– by New Deal democrat The Bonddad Blog Personal income and spending has become one of the two most important monthly reports I follow. This is in large part because the big question this year is whether the contractionary effects of Fed tightening have just been delayed until this year, or whether the fact that there have been no rate hikes since last summer mean that the expansion will strengthen. Because real personal spending on services for the past 50 years has generally risen even during recessions, the more leading components of this report have to do with spending on goods. Additionally, there are several components that form part of the NBER’s “official” toolkit for determining when and whether a recession has begun, including real

Topics:

NewDealdemocrat considers the following as important: 2024, Hot Topics, inflation, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

– by New Deal democrat

The Bonddad Blog

Personal income and spending has become one of the two most important monthly reports I follow. This is in large part because the big question this year is whether the contractionary effects of Fed tightening have just been delayed until this year, or whether the fact that there have been no rate hikes since last summer mean that the expansion will strengthen.

Because real personal spending on services for the past 50 years has generally risen even during recessions, the more leading components of this report have to do with spending on goods. Additionally, there are several components that form part of the NBER’s “official” toolkit for determining when and whether a recession has begun, including real spending minus government transfers, and real total business sales.

Let’s look at each of them in turn. Note that in all graphs below except for YoY comparisons, and the personal saving rate, is normed to 100 as of just before the pandemic.

Real income and spending

In March, nominally income rose 0.5%, while nominal spending for the second month in a row rose a sharp 0.8%. Prices as measured by the PCE deflator increased 0.3% for the month, meaning that in real terms income increased 0.2% and spending rose 0.5%. Since just before the pandemic real incomes are up 7.2%, and spending is up 11.3%:

On a YoY basis, the PCE price index is up 2.7%, the second monthly increase in a row from January’s three year low of 2.4%. While n the previous 16 months, the YoY measure had been declining at the rate of 0.25%/month, suggesting that it would hit the Fed’s 2.0% target this spring, that trend has stopped:

The issue going forward is going to be if this was a temporary pause, a stalling of progress towards the Fed’s goal of 2.0%, or an outright reversal of trend. Suffice it to say, the Fed is not going to cut rates in the near future under either of the two latter scenarios.

As I indicated in the intro, for the past 50+ years, real spending on services has generally increased even during recessions. It is real spending on goods which declines. Last month real services spending rose 0.2%, while real goods spending rose a sharp 1.1%:

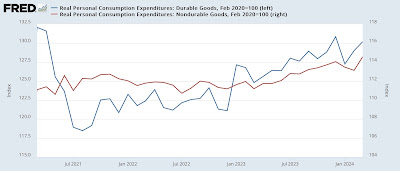

Further, real durable goods spending tends to turn before non-durable goods spending. The former rose 0.9% for the month, and the latter 1.3%. Both of these have now totally or almost totally reversed previous months’ sharp declines:

Savings

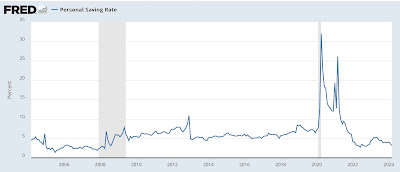

Another important metric for the near future of the economy is the personal savings rate. In February it declined a sharp -0.5%. In March it declined another -0.4% to 3.2%. This longer term look shows how the present compares with the all time low rate of 1.4% in 2005:

On the positive side, the declining trend in this rate since last May indicates a lot of consumer confidence. But on the negative side it is close to its post-pandemic low of June 2022 of 2.7%, as well as its previous all-time low range, indicating vulnerability to an adverse shock. One of my forecasting models uses such a shock as a recession warning indicator. In any event, there is no such shock indicated at the moment.

Important coincident measures for the NBER

Also as indicated above, the NBER pays particular attention to several other aspects of this release. Real income excluding government transfers (like the 2020 and 2021 stimulus payments) rose 0.2% for the month, continuing its consitent increasing trend since November 2022:

Finally, the deflator in this morning’s report is used to calculate, with a one month delay, real manufacturing and trade sales. This rose 0.5% in February, but is still below its November and December 2023 readings:

Summary

I had described January’s report as being pretty close to “Goldilocks,” and last month’s as something of “anti-Goldilocks.” In March we were closer to Goldilocks than not. Real Income, including real income less government transfers, and spending both rose, and spending on goods rose sharply. Real manufacturing and trade sales also rose. The saving rate shows near term confidence, but is a longer term concern. Aside from that the only significant negative was the second straight increase in YoY PCE inflation.

The consumer remains healthy, but is digging into their savings to support much of the increase in spending. In addition to the price of gas, which has recently been rising again, but if this renewed sharp increase in spending is feeding through into a renewed increase in the inflation rate as well (and it may well not be), that would not be good. Because if that’s the case, the Fed is going to consider not just not lowering interest rates, but possibly another increase as well.

Real personal income and spending: if last month was “Goldilocks”, this month was close to “anti-Goldilocks” Angry Bear by New Deal democrat