Peter Praet's speech at the Money, Macro and Finance conference last week was a goldmine. I've already discussed the central bank credibility problem revealed by his final slide. But his presentation went far, far wider than central banks. It raised serious questions about the future of the global economy.This slide - the first in his presentation - shows that there have been three significant global shocks in the last decade, not one: The first, obviously, is the deep global recession caused by the failure of Lehman Brothers in September 2008. But what are the other two?As Toby Nangle's annotations to Peter Praet's second chart show, the second is the Eurozone crisis, and the third is the emerging market crisis triggered by the unwinding of the oil & commodities boom: Looking at

Topics:

Frances Coppola considers the following as important: Economics, Financial Crisis, politics, war

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Peter Praet's speech at the Money, Macro and Finance conference last week was a goldmine. I've already discussed the central bank credibility problem revealed by his final slide. But his presentation went far, far wider than central banks. It raised serious questions about the future of the global economy.

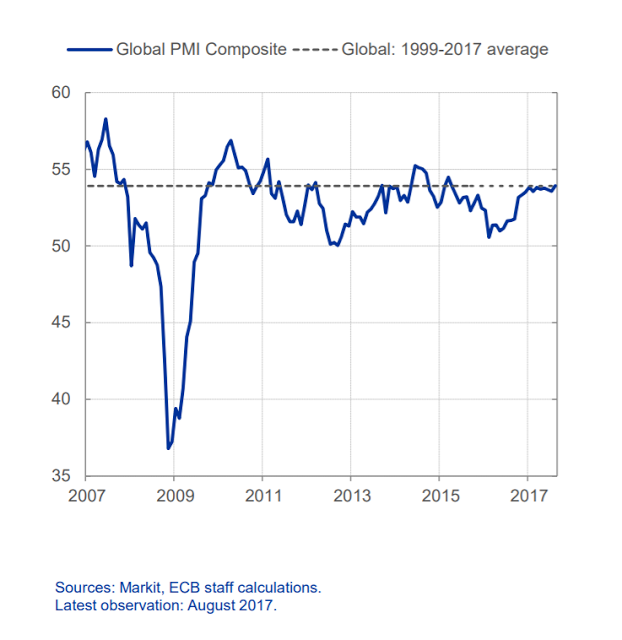

This slide - the first in his presentation - shows that there have been three significant global shocks in the last decade, not one:

As Toby Nangle's annotations to Peter Praet's second chart show, the second is the Eurozone crisis, and the third is the emerging market crisis triggered by the unwinding of the oil & commodities boom:

Looking at these charts made me think of ripples on a pond. When you drop a pebble into a pond, it initially creates a deep hole in the water, with raised sides and splashing. The hole closes quickly, but the impact sets off ripples - waves which travel outwards across the pond from the hole. There may be several of these ripples, but each ripple is smaller than the last. Eventually the water returns to stillness, and the pond looks if the stone had never been dropped.

If you drop a large rock into a pond, it makes a much larger hole in the water, there is much more splashing, and much bigger ripples that wash up over the edges of the pond. When the water returns to normal - which it does quite quickly - some of the water is gone. Even though there is now a rock on the bottom of the pond, the water level is lower than it was before. Over time, though, the water returns. A few months later, the pond looks as if the rock had never been dropped. For the pondlife, however, life is never the same again. There is a rock that wasn't there before, and the edges of the pond may have been damaged by the ripples. Some of the pond's residents are too devastated to survive, but others take the opportunity to colonise the rock and the new pond edges. In any disaster, there are always winners as well as losers.

If something very much larger falls on something very much more rigid, you get the Yucatan event. The Chicxulub asteroid impact created a hole surrounded by two circular rock ridges. And it also set off water ripples - a series of massive tsunamis that rushed in to fill the hole. The effect was catastrophic, of course: this is what finally killed off the large dinosaurs. The Yucatan event and the ensuing "impact winter" are thought to have extinguished 70% of all life on the planet. But life recovered quickly. Even dinosaurs survived - though not in their previous form. We know them now as birds.

Of course, both of these examples are exogenous events, and Lehman's collapse was endogenous, being the inevitable consequence of terrible management. Though we could perhaps regard the disastrous political decision to allow it to fail as exogenous.

So here is another metaphor. A major earthquake is an endogenous event: the buildup of pressure along a fault line eventually splits the earth, deforming it in ways difficult to foresee. It is followed by several smaller aftershocks as the earth adjusts to its new configuration. Again, the effect on life is catastrophic. The bigger the earthquake, and the more aftershocks, the greater the effect. And of course an earthquake can also create ripples - tsunamis that can cause even more devastation than the earthquake itself.

Whether we regard Lehman as an exogenous or endogenous event - or a bit of both, maybe - its effect on the global economic system seems to have been similar to the effect that major natural disasters have on life on Earth. It deformed the economic system in chaotic and unforeseeable ways, and there were sizeable aftershocks, or ripples. Peter Praet's chart shows two, but I think there were more: for example, the Arab Spring arguably was a reaction to the QE-fuelled spike in international food prices, and it led to the collapse of Libya, the Syrian war and the European migrant crisis. Not all shocks reveal themselves in economic statistics.

Major shocks like Lehman are not like a small pebble dropping into a pond, causing temporary displacement of water, minor disruption to pond life and ripples that eventually subside. No, they are more like an asteroid impact or a major earthquake. They permanently change the economic landscape.

The permanent changes are already becoming apparent. These charts, for example, show that trend GDP for the US, the UK and the Eurozone has been knocked off its pre-crisis course and is now proceeding from a lower base and, in the case of the UK and the Eurozone, at a shallower pace:

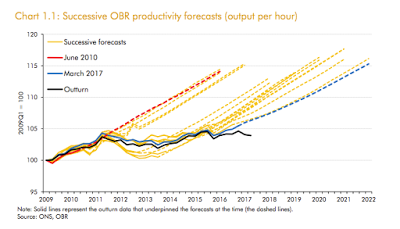

There are other indicators that the world has permanently changed, too. The plethora of charts and blogposts predicting inflation will return "any day now" look increasingly silly as inflation remains low everywhere except the UK, where it is rising because of political uncertainty rather than anything the central bank has done. As a result, interest rates are stuck close to the lower bound despite repeated predictions that they too would rise "any day now". And for reasons that remain unclear, productivity remains persistently far below pre-crisis levels despite persistent predictions that it will improve "any day now" (this is the UK's chart, but the EU and US ones don't look any better):

These indicators are, of course, all related. They all tell the same story - a global economy that is not only damaged, but deformed beyond recognition. When it recovers, which it will (because life always returns), it will not look much like the pre-crisis economy. Some life forms will die out and others will become unrecognisable (birds don't look much like dinosaurs, do they?). Things that previously hid in the shadows will come into the light. Completely new forms of life will appear.

Among the most damaged life forms in this particular pond are macroeconomists. Prior to the crisis, they thought they understood how the economy worked. And because they believed that there could never be a large enough shock to knock the economy permanently off its trend growth path, their prescriptions for repairing the damage all treated Lehman as a large rock, not an asteroid. They told us that if central banks supported the edges of the pond with unconventional monetary policy, and fiscal authorities repaired the holes in the bottom and sides of the pond with fiscal consolidation, and regulators prevented more rocks from falling, eventually economic indicators would return to their pre-crisis trends, just as water slowly drains back into a pond after being displaced by a rock. So inflation, growth, interest rates, productivity - all of these will return "any day now", if only policy makers get their policy settings right.

But as time goes on, and economic indicators show no sign of returning to their pre-crisis trends, macroeconomists are beginning to realise that they are lost. In this new, strange world, their maps are wrong and their models useless. They are flying blind.

Take inflation, for example. Writing about Japan, Noah Smith sends macroeconomists back to the drawing board:

Economists really have no idea how inflation works. It is simply a mystery. Macroeconomists have been thinking about inflation for decades, but no real progress has been made in understanding where it comes from or how to produce it with policy.Personally I think inflation is primarily a political phenomenon with a severe principal-agent problem. Politicians mandate central banks to control inflation while making it almost impossible for them to do so. Christina Romer observed recently that some politicians use central banks as "human shields", relying on loose monetary policy to soften the impact of premature, harsh and counterproductive fiscal tightening. When fiscal authorities are hell-bent on undermining everything central banks do, it is hardly surprising that central banks don't meet their mandates. Central banks' cherished "independence" is all about gaining sufficient distance from politicians to enable them to give the impression of being in control of inflation.

They are still desperately trying to give that impression. "Inflation will return to our 2% target in the medium term", they repeat endlessly. But this mantra looks increasingly like "jam tomorrow". Twenty-seven years on from the Japanese banking crisis, the Bank of Japan still can't get inflation off the floor. I predict that unless there is a much more radical change in policy, the Fed and the ECB will still be trying to get inflation off the floor twenty-seven years on from the Lehman shock. That is, if they still have their independence - indeed, if they continue to exist in any recognisable form. There is no such thing as a permanent institution when the world is in the throes of major economic and political upheaval.

Then there is the "productivity puzzle". Personally I don't think this is much of a puzzle, but it is most definitely a political challenge. It is really about the apparent impossibility of explaining why people who aren't paid very much don't produce very much, and why employers don't invest in technology to improve productivity when they have an apparently endless pool of poorly-paid workers to draw upon, and why politicians really like to have everyone employed even if they all have to be supported by the state because employers don't want to pay them enough to live on. People struggle to understand that if we want productivity, work cannot be a moral imperative and the accumulation of unproductive capital (particularly residential real estate) must be actively discouraged.

And what about interest rates? No, economists don't understand those either. Some now think the "natural rate of interest" (r*) might be permanently lower than before the crisis. I suppose this is progress, since at least it acknowledges the permanence of the economic deformation, but it is worrying that as yet they appear to have no idea why the natural interest rate should be lower, and what that means for growth, inflation, investment, productivity and employment.

Since they don't understand the drivers of growth in this strange new world, it is hardly surprising that those tasked with delivering growth - or, rather, prosperity - are reaching for the prayer shawls and incense. Voodoo is back.

To be fair, macroeconomists are desperately trying to grow wings, and there are already signs of feathers. But their reinvention of themselves is seriously hampered by the self-preserving behaviour of another life form that has been seriously damaged by the crisis, though it does not know it. Politicians.

Politicians are clinging like limpets to political and economic paradigms of the past, in some cases the very distant past. Not till their grasp is broken can the world truly recover: but breaking their grip will not be easy.

This post is entitled "aftershocks", because after a major crisis come secondary shocks as the world adjusts to the new paradigm. I don't think we have seen the last of the aftershocks, nor even the worst of them. The last time the world experienced a crisis on the scale of Lehman, the shock that finally broke the prevailing political and economic paradigm was the most destructive in history. I see no reason why this time should be different. Unless politicians voluntarily relinquish their grip on the past and, like macroeconomists, start reinventing themselves for the future, the world is headed for war.

Related reading:

The failure of macroeconomics

Austerity and the rise of populism

Animated image at the head of the post depicts the Chicxulub crater formation, courtesy of David Fuchs at English Wikipedia.