Today (Thursday), the Office for National Statistics published its monthly set of employment stats. While its Labour Force Survey has been under the cosh for some time for unreliability, the ONS’s data on average wage rates and changes retain their importance. The data – this time for January 2025 – covers average total pay, regular pay and bonus pay for the whole workforce. It also provides average wage data by broad sector.The ONS also publishes its estimate of ‘real pay’ after taking account of inflation – for this it uses its CPIH index (which by including some housing elements differs slightly from the more generally used Consumer Price Index, CPI).The Bank of England’s Monetary Policy Committee also announced, today, its decision to hold its Bank Rate unchanged at 4.5%. The MPC

Topics:

Jeremy Smith considers the following as important: Article, inequality, Inflation & Deflation, Pay & Earnings, UK

This could be interesting, too:

T. Sabri Öncü writes Argentina’s Economic Shock Therapy: Assessing the Impact of Milei’s Austerity Policies and the Road Ahead

T. Sabri Öncü writes The Poverty of Neo-liberal Economics: Lessons from Türkiye’s ‘Unorthodox’ Central Banking Experiment

Robert Skidelsky writes The Roots of Europe’s Immigration Problem – Project Syndicate

Robert Skidelsky writes Speech in the House of Lords Conduct Committee: Code of Conduct Review – 8th of October

Today (Thursday), the Office for National Statistics published its monthly set of employment stats. While its Labour Force Survey has been under the cosh for some time for unreliability, the ONS’s data on average wage rates and changes retain their importance. The data – this time for January 2025 – covers average total pay, regular pay and bonus pay for the whole workforce. It also provides average wage data by broad sector.

The ONS also publishes its estimate of ‘real pay’ after taking account of inflation – for this it uses its CPIH index (which by including some housing elements differs slightly from the more generally used Consumer Price Index, CPI).

The Bank of England’s Monetary Policy Committee also announced, today, its decision to hold its Bank Rate unchanged at 4.5%. The MPC report refers to the ONS’s latest pay data:

“A range of indicators suggested that underlying Bank of England pay growth had eased further in recent months, although annual growth in private sector regular average weekly earnings had picked up to 6.1% in the three months to January.”

But while 6.1% sounds a lot (with the BoE aiming for 2% inflation), pay as a whole has not in reality leapt ahead in recent times.

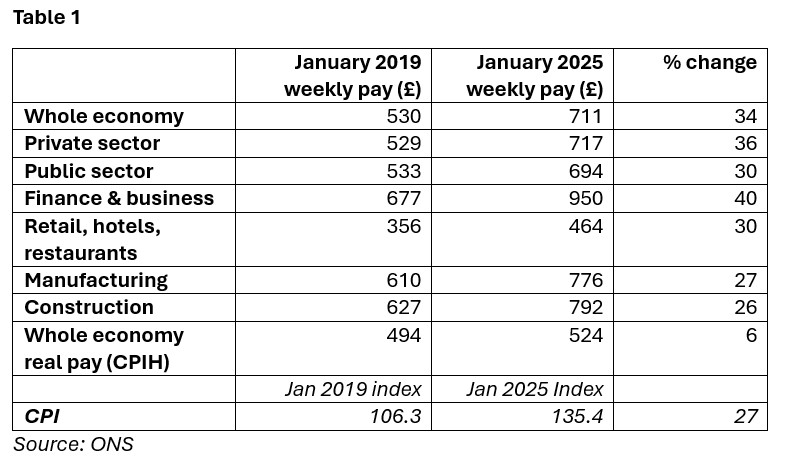

To see how ‘normal’ or otherwise pay now is, I have compared levels of average total pay from January 2019 with those for January 2025, i.e. over a 6 year period, starting well before the 2020 pandemic.

Over that period, the CPI has risen by 27%. Real pay across the whole workforce has now risen by around 6% since 2019, but this masks big sectoral differences.

The overall picture, summarized in Table 1, shows that real average pay for most sectors has now – after falling in real terms for a long period – just about kept up with the rate of inflation (measured by the CPI) over the period, or crept a tiny bit ahead. Pay in manufacturing (+27%) and construction (+26%) have, on average, struggled to keep pace with CPI inflation, while the public sector and retail/hotels etc. have done just a tiny bit better.

Except for one big sector…whose workforce, as a whole, has done far better.

The one exception is the “finance and business services” sector, which has seen a huge real terms increase of 13% over the 6 years. This sector covers financial, insurance, real estate and general professional and business services, plus support activities.

There will have been ‘compositional changes’ both within and between sectors, i.e. jobs do not remain constant over time, so the statistics are not necessarily comparing absolutely like for like.

But taking the big picture, we can say for sure that those doing very well out of our generally stagnant economy are overwhelmingly in the business service sectors, whose average pay – which was already far greater than others at the start-point – has grown very substantially in real terms, and accounts for almost all of the 6% overall increase in real pay over the past 6 years. This sharply differential trend exemplifies, once more, the growing inequality within our society.

All other sectors lag far behind… and as for all the earlier nonsense from Tory Ministers and press about public sector workers causing or stoking inflation, we can see clearly that this was, and always has been just that – nonsense. The Times’ editorial from 2023, pictured at the head of this article, is a particularly fine example of the genre.