This is Part 1 of 2 of an article by Andy Kiersz of Business Insider. Rather than smash it altogether, I thought splitting it into two likely parts would improve the presentation on Angry Bear. Gen Z, Millennials Should Stop Complaining About Baby Boomers, Economy, business insider, Andy Kiersz Nostalgia might be one of the most powerful and enduring human emotions. Civilizations have always looked to a golden age in the past when times were better and people were nobler. Even the Romans, throughout their long period of dominance and empire, routinely criticized their current state as decadent and weak, longing for the strength of previous eras. Americans in the 21st century aren’t immune to the impulse to don rose-colored glasses —

Topics:

Angry Bear considers the following as important: Baby Boomers, Business Insider, Hot Topics, Part 1, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

This is Part 1 of 2 of an article by Andy Kiersz of Business Insider. Rather than smash it altogether, I thought splitting it into two likely parts would improve the presentation on Angry Bear.

Gen Z, Millennials Should Stop Complaining About Baby Boomers, Economy, business insider, Andy Kiersz

Nostalgia might be one of the most powerful and enduring human emotions. Civilizations have always looked to a golden age in the past when times were better and people were nobler. Even the Romans, throughout their long period of dominance and empire, routinely criticized their current state as decadent and weak, longing for the strength of previous eras.

Americans in the 21st century aren’t immune to the impulse to don rose-colored glasses — commentators on both the left and the right routinely pine for a return to an idealized postwar era of tranquility and abundance. But nowadays, the nostalgia comes with an added emotional layer: blame. For many American millennials and Gen Zers, the greed and economic failures of their parents and grandparents are the root cause of the various financial challenges they face. The supposition is that boomers had it easier: Homes could be had for a dime and a handshake, a single paycheck supported three kids with two cars and a white picket fence to boot, and you could work your way through college without going into debt. The boomers had it great, the argument goes, but then they went and screwed it all up.

That instinct is wrong. For one thing, baby boomers didn’t have it easy: The America they grew up in was poorer, less educated, less healthy, and more unfair than the society we live in today. And for all the flak the older generation gets, the boomers have by and large left America a better place than how they found it.

This isn’t to say that the boomers are handing young people a utopia. Plenty of challenges still need to be solved — from a housing shortage and high inequality to the dangers of the climate crisis and rising political instability — and many of them were partly caused by the boomers’ decisions. But we won’t be able to solve those problems by lying to ourselves about the past or the progress we’ve made over the past 70 years. It’s time Gen Zers and millennials gave the boomers their due credit, even as they try to fix some of the messes they’ve made.

Things are better now

It’s easy to be envious when viewing the midcentury Norman Rockwell paintings of the beautiful family sitting in their lovely home preparing to dig into a massive meal. But I have a secret to tell you: On a statistical basis, there’s a good chance you’re richer than them. That’s because, despite the protestations from the commentariat, the simple fact is the US is a vastly wealthier and more productive country than it used to be.

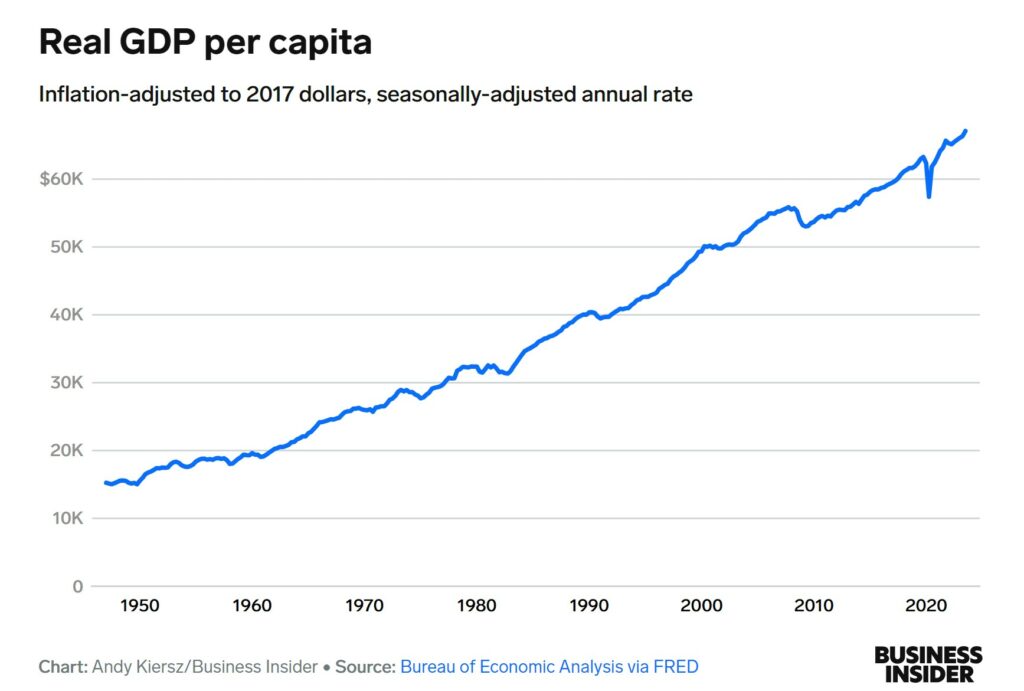

The most encompassing way to measure this is real gross domestic product per capita, which takes the entire economic output of the US — all the goods we make, from cars to houses to food, and all the services we buy from each other, from doctor visits to education — and divides it up by the number of people who live in the country. Importantly, the “real” part adjusts for inflation: We’re looking at the actual quantity of goods and services bought and sold without being skewed by the upward drift of prices. In effect, it tells us that we make and do far more things than we did a half century ago. Since World War II, real GDP per capita has steadily and inexorably grown outside brief recessions. There are three times as many goods and services produced in the US available per person now as there were in the 1960s.

Of course, looking at GDP per capita doesn’t necessarily show who’s gaining from that rising tide. To better understand how individuals and families are experiencing the economy, it’s important to look at wages, income, and wealth. These three measures can give us a better sense of how people’s finances are doing.

First, there are wages, which measure people’s paychecks and salaries from their jobs. Real average hourly wages for nonsupervisory and production workers — meaning frontline workers instead of managers or business owners — slid fairly dramatically from the ’70s through the mid-’90s. But since that time, wages have steadily increased. Even with the recent bout of high inflation, the strong labor market has pushed wages for frontline workers higher than they’ve been since the ’70s.

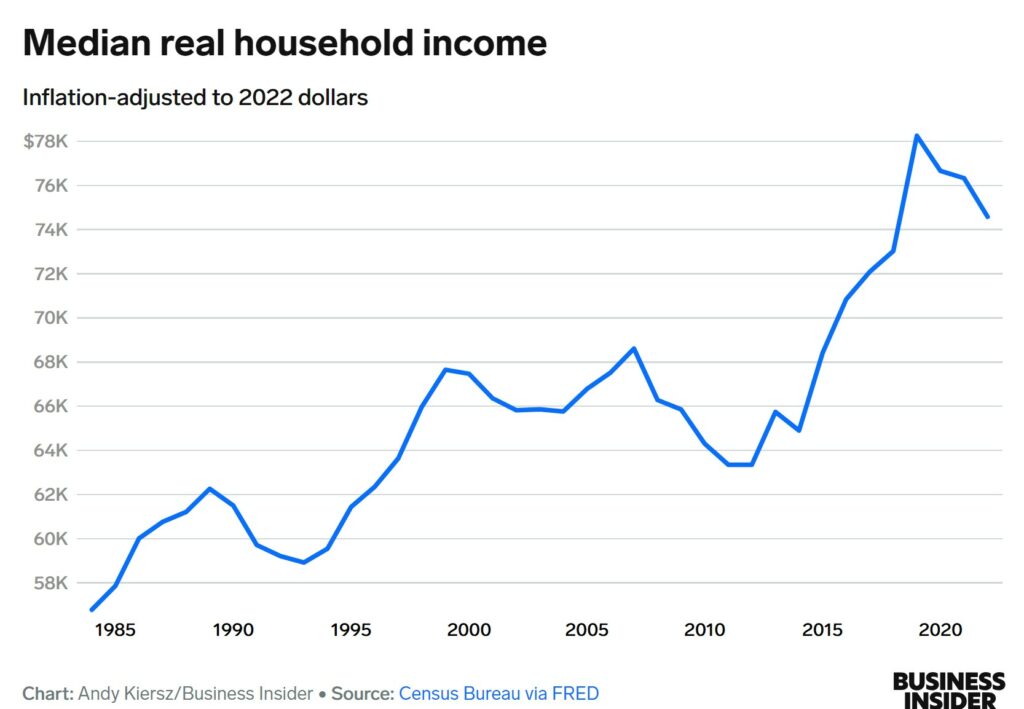

Next is household income — the total amount of money the typical family makes from everyone’s jobs and businesses in a year. While recessions have led to fits and starts, the typical family is more affluent than 40 years ago. Median household income after adjusting for inflation in 2022 was 31% higher than in 1984, meaning families having more money.

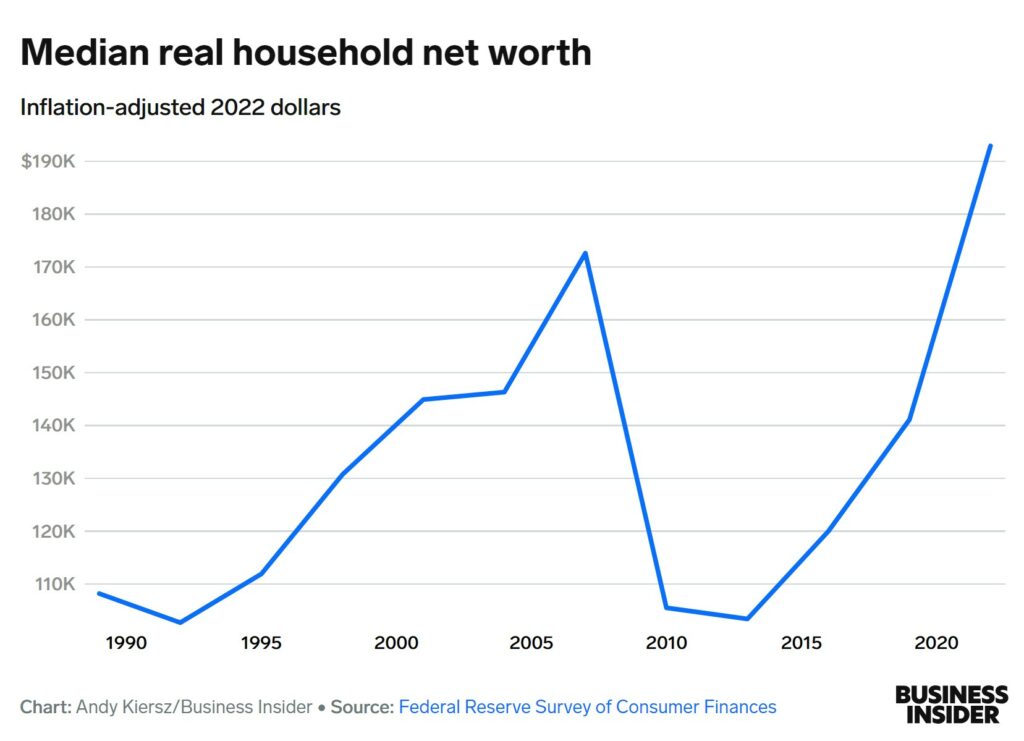

Finally, there’s wealth, which tracks a family’s assets, such as real estate, financial investments, and checking accounts minus their debt. Once again, families are better off by this measure than when the boomers were becoming dominant in the economy. Real household net worth fell dramatically after the 2008 financial crisis because of the collapse in home prices but steadily recovered over the next decade before skyrocketing between 2019 and 2022 as home values and stock prices surged and the country healed from the pandemic.

By most measures of financial health, the typical American is doing much better today than in the decades when the boomers were coming up. Of course, money isn’t the only way to evaluate a life. But by many nonfinancial measures, Gen Zers and millennials have it better than their parents’ generation.