Up to 35,000 UBS and Credit Suisse jobs at risk, SWI swissinfo.ch The megabank created by the UBS takeover of Credit Suisse is reducing its global workforce by 20-30% or between 25,000 to 36,000 positions. This is according to the Sonntags Zeitung newspaper, citing an unnamed senior UBS manager. This was interesting in the US. According to CNBC Markets (Elliot Smith, three issues were occurring and pushing Credit Suisse to the brink of bankruptcy and take over. Credit Suisse’s share price fell with the collapse of U.S.-based Silicon Valley Bank. This was making the situation more complex. The Swiss lender announced finding “material weaknesses” in its financial reporting procedures. The Saudi National Bank said it could no longer provide

Topics:

Angry Bear considers the following as important: politics, Taxes/regulation, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Up to 35,000 UBS and Credit Suisse jobs at risk, SWI swissinfo.ch

The megabank created by the UBS takeover of Credit Suisse is reducing its global workforce by 20-30% or between 25,000 to 36,000 positions. This is according to the Sonntags Zeitung newspaper, citing an unnamed senior UBS manager.

This was interesting in the US. According to CNBC Markets (Elliot Smith, three issues were occurring and pushing Credit Suisse to the brink of bankruptcy and take over.

- Credit Suisse’s share price fell with the collapse of U.S.-based Silicon Valley Bank. This was making the situation more complex. The Swiss lender announced finding “material weaknesses” in its financial reporting procedures.

- The Saudi National Bank said it could no longer provide more funding to Credit Suisse. A defining and final blow. A loan of up to 50 billion Swiss francs ($54.2 billion) came from the Swiss National Bank.

- The Swiss National Bank loan intervention ultimately failed to restore investor confidence and Swiss authorities brokered the bank’s emergency sale to UBS for 3 billion Swiss francs.

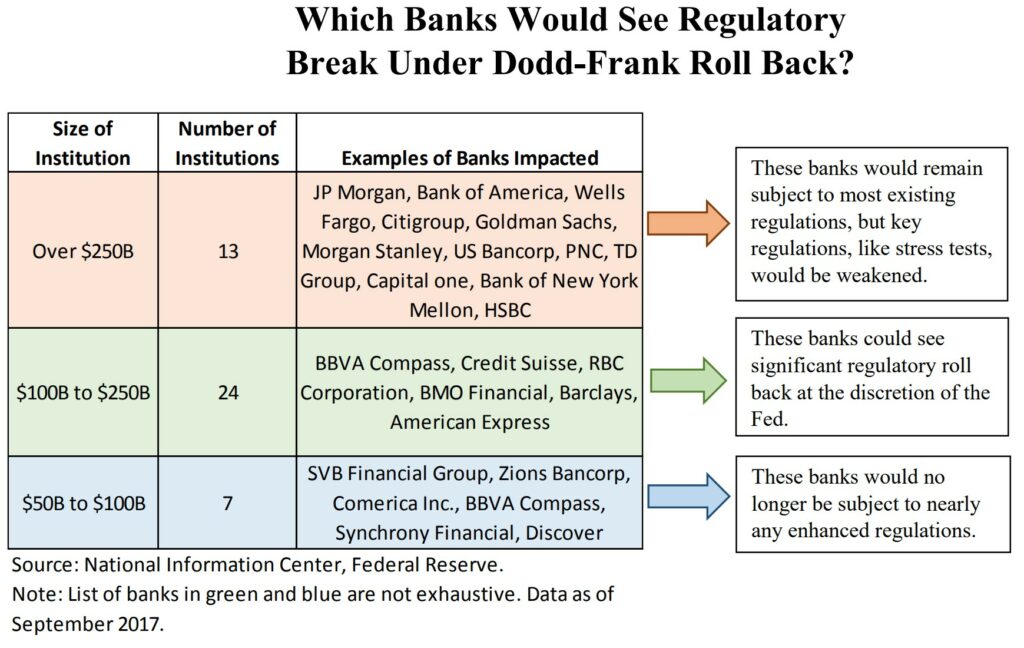

Credit Suisse was one of the banks deregulating as detailed in the roll back of dobb frank.

The deregulation od Dobb Frank was not just about regional banks. The 25 banks deregulated included the U.S. holding companies of massive, scandal-plagued foreign banks. Banks such as Deutsche Bank, BNP Paribas, UBS, and Credit Suisse. The last banks on earth that should be deregulated.1

In the past, I was entertaining quite a few arguments discussions. Discussions with others as to why an extensive rollback should not be allowed. Instead, smaller incremental increases should have been made. WallStreet (investment companies made banks) and banks in 2007/8 put Main Street in a dire predicament.

The banks impacted are to the right.1,2. Credit Suisse was given greater latitude under Dobb Frank. Credit Suisse has had many issues since 2008. It was just too soon. And again Main Street is paying for bank’s lack of disciple,

Back to SwissInfo.ch.

The now planned cutback is greater than the 9,000 jobs Credit Suisse had planned to cut in its restructuring plan. This was before the Swiss authorities forced UBS to buy out its imploding rival on March 19.

In Switzerland alone, up to 11,000 jobs would be affected as reported by the SonntagsZeitung. Before the takeover, UBS employed approximately 72,000 people worldwide. Credit Suisse has an approximate 50,000. Labor reduction obliviously.

The plan? UBS agreed to buy Zurich rival Credit Suisse for CHF3 billion ($3.3 billion) in a deal engineered by the Swiss government, the central bank, and the market regulator. Done and accomplished to avoid a meltdown in the country’s financial system.

As reported the fear now is the deal has raised concerns over the size of a new bank with $1.6 trillion (CHF1.45 trillion) in assets. The deal was designed to help to secure financial stability globally. On Saturday the former and future head of Swiss bank UBS, Sergio Ermotti was attempting to allay fears the institution would be too big.

According to the SonntagsBlickExternal link, the Credit Suisse brand will exist for another three or four years before it disappears. Credit Suisse shareholders, will receive 76 cents per share. They are due to meet in Zurich on Tuesday for the bank’s general meeting. UBS shareholders will meet the following day in Zurich.

The merger is taking place without the approval of their respective shareholders, as the Swiss authorities have waived the obligation to consult them in the name of the best interests of the Swiss financial center.

References and Foot Notes

1.dodd-frank-roll-back-bill–a-windfall-for-big-banks.pdf, senate.gov.

2.Mnuchin Confirms Dodd-Frank Rollback Bill Will Benefit Foreign Mega Banks, Shadow Banks, Senator Sherrod Brown (senate.gov).

3.Swiss claim the U.S. banking crisis ultimately toppled Credit Suisse, cnbc.com.