Now looking like this peaked as oil prices collapsed: Consumer Credit Highlights Revolving credit continues to show life, up a solid .0 billion in August for a sixth straight gain. Gains in this reading, which have been scarce this recovery, perhaps suggest that consumers are growing less reluctant to run up their credit cards, which would be good news for retailers going into the holidays. Non-revolving credit, driven by both vehicle financing and student financing which is tracked in this component, rose .0 billion to make for a headline increase of .0 billion. United States Consumer Credit Change Consumer Credit in the United States increased by 16.02 USD Billion in August of 2015, following a downwardly revised 18.94 USD Billion in the previous month and below market expectations. Consumer Credit in the United States averaged 4.38 USD Billion from 1950 until 2015, reaching an all time high of 115 USD Billion in December of 2010 and a record low of -18 USD Billion in June of 2009. Consumer Credit in the United States is reported by the Federal Reserve. The post Consumer Credit appeared first on The Center of the Universe.

Topics:

WARREN MOSLER considers the following as important: Credit

This could be interesting, too:

NewDealdemocrat writes Two long leading indicators – real money supply and credit conditions – worsen

Stavros Mavroudeas writes Comment on Miguel Ramirez’s paper, ‘Credit, Indebtedness and Speculation in Marx’s Political Economy’ – ECONOMIC THOUGHT

Mike Norman writes Vladimir Asriyan, Luc Laeven, Alberto Martin — Credit booms and information depletion

Mike Norman writes Brad DeLong — This is, I think, both right and wrong. China has an… interesting property-rights system—your property is secure not …

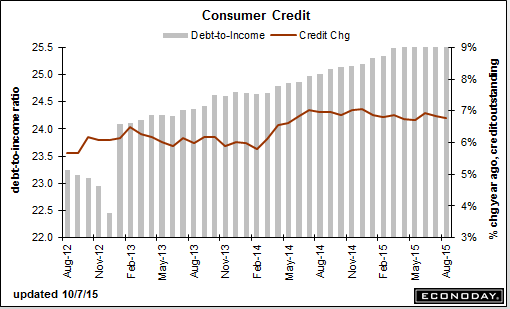

Now looking like this peaked as oil prices collapsed:

Highlights

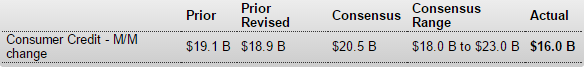

Revolving credit continues to show life, up a solid $4.0 billion in August for a sixth straight gain. Gains in this reading, which have been scarce this recovery, perhaps suggest that consumers are growing less reluctant to run up their credit cards, which would be good news for retailers going into the holidays. Non-revolving credit, driven by both vehicle financing and student financing which is tracked in this component, rose $12.0 billion to make for a headline increase of $16.0 billion.

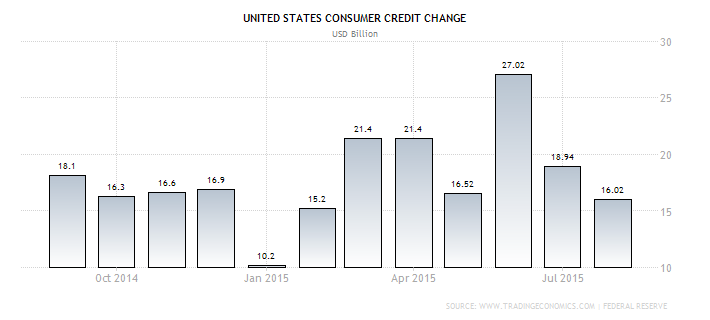

United States Consumer Credit Change

Consumer Credit in the United States increased by 16.02 USD Billion in August of 2015, following a downwardly revised 18.94 USD Billion in the previous month and below market expectations. Consumer Credit in the United States averaged 4.38 USD Billion from 1950 until 2015, reaching an all time high of 115 USD Billion in December of 2010 and a record low of -18 USD Billion in June of 2009. Consumer Credit in the United States is reported by the Federal Reserve.

The post Consumer Credit appeared first on The Center of the Universe.