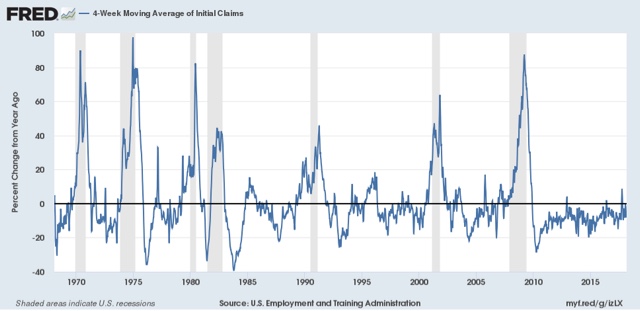

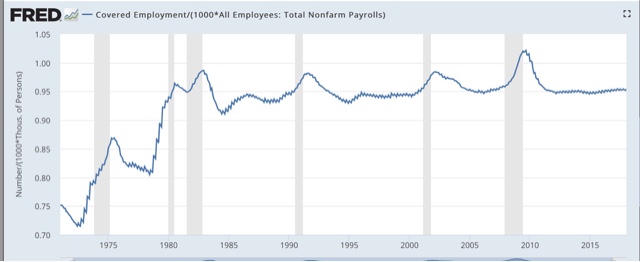

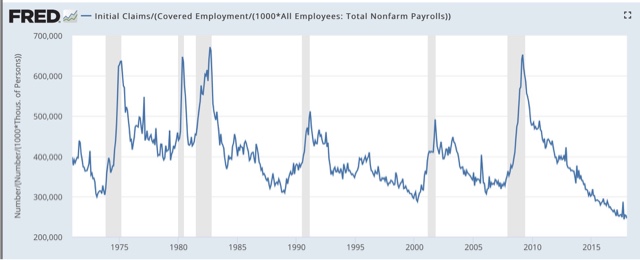

I haven’t been bothering to comment on initial jobless claims reports lately, for the simple fact that every week it’s the same story: they’re good! In fact, the initial jobless claims reports are probably the single most positive aspect of the entire economic expansion. For all intents and purposes, nobody is being laid off! For initial jobless claims even to be giving a “caution signal” about the economy, I would need the YoY comparison to increase: Note that this frequently but not always happens several years in advance of any downturn. By contrast, current numbers are running on the order of 5% less than last year. One dismissal that it occasionally heard is that the number is bogus because there are fewer “covered employees,” i.e.,

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

WEDNESDAY, FEBRUARY 21, 2018

Conflicting reports on the “rental affordability crisis”

– by New Deal democrat

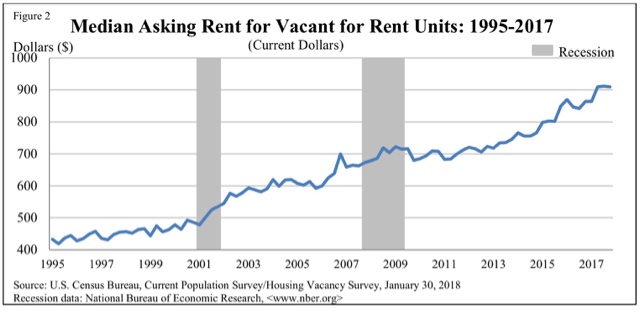

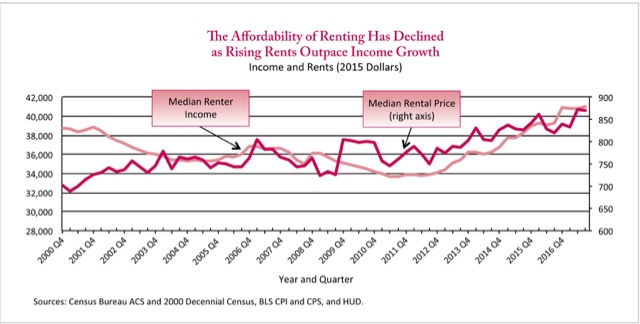

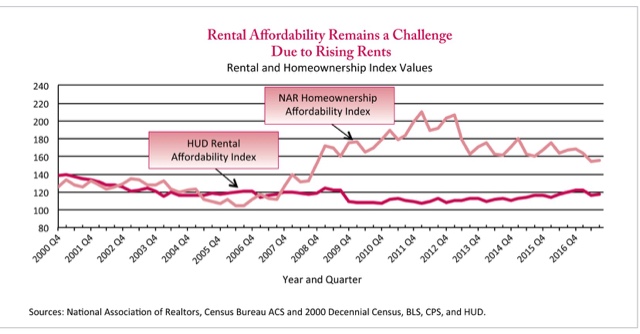

About half of renters spend more than 30 percent of their income on rent, up from 18 percent a decade ago, according to newly released research by Harvard’s Joint Center for Housing Studies. Twenty-seven percent of renters are paying more than half of their income on rent.

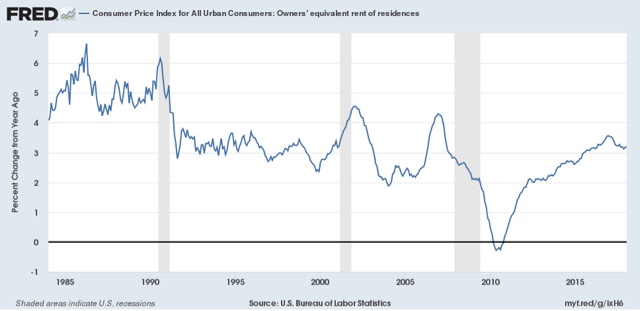

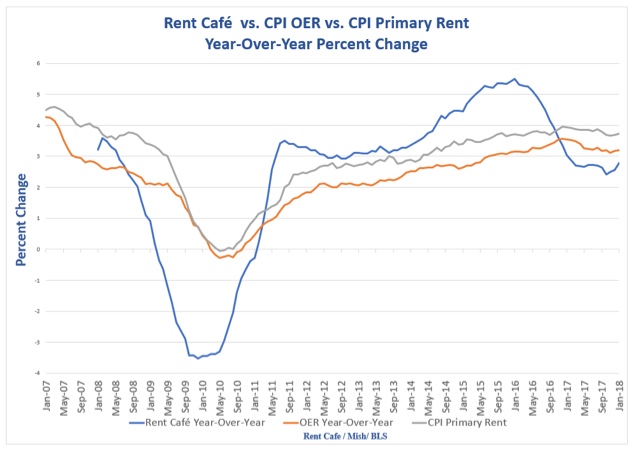

This is a serious real-world issue. I have been tracking rental vacancies, construction, and rents ever since. The Q4 2017 report on vacancies and rents was released a few weeks ago, so let’s take an updated look.

In the second quarter of last year, median asking rents zoomed up over 5% from $864 to $910. In the two quarters since, they have remained at that level:

Here is an updated look at real. inflation adjusted median asking rents, showing that rent pressures on household budgets continued to rise in 2017:

| Year | Median Asking Rent |

Usual weekly earnings |

Rent as % of earnings |

|

|---|---|---|---|---|

| 1988 | 330 | 382 | 86 | |

| 1992 | 401 | 437 | 92 | |

| 1993 | 422 | 450 | 88 | |

| 2000 | 478 | 568 | 84 | |

| 2002 | 545 | 607 | 90 | |

| 2004 | 599 | 629 | 95 | |

| 2009 | 680 | 739 | 92 | |

| 2012 | 717 | 768 | 93 | |

| 2013 | 734 | 778 | 94 | |

| 2014 | 762 | 791 | 96 | |

| 2015 | 813 | 809 | 100 | |

| 2016 | 859 | 832 | 103 | |

| 2017 H1 | 887 | 860 | 103 | |

| 2017 Q3 | 912 | 866 | 105 | |

| 2017 Q4 | 910 | 854 | 107 | |

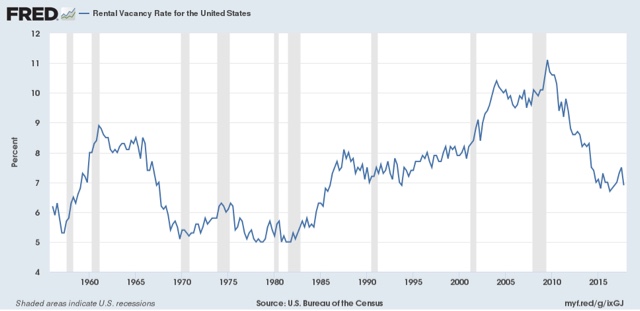

The big increase in unaffordability is unfortunately of a piece with the rental vacancy rate which, after appearing to have bottomed in 2016, tightened again in this report:

Like the median household income data, this shows renters’ income bottoming out in 2011-12, and rising since relative to rents as calculated by the ACS.

.