ISM manufacturing index remains in contraction, and the trend in vehicle sales may have turned down as well by New Deal democrat The ISM manufacturing index, where any value below 50 indicates contraction, once again came in negative for both the total index, at 47.4, and the more leading new orders subindex, at 47.1. Both have been indicating contraction for more than a year: Which begs the question. Because, despite a nearly flawless 75 year history as a leading indicator, there has been no recession. An important reason is that the ISM is a *diffusion* index, not a weighted one. And a very important but narrow part of manufacturing, motor vehicles, has been very positive – at least until a few months ago. As reported last week by the

Topics:

NewDealdemocrat considers the following as important: Hot Topics, New Deal Democrat, US EConomics, Vehicle Sales

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

ISM manufacturing index remains in contraction, and the trend in vehicle sales may have turned down as well

- by New Deal democrat

The ISM manufacturing index, where any value below 50 indicates contraction, once again came in negative for both the total index, at 47.4, and the more leading new orders subindex, at 47.1. Both have been indicating contraction for more than a year:

Which begs the question. Because, despite a nearly flawless 75 year history as a leading indicator, there has been no recession.

An important reason is that the ISM is a *diffusion* index, not a weighted one. And a very important but narrow part of manufacturing, motor vehicles, has been very positive – at least until a few months ago.

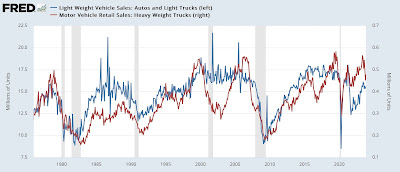

As reported last week by the BEA, in November light vehicle sales (blue in the graph below) declined by -127,000 on an annualized basis, to 15.319 million units, while heavy truck sales (red) rose by 27,000 annualized, to 478,000 units:

Light vehicle sales peaked, at least for the near term, last June at 16.060 million units. Perhaps more importantly, heavy truck sales peaked last May at 565,000 units.

That’s because heavy truck sales reliably turn early, and are much less noisy. And only twice in the past 50 years have they declined on a percentage basis as much as they have in the past 8 months without heralding a recession, in 1987 and 2016.

This goes back to the importance of yesterday’s construction spending data, and residential construction in particular. With manufacturing being less of a share of the US economy than it was before the “China shock” that started in 1999 when that nation became a regular trading partner of the US, construction has assumed a more important role as a leading indicator for expansions and recessions. And as we have seen with building units under construction as well as residential construction spending, that sector of the economy, unlike manufacturing, has not turned down.

November data starts out strong with a very positive ISM manufacturing index, Angry Bear, by New Deal democrat