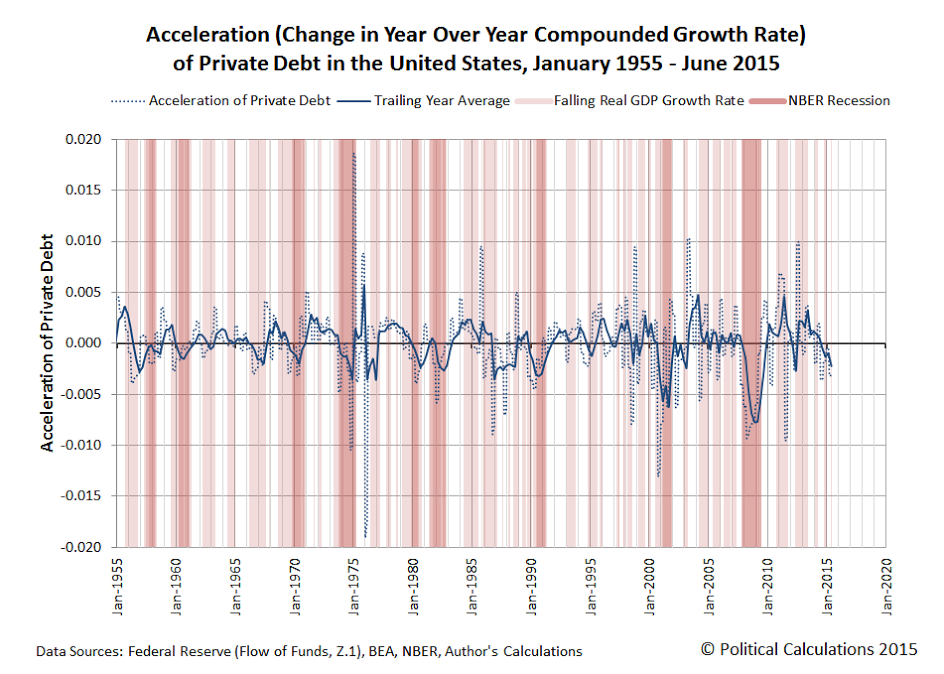

This shows how private sector credit deceleration is associated with recessions. It’s about the need for those spending more than their incomes to offset those spending less than their incomes. And most often private sector deficit spending decelerates some time after public sector deficit spending decelerates and fails to provide the income and net financial assets that supports private sector deficit spending. United States : JOLTSHighlightsIn a positive sign for labor demand, job openings in the JOLTS report popped back up in September, to 5.526 million from a revised 5.377 million in August. Openings peaked in July at a recovery best 5.668 million. High job demand will absorb yet more slack from what is a dwindling supply of available labor, in what could precede wage inflation and become a major concern for Fed policy makers. But in a contrasting indication of worker hesitance, confidence in the strength of the labor market may be limited based on the report’s quits rate which remains stubbornly low, unchanged for a sixth month at 1.9 percent.

Topics:

WARREN MOSLER considers the following as important: Employment, GDP

This could be interesting, too:

Ken Houghton writes Just Learn to Code

Angry Bear writes GDP Grows 2.3 Percent

Merijn T. Knibbe writes Employment growth in Europe. Stark differences.

NewDealdemocrat writes Real GDP for Q3 nicely positive, but long leading components mediocre to negative for the second quarter in a row

This shows how private sector credit deceleration is associated with recessions. It’s about the need for those spending more than their incomes to offset those spending less than their incomes. And most often private sector deficit spending decelerates some time after public sector deficit spending decelerates and fails to provide the income and net financial assets that supports private sector deficit spending.

United States : JOLTS

Highlights

In a positive sign for labor demand, job openings in the JOLTS report popped back up in September, to 5.526 million from a revised 5.377 million in August. Openings peaked in July at a recovery best 5.668 million. High job demand will absorb yet more slack from what is a dwindling supply of available labor, in what could precede wage inflation and become a major concern for Fed policy makers. But in a contrasting indication of worker hesitance, confidence in the strength of the labor market may be limited based on the report’s quits rate which remains stubbornly low, unchanged for a sixth month at 1.9 percent.