I am late to the discussion of the (possible) US soft landing. I think I better write about the soft landing (so far) in case it is ceasing to be soft (I am not making a forecast). The remarkable thing is that the dramatic increase in the Federal Funds Rate did not induce a downturn let alone a recession The way interest rates affect GDP is principally residential investment and exchange rates. Other monetary authorities also raised rates in response to the Covid increase in inflation, so I won’t write about exchange rates. The interest rate relevant to housing demand is the mortgage interest rate. It is very, very different from the Federal funds rate but it also increased dramatically This odd in itself as all evidence suggests that medium

Topics:

Robert Waldmann considers the following as important: Featured Stories, Soft-landing, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

I am late to the discussion of the (possible) US soft landing. I think I better write about the soft landing (so far) in case it is ceasing to be soft (I am not making a forecast).

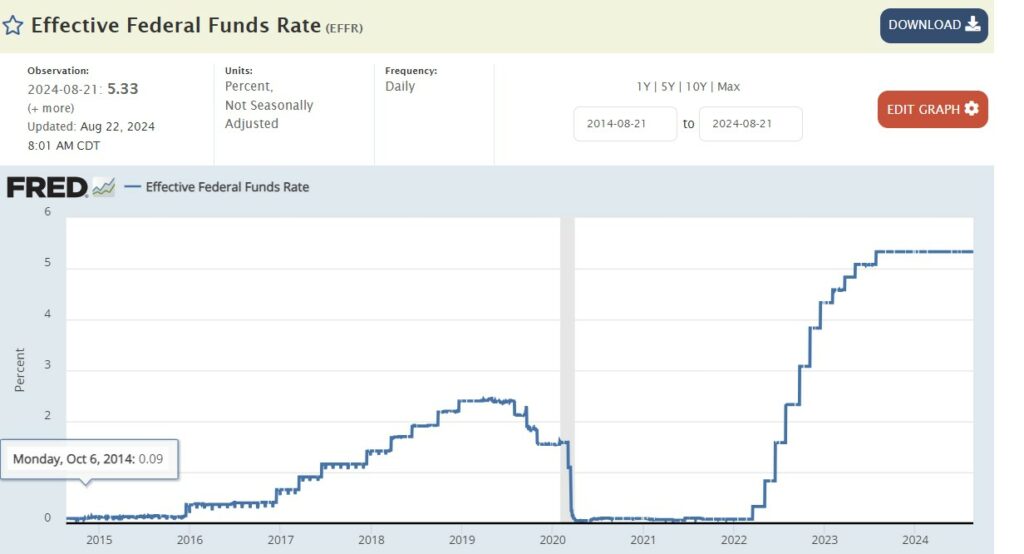

The remarkable thing is that the dramatic increase in the Federal Funds Rate did not induce a downturn let alone a recession

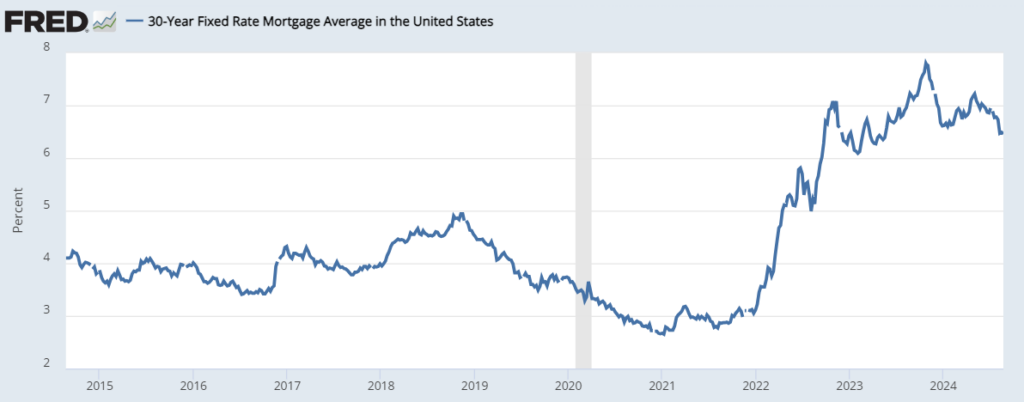

The way interest rates affect GDP is principally residential investment and exchange rates. Other monetary authorities also raised rates in response to the Covid increase in inflation, so I won’t write about exchange rates. The interest rate relevant to housing demand is the mortgage interest rate. It is very, very different from the Federal funds rate but it also increased dramatically

This odd in itself as all evidence suggests that medium term inflation expectations remained anchored, so this appears to be a dramatic increase in the medium future expected real mortgage rate. It also makes little sense as tight monetary policy was never expected to last.

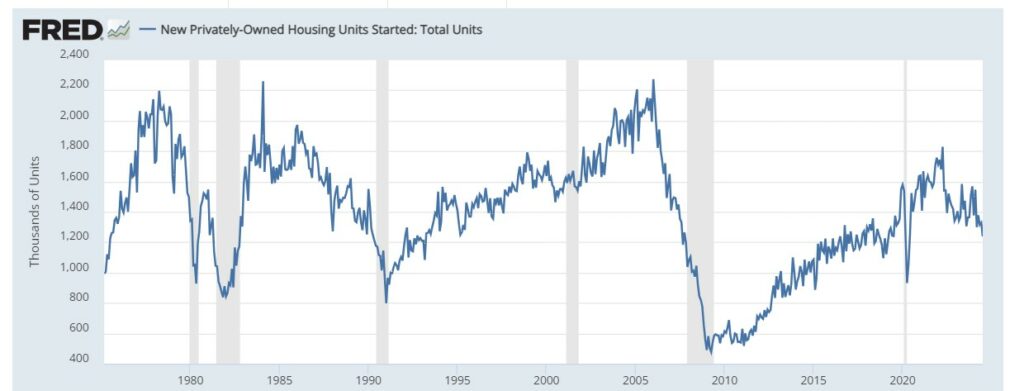

But I want to write about the striking fact that residential investment and housing starts held up in spite of the huge increase in interest rates.

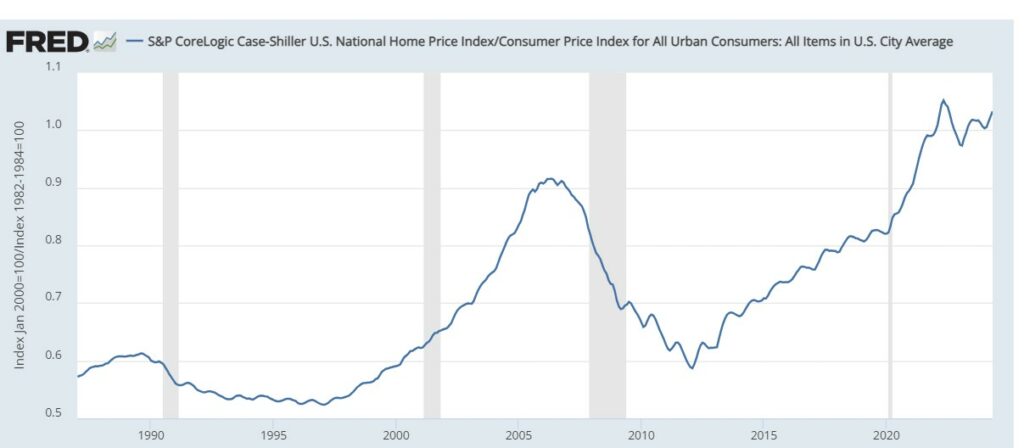

Homes were purchased in spit of the suddenly much higher mortgage rate and the extraordinarily high relative price of houses which has surpassed the notoriously bubble inflated price ratio in 2006.

The combination of high purchase prices and high mortgage interest rates implies that the cost of newly purchased owner-occupied housing services is extremely high. Why are people willing to pay it (while complaining a lot)?

One explanation is that rents have increased dramatically. This means that the alternative to owner occupied housing is also very expensive. It suggests a high market price of housing services. Bother might be explained by the prolonged period of low residential investment after the 2008-9 recession leading to a housing shortage.

However, I suspect that the issue is, again, strong expected appreciation of home prices. I have trouble finding data on this (so can speculate about speculation) but I fear we are in another housing bubble which will burst.