Housing remains depressed, and not the driver of US growth that had been forecast by most analysts: Highlights Housing starts are being hit by huge swings. November starts fell 18.7 percent in November to a much lower-than-expected 1.090 million annualized rate following an upward revised gain of 27.4 percent to 1.340 million in October. There’s less volatility on the permits side where a roughly 30,000 undershoot in November, at 1.201 million vs the Econoday consensus for 1.240 million, is offset by a roughly 30,000 upward revision to October which is now at 1.260 million. Trends for both starts and permits have been struggling with year-on-year starts down 6.9 percent and year-on-year permits down 6.6 percent. The best news in the report is a 15.4 percent gain in housing completions to a 1.216 million rate which follows a 6.3 percent jump in the prior month. Houses authorized but not started are also up, 3.0 percent higher to 138,000. Gains here will help ease what is very tight supply for new homes. Still, lack of supply remains a negative for the new home market where sales, in sharp contrast to starts and permits, look to post a roughly 20 percent gain this year.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Housing remains depressed, and not the driver of US growth that had been forecast by most analysts:

Highlights

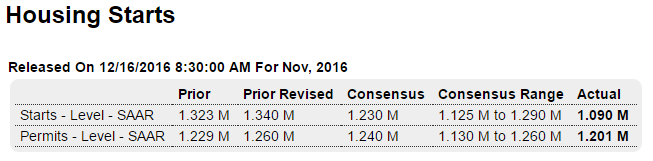

Housing starts are being hit by huge swings. November starts fell 18.7 percent in November to a much lower-than-expected 1.090 million annualized rate following an upward revised gain of 27.4 percent to 1.340 million in October. There’s less volatility on the permits side where a roughly 30,000 undershoot in November, at 1.201 million vs the Econoday consensus for 1.240 million, is offset by a roughly 30,000 upward revision to October which is now at 1.260 million.

Trends for both starts and permits have been struggling with year-on-year starts down 6.9 percent and year-on-year permits down 6.6 percent.

The best news in the report is a 15.4 percent gain in housing completions to a 1.216 million rate which follows a 6.3 percent jump in the prior month. Houses authorized but not started are also up, 3.0 percent higher to 138,000. Gains here will help ease what is very tight supply for new homes.

Still, lack of supply remains a negative for the new home market where sales, in sharp contrast to starts and permits, look to post a roughly 20 percent gain this year.

This chart is not population adjusted:

This is strong euro stuff, further supported by low inflation, even as the euro falls to decade lows due to ongoing portfolio shifting:

Euro Area Balance of Trade

The Eurozone trade surplus rose 37.8 percent to €26.5 billion in September 2016 compared to a €19.2 billion in the same month of the previous year, above market consensus of €22.5 billion. Exports increased 2 percent while imports dropped 2 percent. Considering the first nine months of the year, the trade surplus increased to €204.8 billion, compared with €169.1 billion in the same period of 2015.

Budget Shortfalls Expected in the Most States Since Recession

By Liz Farmer

Dec 13 (Governing) — Almost half the states cut their budgets this year, and that trend is likely to continue into 2017.

Weak revenues are causing the most state budget shortfalls since the Great Recession.

According to the National Association of State Budget Officers’ (NASBO) annual state spending survey, half of all states saw revenues come in lower than budgeted in fiscal 2016 and nearly as many (24) are seeing those weak revenue conditions carry into fiscal 2017, which ends in summer 2017 for most states. It marks the highest number of states falling short since 36 budgets missed their mark in 2010.

As a result, 19 states made mid-year budget cuts in 2016, totaling $2.8 billion. That number of states “is historically high outside of a recessionary period,” according to the report.

The revenue slowdown is caused mainly by slow income tax growth, even slower sales tax growth and an outright decline in corporate tax revenue.

Farmland Values in Iowa Tumble

First time they have dipped 3 years in row since ’80s farm crisisIowa’s average farmland value declined for the third year in a row, down 5.9 percent to $ 7,183 an acre over the past year. It’s the first time since the 1980s farm crisis that land values have fallen three straight years, according to an Iowa State University report released Tuesday.