Retail sales faceplant; industrial production continues 16-month streak of weakness – by New Deal democrat Let’s take a look at two the big short leading and coincident indicators that were reported yesterday, respectively real retail sales and inducatrial production. Retail sales can be volatile monthly, and about once in a typical year they either faceplant or unexpectedly soar. Yesterday we got the facelpalnt. Retail sales declined nominally -0.8% in January. Because consumer prices rose 0.3%, in real terms sales declined -1.1%: This is the lowest level in 10 months. It’s important to note that January sales, on a non-seasonally adjusted basis, are always awful, and while this year was even poorer than last year, it was better

Topics:

NewDealdemocrat considers the following as important: Hot Topics, industrial production, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Retail sales faceplant; industrial production continues 16-month streak of weakness

– by New Deal democrat

Let’s take a look at two the big short leading and coincident indicators that were reported yesterday, respectively real retail sales and inducatrial production.

Retail sales can be volatile monthly, and about once in a typical year they either faceplant or unexpectedly soar. Yesterday we got the facelpalnt.

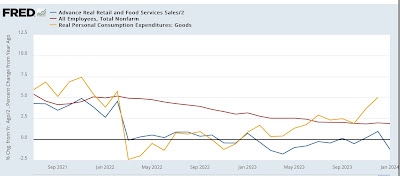

Retail sales declined nominally -0.8% in January. Because consumer prices rose 0.3%, in real terms sales declined -1.1%:

This is the lowest level in 10 months. It’s important to note that January sales, on a non-seasonally adjusted basis, are always awful, and while this year was even poorer than last year, it was better than in the years before the pandemic hit. So the seasonal adjustment may be a little askew due to pandemic-era comparisons.

On a YoY basis real retail sales (blue) are down -0.8%. Below I also show real personal consumption of goods (gold) and nonfarm payrolls (red), since the former two although noisy tend to forecast the trend in jobs:

If this were to persist, usually in the past is has meant recession (but not in the last 18 months!) – and note the unusual big divergence between the sales and consumption measures (for now!), which will probably resolve.

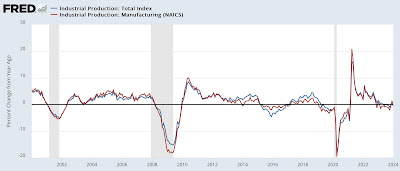

Meanwhile industrial production, one of the most important coincident indicators, also declined, by -0.1%, and is down -0.9% from its September 2022 peak. Manufacturing production declined sharply, down -0.5%, and is now -2.1% below its October 2022 peak:

This is the lowest reading for manufacturing production since the beginning of 2023.

On a YoY basis, total production is unchanged, and manufacturing is down -0.8%:

In the modern era since China’s accession to normal trading status in 2000, the 2023 downturn was not quite as negative as the 2015-16 downturn, which did not lead to a recession, although it was definitely as soft spot.

While we did not get a recession in 2023, it is nonetheless true that both manufacturing and housing did decline from their respective peaks after the Fed began raising rates, and have not recovered them yet.

I am treating these reports as “more of the same” weakness for manufacturing, and a one-off volatile downward number for sales unless it is confirmed by further weakness for at least one more month.

Industrial production continues in near-recessionary trajectory, Angry Bear, by New Deal democrat