Initial jobless claims continue positive, suggesting good news for the tomorrow’s February unemployment rate as well – by New Deal democrat The most important reason I cover initial jobless claims is because they are an “official” short leading indicator. They are also very good at forecasting the short-term trend in the unemployment rate in the monthly jobs report, which will be updated for February tomorrow. And the news continues to be positive. Initial claims were unchanged at 217,000, continuing near their 50 year lows from several months ago. The four week moving average declined -750 to 212,250, while continuing claims, which comparatively lag, and are reported with a one week delay, rose 8,000 to 1.906 million, close to a two year

Topics:

NewDealdemocrat considers the following as important: Hot Topics, initial jobless claims, March 2024, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Initial jobless claims continue positive, suggesting good news for the tomorrow’s February unemployment rate as well

– by New Deal democrat

The most important reason I cover initial jobless claims is because they are an “official” short leading indicator. They are also very good at forecasting the short-term trend in the unemployment rate in the monthly jobs report, which will be updated for February tomorrow.

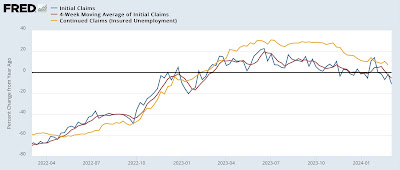

And the news continues to be positive. Initial claims were unchanged at 217,000, continuing near their 50 year lows from several months ago. The four week moving average declined -750 to 212,250, while continuing claims, which comparatively lag, and are reported with a one week delay, rose 8,000 to 1.906 million, close to a two year high:

More important for forecasting purposes is the YoY% change. In that regard, initial claims are down -11.4%, and the four week moving average is down -5.6%. While continuing claims are up 7.0%, this is the lowest YoY comparison in almost a year:

Continuing claims rose significantly immediately following the Silicon Valley Bank meltdown, as tech companies all laid off workers. It is likely the increased difficulty in finding suitable new positions in that sector of the economy that has driven the increase in continuing claims. Nevertheless, as I wrote above, they generally lag initial claims, which is the pattern we see in the YoY data.

Finally, as indicated at the outset of this post, initial claims, averaged monthly, have an excellent record of forecasting the trend in the unemployment rate in the ensuing months, and so lead the Sahm rule for forecasting recessions by several months. Here is that update:

The downshift in initial jobless claims over the past 6 months has started to be reflected in the monthly unemployment rate. As a result, in tomorrow’s report I am expecting the unemployment rate to remain at 3.7% or decline to 3.6%. An increase above 3.8% is almost certainly not going to happen.

Additionally, based on yesterday’s JOLTS report, since the quits rate (which leads wages YoY) declined to new post-pandemic lows, I am expecting average hourly earnings for nonsupervisory workers to decelerate further YoY from 4.8%, possibly to a new post-pandemic low of 4.5%. This doesn’t mean the jobs report will be poor, just that the supercharged wage growth that immediately followed the pandemic is continuing to ebb.

Initial jobless claims still very positive, especially YoY, Angry Bear by New Deal democrat.