February JOLTS report shows further *relative* weakening in the jobs market – by New Deal democrat The February JOLTS report showed a weakening in almost all important trends. The strongest component of the entire series has been job openings. I tend to place lower significance on this, because there is ample evidence that companies have “gamed” this metric either to build up a bank of resumes, or else to suggest that their growth is strong (whether or not that is truly the case). Well, even so job openings (blue in the graph below, normed to 100 as of February 2020) declined -632,000 to 9.931 million, the lowest number since spring of 2021. Actual hires (red) declined -164,000 to 6.163 million (also the lowest since spring 2021), while

Topics:

NewDealdemocrat considers the following as important: Hot Topics, New Deal Democrat, politics, US EConomics, Weakening Jobs Market

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

February JOLTS report shows further *relative* weakening in the jobs market

– by New Deal democrat

The February JOLTS report showed a weakening in almost all important trends.

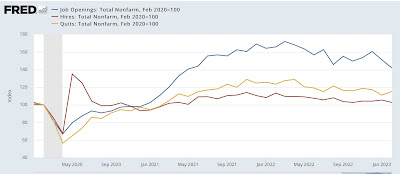

The strongest component of the entire series has been job openings. I tend to place lower significance on this, because there is ample evidence that companies have “gamed” this metric either to build up a bank of resumes, or else to suggest that their growth is strong (whether or not that is truly the case). Well, even so job openings (blue in the graph below, normed to 100 as of February 2020) declined -632,000 to 9.931 million, the lowest number since spring of 2021. Actual hires (red) declined -164,000 to 6.163 million (also the lowest since spring 2021), while quits (gold) increased 146,000 to 4.024 million:

Note that an increase in voluntary quits is a good thing, because it indicates confidence by the person quitting that they can find a new job relatively easily. But even with February’s increase, quits remain below their 2021-early 2022 monthly levels.

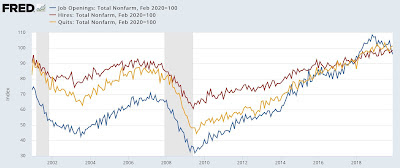

For comparison’s sake, here is the rest of the history of all three series up until the pandemic:

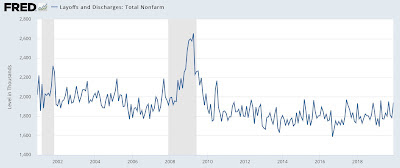

Finally, layoffs and discharges declined -215,000 to 1.504 million, also good. But this number only reverses January and takes us back to recent levels. The overall increasing trend (a negative) is clear:

Again, for comparison purposes, here is the rest of this series:

For about the last year, I have been paying particular attention to job openings, because it is only when they revert close enough to pre-pandemic levels that we are likely past the period of “reverse musical chairs” whereby employees find it easier to find higher paying jobs (for the record, I look favorably upon this period of labor strength, after decades of employers having the upper hand). That final capitulation of the job market, while not an absolutely necessary predicate to a recession, would likely be the icing on the cake.

On Friday March nonfarm payrolls will be reported. Because initial jobless claims have remains so positive, I do not expect an appreciable weakening of that number, but a continuation of the decelerating trend remains likely. I will be especially looking at the leading sectors, like manufacturing and residential construction, to see if those have turned negative.

January JOLTS report consistent with a softening, but still very strong, labor market, Angry Bear, New Deal democrat