LOOK AT THE BIG DIVERGENCE BETWEEN “SOFT” AND “HARD” DATA … Ummm ..never mind…. Since this year the Doomers haven’t even been able to rouse themselves up enough to call for OMG recession imminent!!!, they have had to settle for how slow the growth in the economy has been. Their favorite theme has been the alleged divergence between the “soft” consumer confidence and ISM survey data, and the “hard” data, like industrial production: Oh, wait! Never mind … Well, then, how about durable goods? Since it was just updated this morning, let’s take a look at that: Durable goods orders are up over 15% since bottoming in June 2016 (for the record, I expect a downward revision to the big surge this month and/or a decline next month — the series is noisy). “Core”

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

LOOK AT THE BIG DIVERGENCE BETWEEN “SOFT” AND “HARD” DATA … Ummm ..never mind….

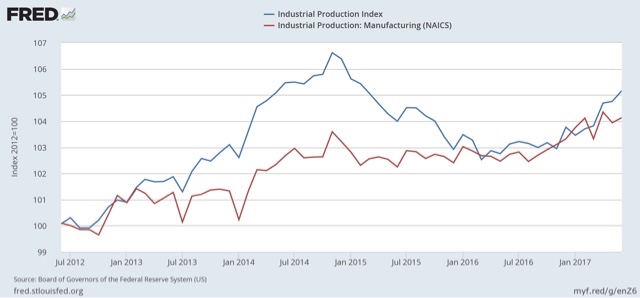

Since this year the Doomers haven’t even been able to rouse themselves up enough to call for OMG recession imminent!!!, they have had to settle for how slow the growth in the economy has been. Their favorite theme has been the alleged divergence between the “soft” consumer confidence and ISM survey data, and the “hard” data, like industrial production:

Oh, wait! Never mind …

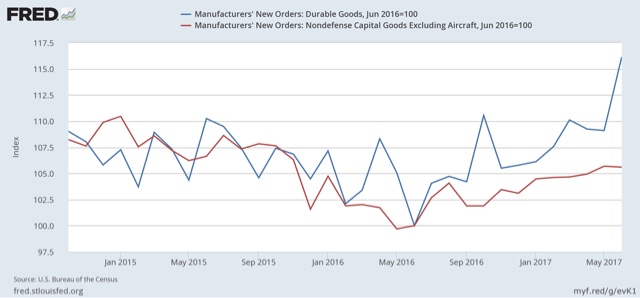

Well, then, how about durable goods? Since it was just updated this morning, let’s take a look at that:

Durable goods orders are up over 15% since bottoming in June 2016 (for the record, I expect a downward revision to the big surge this month and/or a decline next month — the series is noisy). “Core” capital goods are up about 6%.

#@&*!!

Damned positive data! It’s just really hard to get all lathered up and steamy about doom and gloom these days . . . .