbers from spring 2021, as I wrote about yesterday, because of distortions due to comparisons with the spring 2021 stimulus months, there is no distortion in these negative readings. If they continue any further, that would be very strong evidence that a recession is close at hand.

Which returns us to the red line in the graph above. Remember that consumption leads jobs. If we omit the March-May months, we have 7 months since of absolute weakness in consumption growth, and decelerating jobs gains. This morning’s report is a potent warning that we should expect jobs growth to decelerate further, and perhaps sharply.