– by New Deal democrat After almost half a year of general stabilization, or very slow deceleration, the JOLTS report for March featured multi-year lows in almost all of its components. Job openings (blue in the graph below), a soft statistic that is polluted by imaginary, permanent, and trolling listings, declined -325,000 to a three year low of 8.488 million. Actual hires (red) declined -281,000 to 5.500 million, the lowest level since the pandemic lockdowns. Voluntary quits (gold) declined -198,000 to a more than three year low of 3.329 million. In the below graph, they are all normed to a level of 100 as of just before the pandemic: As has been the case for a number of months now, hires are below the level they were at just in early

Topics:

NewDealdemocrat considers the following as important: Hot Topics, Jolts Report, March 2024, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

– by New Deal democrat

After almost half a year of general stabilization, or very slow deceleration, the JOLTS report for March featured multi-year lows in almost all of its components.

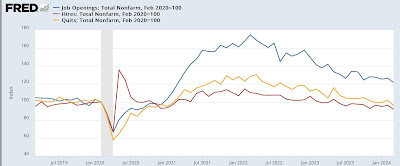

Job openings (blue in the graph below), a soft statistic that is polluted by imaginary, permanent, and trolling listings, declined -325,000 to a three year low of 8.488 million. Actual hires (red) declined -281,000 to 5.500 million, the lowest level since the pandemic lockdowns. Voluntary quits (gold) declined -198,000 to a more than three year low of 3.329 million. In the below graph, they are all normed to a level of 100 as of just before the pandemic:

As has been the case for a number of months now, hires are below the level they were at just in early 2020 just before the pandemic hit, and this month they were joined by quits as well.

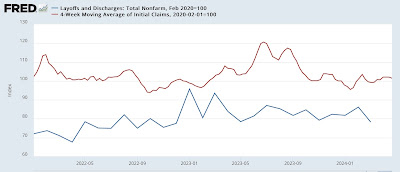

The reason the above situation has not been bad is that layoffs and discharges (blue in the graph below) also made a fifteen month low, and are still running 20% below the level they were at just before the pandemic, and indeed (not shown), at *any* point before :

The more leading weekly initial jobless claims (red) suggest that layoffs and discharges will remain in this range at least for several more months.

Finally, the quits rate also declined -0.1% to a new 3.5 year low as well. Since, as I have noted for a number of months now, the quits rate (blue in the graph below, right scale) tends to lead average hourly earnings (red) [and here’s the long-term view]:

This suggests that the deceleration in wage growth will continue in coming months as well, as shown in the below post-pandemic close-up:

Needless to say, if such a further deceleration in wage growth coincides with an upturn in inflation, that is going to put a dent in real consumer income and spending. So, I will pay even more attention to those two numbers on Friday and later in the month. It also highlights the continuing importance of very low initial jobless claims.

February JOLTS report: soft landing-ish? – except for a noisy jump in layoffs – Angry Bear, by New Deal democrat.