Originally Published at The Bonddad Blog by New Deal democrat Industrial production is an indicator that has faded somewhat in importance in the modern era since China’s accession to normal trading status in 2000. Before that, a downturn in production was an excellent coincident indicator for a general downturn in the economy. Since then there have been several downturns, most importantly during 2015-16, when the broader economy, most notably housing and the consumer, did not follow. That was again the case of the downturn in 2023 – which has not resolved yet. This morning’s report was another case of good news and bad news. The good news is that industrial production rose 0.1% for the month, and manufacturing production rose 0.8% from

Topics:

NewDealdemocrat considers the following as important: Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Originally Published at The Bonddad Blog

- by New Deal democrat

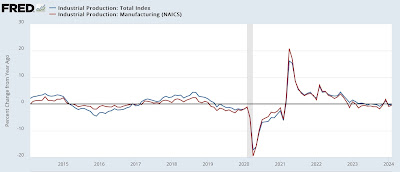

Industrial production is an indicator that has faded somewhat in importance in the modern era since China’s accession to normal trading status in 2000. Before that, a downturn in production was an excellent coincident indicator for a general downturn in the economy. Since then there have been several downturns, most importantly during 2015-16, when the broader economy, most notably housing and the consumer, did not follow. That was again the case of the downturn in 2023 – which has not resolved yet.

This morning’s report was another case of good news and bad news. The good news is that industrial production rose 0.1% for the month, and manufacturing production rose 0.8% from downwardly revised January numbers:

The bad news is that both remain down YoY, by -0.3% and -0.2% respectively (which, note, is not as bad a YoY comparison as either 2015-16 or 6 to 12 months ago), and both remain down from their respective peaks of September and October 2022. Here’s the YoY view:

In fact, the general trend over the past half year appears to be a further slight fade from a secondary peak in the summer of 2023.

This is, needless to say, particularly unwelcome in view of yesterday’s poor real retail sales report. If both manufacturing and the consumer are stallling out, that is not good. It will heighten the importance of this month’s report on personal spending, to see how well the broader measure of real spending on goods in particular is holding up.

Retail sales faceplant; industrial production continues 16-month streak of weakness, Angry Bear by New Deal democrat