The important trend in retail sales that Redbook’s weekly report is telling us about – by New Deal democrat This is the first of hopefully two posts I will put up today. Tomorrow retail sales for December will be reported. In advance of that, I wanted to discuss their comparison with the weekly high-frequency data of Redbook consumer sales, which I have been paying heightened attention to in the past several months. Here is what Redbook YoY sales look like since the beginning of 2020: After the initial pandemic lockdowns, they returned to positivity by summertime. Then they really took off with the receipt of the 2021 stimulus $$$ in March, peaking at about 18% YoY (on a 4 week average) at the end of the year. During 2022 they

Topics:

NewDealdemocrat considers the following as important: New Deal Democrat, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

The important trend in retail sales that Redbook’s weekly report is telling us about

– by New Deal democrat

This is the first of hopefully two posts I will put up today.

Tomorrow retail sales for December will be reported. In advance of that, I wanted to discuss their comparison with the weekly high-frequency data of Redbook consumer sales, which I have been paying heightened attention to in the past several months.

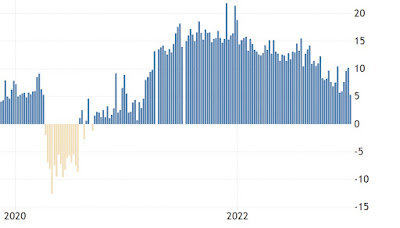

Here is what Redbook YoY sales look like since the beginning of 2020:

After the initial pandemic lockdowns, they returned to positivity by summertime. Then they really took off with the receipt of the 2021 stimulus $$$ in March, peaking at about 18% YoY (on a 4 week average) at the end of the year. During 2022 they maintained strong YoY comparisons, before declining on a 4 week average basis from 14% at the end of July to only 7% in early December. If that trend were to continue, Redbook sales will go negative YoY in roughly April of this year.

Now let’s compare that with retail sales YoY, shown since July 2020 below (blue), compared with YoY CPI (red):

At first YoY retail sales and YoY Redbook do not appear that closely related. But on closer examination there is really only one difference. Retail and Redbook correspond at all times except during the three month March-May period of the 2021 stimulus spending, and again in the YoY comparisons one year afterward. In all other periods the two correspond – and Redbook has the smoother, less noisy trajectory.

I’m not sure what subset of retail sales went nuts in spring 2021 that Redbook wasn’t picking up (the first suspect was e-commerce, but that did not prove to be the case).

The point is that during late 2020, both Redbook at retail were higher about 2-5% YoY, then increased to 15-20% higher YoY in the second half of 2021, and decreased to 5-8% in the second half of 2022 through November.

Redbook did have several good weeks at the end of December, so I won’t hazard any prediction of what tomorrow will bring for retail sales. but the suggestion is that they, like Redbook, have been deteriorating sharply on a YoY basis since last summer. At present, real retail sales are flat compared with inflation YoY. But if the deterioration continues several more months, I would expect a significant negative real retail sales comparison, which has a history going back over 50 years as being a harbinger of imminent recession.

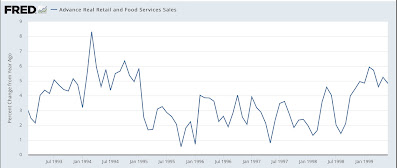

One final note: here is what real retails sales looked like YoY in the early to mid-1990’s:

Note they deteriorated significantly but did not go negative in 1995-7. I’ll explain the significance in my second post today.